Bitcoin Open Interest and Futures Volume on Binance at ATH As BTC Price Eyes $20,000

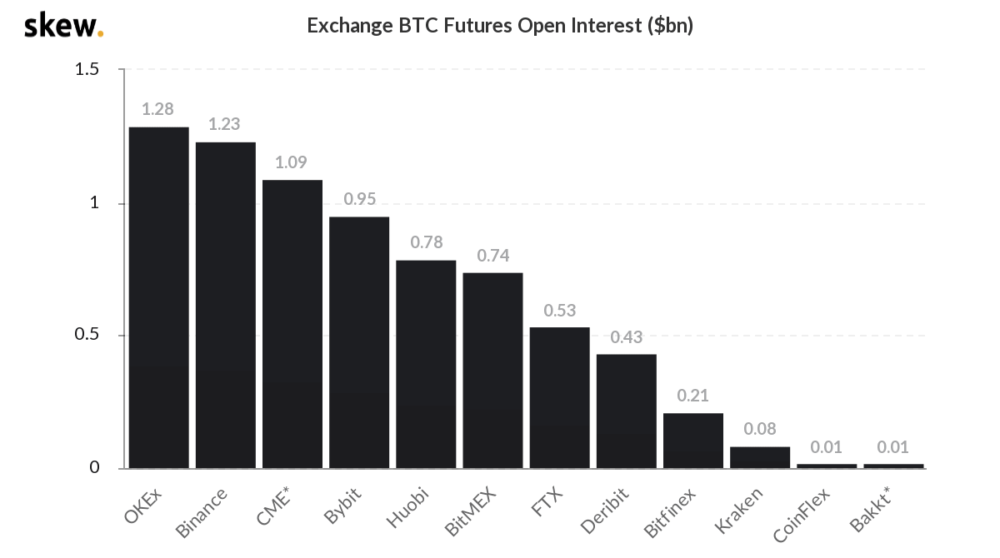

Bitcoin price just surged past the $19,000 mark and is looking to retake the previous all-time high of $20,000. This spike in volatility has caused all BTC markets to experience some serious trading traffic – especially the bitcoin futures market. And how? Well, open interest in the Binance futures market just topped $1.2 billion.

Binance Bitcoin Futures Market Register Record Open Interest And Daily Volumes

According to the crypto market and on-chain analysis firm Glassnode, the bitcoin futures market on Binance just logged an all-time high open interest of more than $1.2 billion. This comes as BTC flipped the $19,000 price level into support for a move towards its previous ATH of $20,000.

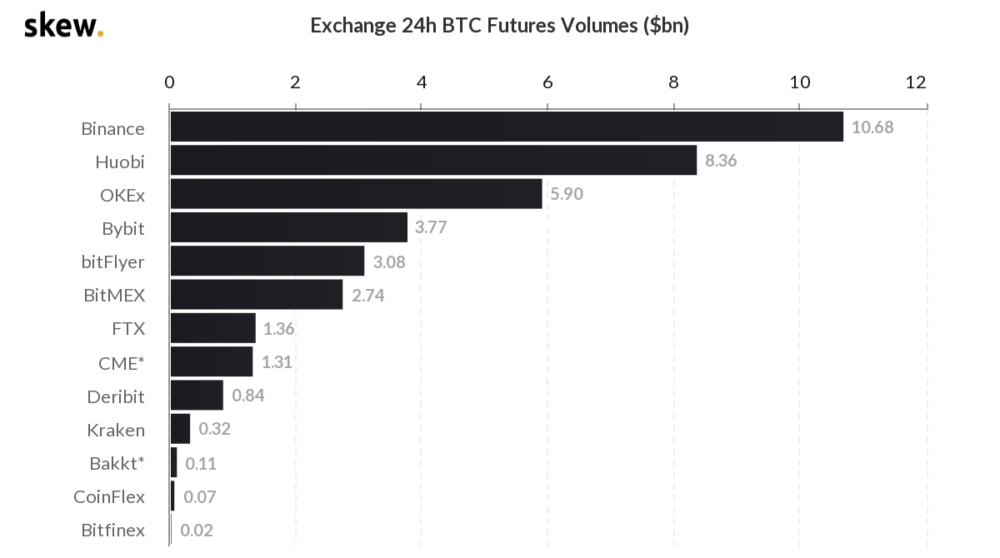

What’s even more interesting is that 24h BTC futures volumes on the exchange are trending way higher than all other platforms in the space. Binance is currently operating with almost $11 billion worth of bitcoin futures trades, with Huobi is trailing behind with $8.3 billion worth of 24h BTC futures volume.

Along with this, the spot crypto trading volume on Binance is going bonkers as well. A few hours ago, founder and CEO Changpeng Zhao tweeted about it, mentioning the data from CoinMarketCap.

ATH Volume again. https://t.co/UUKLM2x1EG pic.twitter.com/R3mTCtWvfS

— CZ Binance (@cz_binance) November 24, 2020

Bitcoin Price Rips Past $19,000 Towards Previous All-Time High

In a renewed face-melting price action, bitcoin took off after the ETH rally tempered a bit. While Ethereum’s native cryptocurrency settled below $600 after lifting off towards $618, BTC bulls pumped the top cryptocurrency with an intention to retake 2017’s all-time high of $20,000.

As of writing, BTC price is trading near $19,200, but a test of the famed $20,000 resistance remains highly possible in this scenario. Bitcoin stock-to-flow model propounder PlanB, while commenting on the current state of the BTC market, said this looks like the beginning of a new bull market.

Slowly but surely this is beginning to look like (the start of) a bull market. Best ever #bitcoin month in $ terms (+$5400) and RSI crawling towards bull market levels. pic.twitter.com/he6iac1J6c

— PlanB (@100trillionUSD) November 24, 2020

RSI is currently trending in the 70 – 80 range. During the height of the bubble in 2017, RSI numbers almost closed in on 100. But BTC’s rally had fizzled out after topping at $20k. In the latest market scenario, RSI has just jumped out of a tight range that has kept bitcoin bounded for more than two years now.

Does this mean that there’s more to this bitcoin (BTC) price rally than meets the eye? That still remains to be seen.