Bitcoin News Roundup for April 29, 2020

BTC prices rise as experts agree the halving isn’t that big a deal. It’s CoinDesk’s Markets Daily Podcast.

Today’s stories:

For early access before our regular noon Eastern time releases, subscribe with Apple Podcasts, Spotify, Pocketcasts, Google Podcasts, Castbox, Stitcher, RadioPublica or RSS.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Related Posts

NEM’s Enterprise Blockchain ‘Symbol’ Enters Final Stage Before Launch

Dec 8, 2020 at 3:01 p.m. UTCNEM in Final Stage Before Launch of Enterprise Blockchain ‘Symbol’NEM says it is now carrying out the last tests before sending its enterprise-focused Symbol blockchain platform live in early 2021.Announced Tuesday, the code for Symbol has now been "frozen" in its current iteration, marking the last step in preparing…

Binance, KuCoin Win Registration With India’s Financial Intelligence Unit

The world's largest cryptocurrency exchange, Binance, and rival KuCoin have been registered with India's Financial Intelligence Unit, the most senior official of the unit, which falls under the nation's Finance Ministry, told CoinDesk.This is the first time offshore crypto related entities have been approved by the country's anti-money laundering unit.KuCoin paid a fine of $41,000

Introducing Most Influential 2023

It was a year of retrenchment and transition for the crypto industry. After 2022’s scandals, including FTX, Three Arrows and Celsius, asset prices had gotten crushed and the industry was in hunker-down mode: building, retooling, sharpening up compliance. Regulators went on a warpath, launching major investigations against Coinbase, Binance, Kraken and others. Long-standing, and potentially

US Government Shutdown Derailed Bitcoin ETF Talks, Says VanEck CEO

news A closely-watched proposal to list a bitcoin exchange-traded fund on the Cboe BZX Exchange was withdrawn Wednesday – and the ongoing partial shutdown of the U.S. government appears to be to blame. As CoinDesk reported, the filing was “temporarily withdrawn”, according to VanEck VanEck director of digital asset strategy Gabor Gurbacs. He also said that…

Binance Could Face U.S. Fraud Charges, but Prosecutors Worry About Risk of Bank Run: Semafor

Please note that our privacy policy, terms of use, cookies, and do not sell my personal informationhas been updated.The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk…

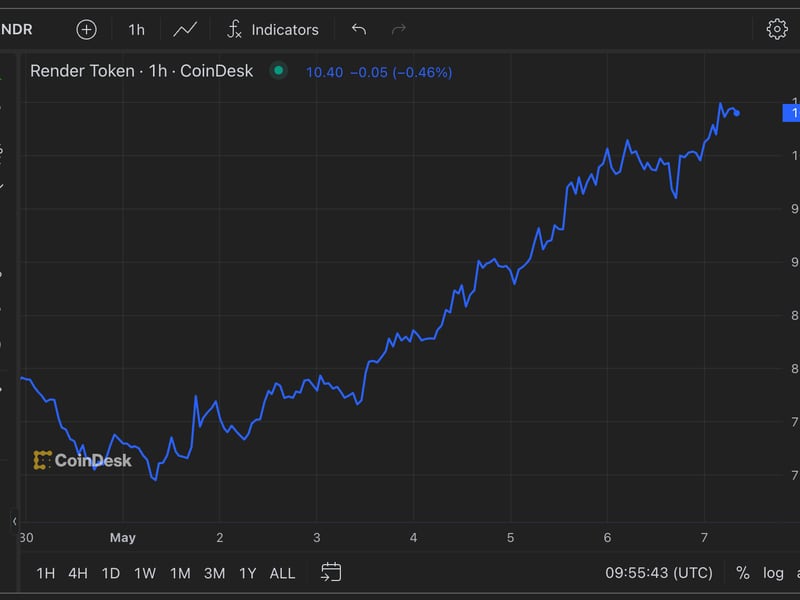

AI Tokens Lead Crypto-Market Recovery as Nvidia Hits One-Month High

AI tokens such as RNDR, AGIX, FET outshine bitcoin by a wide margin.NVDA rallies to a one-month high as excitement builds around the chipmaker's impending earnings report.Native cryptocurrencies of blockchain projects supposedly using artificial intelligence (AI) have led the crypto market recovery in recent days, while shares of Nasdaq-listed chipmaker Nvidia (NVDA), the poster child

BlockFi Adds an Independent Pricing Partner to Guard Against Flash Crashes

Aug 27, 2020 at 13:00 UTCUpdated Aug 27, 2020 at 13:23 UTCBlockFi CEO Zac Prince (CoinDesk archives)Crypto lender BlockFi is partnering with an independent crypto pricing provider to value customer deposits and collateral. CF Benchmarks will price customers’ assets based on data it has sourced from five crypto exchanges that have passed the criteria in…

Bank of Japan Governor Hints at More Rate Hikes; BTC Drops 0.4%

Kazuo Ueda reiterated the commitment to raise Japanese interest rates further. The yen rallied, while BTC and S&P 500 futures registered moderate losses. BOJ-Fed policy divergence points to continued yen strength and pain for risk assets, including BTC. Bank of Japan Governor Kazuo Ueda reiterated that the central bank will raise interest rates further if