Bitcoin Needs to Break This Level Before Pushing for $30K (BTC Price Analysis)

Bitcoin’s price has been consolidating above the $25K support level following the recent drop from the key $30K zone.

However, for the price to reach a new high and break past $30K, there is still much work to do.

Technical Analysis

By Edris

The Daily Chart

On the daily chart, the price has been rejected from the $25K support level and is trending higher. Yet, the 50-day and 200-day moving averages around the $28K mark are two significant resistance levels that the market should break through for a retest and potential breakout from the $30K zone.

The RSI indicator has also increased above the 50% threshold, indicating that momentum is once again in favor of the buyers.

The 4-Hour Chart

The 4-hour timeframe demonstrates a clearer picture of the recent price action. The market is currently attempting to break above the upper boundary of the large falling wedge pattern. In case of a successful breakout, the price is likely to rally towards the $30K resistance level in the short term, as this is a classic bullish reversal pattern.

The RSI’s recent bullish divergence also validates the reversal scenario, making another rise toward the $30K zone more probable.

On-chain Analysis

By Edris

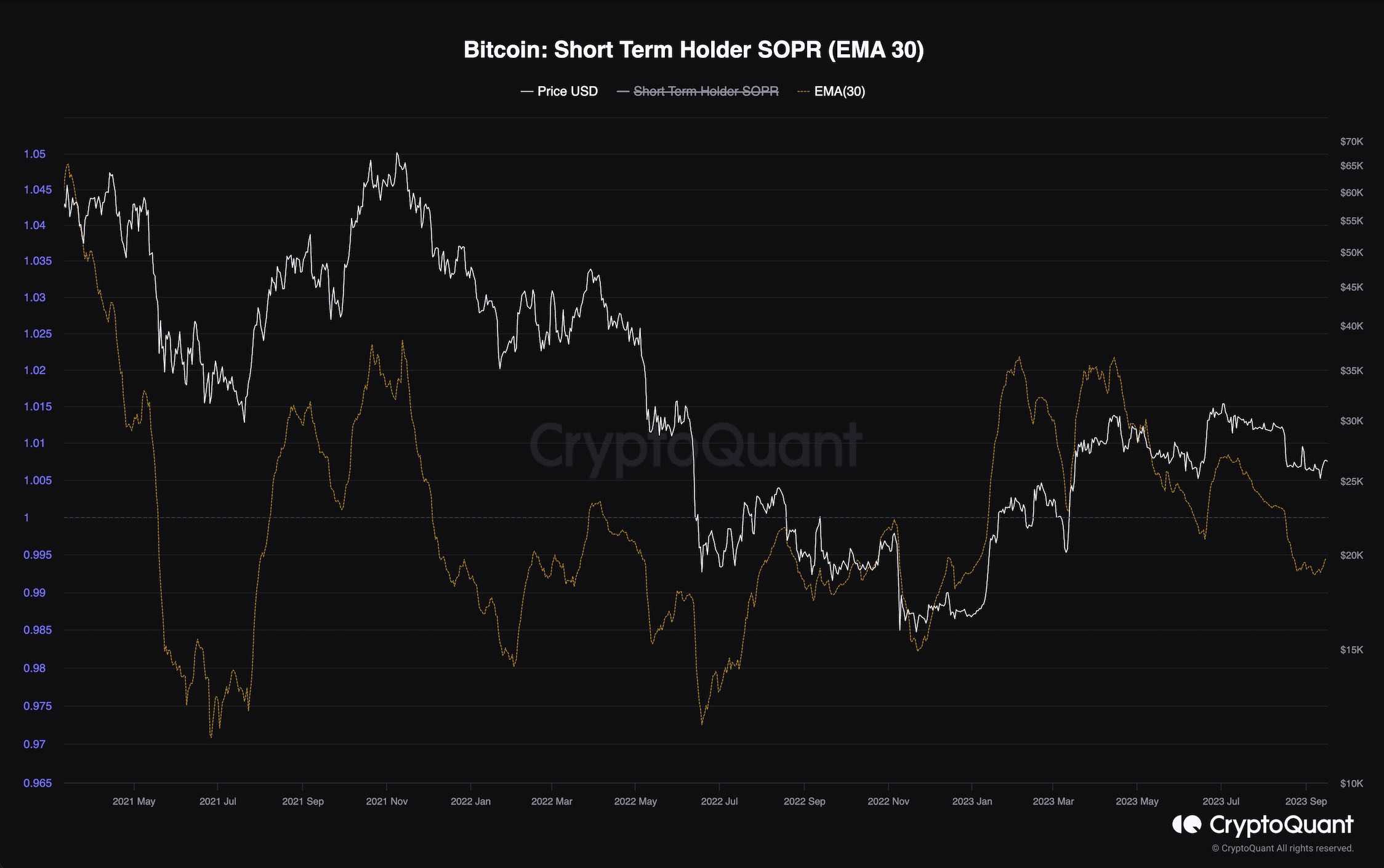

Short-Term Holder SOPR

Bitcoin’s price has been decisively rejected from the $30K resistance level and has been trending down. This price decline has affected investors, and analyzing its effects could provide valuable insights.

This chart demonstrates the Short-Term Holder Spent Output Ratio metric or STH SOPR. A 30-day exponential moving average is applied for better visualization. This metric indicates whether short-term holders who have bought their coins in the past 6 months are selling at a profit or a loss on aggregate. Values above 1 show profit realization, while values below 1 indicate realizing losses.

As the chart depicts, the STH SOPR metric has been trending below 1 over the last few weeks following the recent price drop. Therefore, short-term holders are selling their coins below their buying price out of fear and to prevent further losses. While capitulation in the middle of an uptrend is usually a good thing, as weak hands transfer their coins to strong hands, the market is not in a bullish phase yet. Therefore, if this behavior continues, the market might be overwhelmed by the resulting excess supply and drop lower.

The post Bitcoin Needs to Break This Level Before Pushing for $30K (BTC Price Analysis) appeared first on CryptoPotato.