Bitcoin Option Traders Now Betting on Short-Term Price Drop

(thatkasem14/Shutterstock)

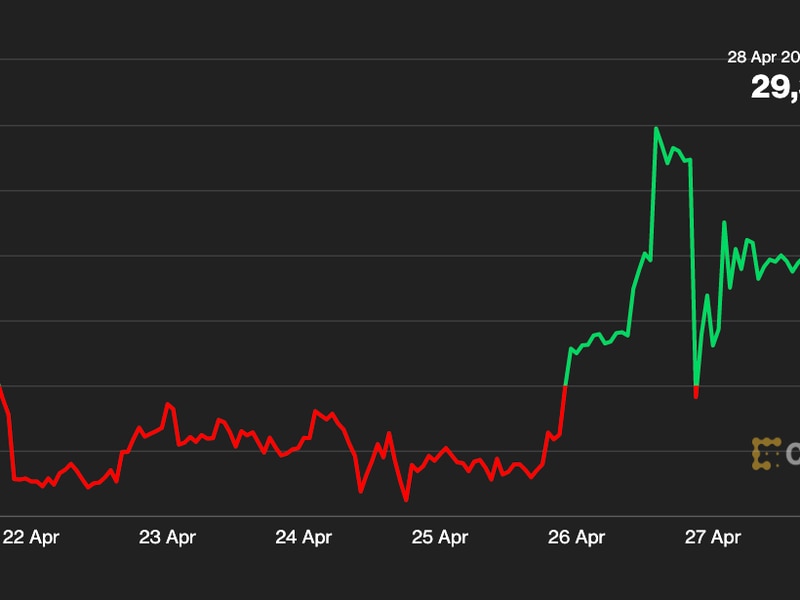

With bitcoin looking heavy this week, short-term sentiment in the options market has flipped bearish.

- The leading cryptocurrency by market value fell to $9,070 soon before press time, reversing the 2.5% rise to $9,450 seen last week, according to CoinDesk’s Bitcoin Price Index.

- Prices are now closing on the lower end of the multi-week-long trading range of $9,000–$10,000.

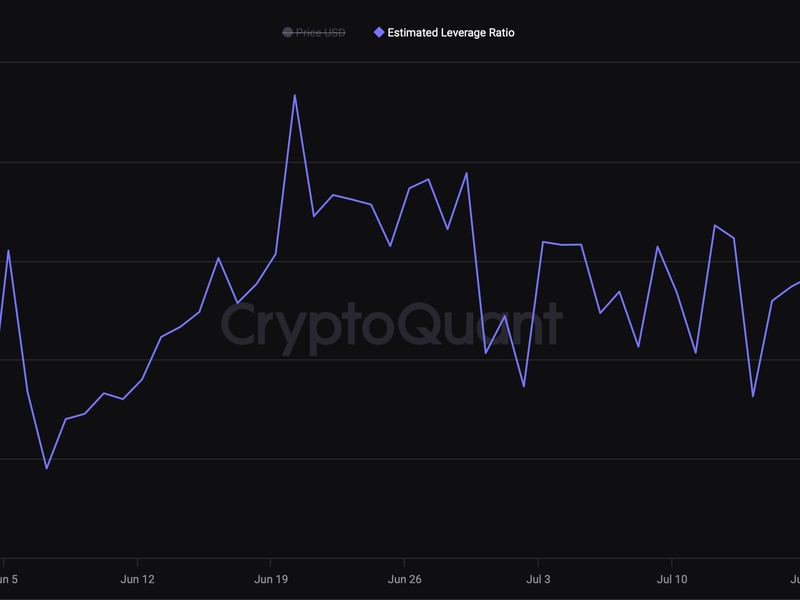

- Reflecting the downward trend, the one-month put-call skew for bitcoin options, a metric that measures the price of (bearish) put options relative to (bullish) call options, has risen to 4.9%, according to data provided by crypto derivatives research firm Skew.

- The positive number indicates short-term put options are drawing higher prices than calls.

- Traders, the data suggests, are making speculative bets to the downside or are hedging against a potential bearish move (that is, buying puts against long positions in the spot market), Shaun Phoon, senior trader at QCP Capital, told CoinDesk.

- The one-month skew was hovering at lows below -7% a week ago, indicating stronger demand for call options – a sign of bullish bias in the options market.

- While the one-month skew is now more bearish, the six-month skew remains below zero or bullish.

- Demand for call options expiring in December is still higher than that for puts.

- The three-month skew is hovering in the neutral zone near 0%.

Disclosure: The author holds no cryptocurrency assets at the time of writing.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.