Bitcoin Nears $98,000, Just 2% Away From Six Figures

Bitcoin prices hit $97,765 in early trading in Asia on Thursday, Nov. 21, according to Tradingview on Bitstamp.

The cryptocurrency has now gained a whopping 40% since Donald Trump’s presidential election victory earlier this month, adding more than $28,000 to its price. To put this into perspective, one BTC traded for around $28,000 in October 2023, just over a year ago.

Moreover, BTC is now around 2% away from hitting the milestone six-figure price of $100,000.

Where we’re heading, $100K candles are the new $10K candles.

— K A L E O (@CryptoKaleo) November 21, 2024

Experts and Analysts React

Industry experts and analysts have started talking about the supply shock, with demand for BTC far outstripping supply.

On Nov. 21, ETF Store president Nate Geraci observed that almost 20 million BTC had already been mined, between four and five million were “lost,” and one million were in Satoshi wallets. Moreover, Bitcoin ETFs now hold a million BTC, and MicroStrategy is on its way to holding 400,000 BTC.

“Not a price prediction, but there’s only so much to go around,” he said.

Nearly 20mil btc have been mined out of total final supply of 21mil…

Estimates are that 4-5mil btc is lost forever.

Satoshi holds over 1mil btc.

Spot ETFs already own over 1mil btc.

MSTR on its way to 400k btc.

Not a price prediction, but there’s only so much to go around.

— Nate Geraci (@NateGeraci) November 21, 2024

Meanwhile, Capriole Fund founder Charles Edwards said the “normie mind” cannot comprehend Bitcoin greater than $100,000, and retail FOMO will kick off when this milestone is hit.

“A ton of supply unloading between $90K-$100K for this reason. Teleportation occurs beyond $100K as the masses re-enter with FOMO.”

On Nov. 21, Lookonchain reported that whales were still accumulating BTC even at peak prices. One whale accumulated 3,289 BTC worth over $300 million from Binance over the past two days and currently holds 25,010 BTC worth $2.37 billion, it reported.

Wednesday was also another big day for spot Bitcoin ETFs, with BlackRock’s IBIT seeing a massive $628 million inflow.

No Love For Altcoins

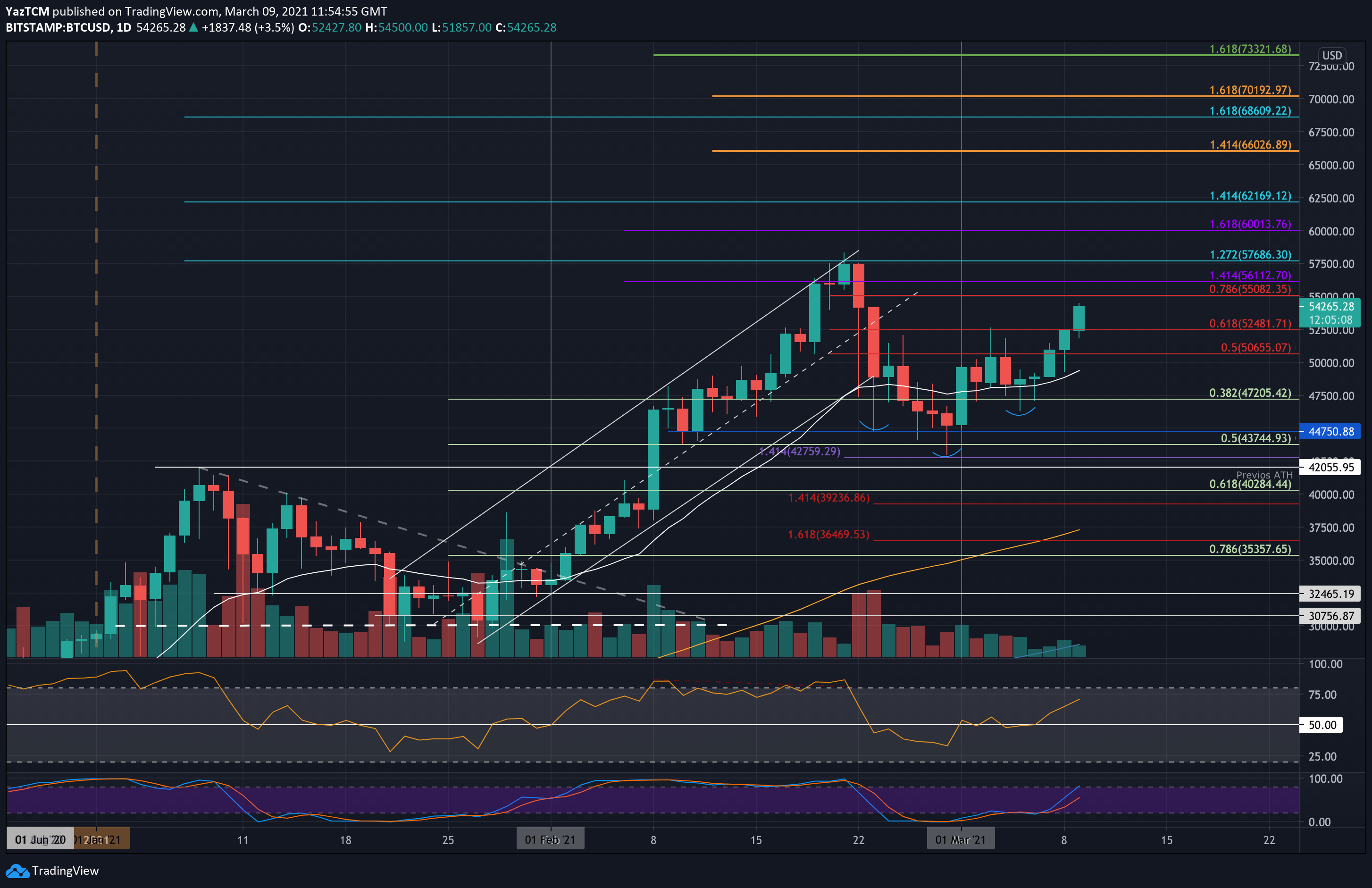

Bitcoin dominance continues to increase, hitting 61.5% on Nov. 21, its highest level since March 2021. This has also pushed the total crypto market cap to an all-time high of $3.28 trillion.

At the same time, Ethereum continues to weaken, remaining flat on the day to trade at $3,100 at the time of writing. The ETH/BTC ratio is also at its lowest for three and a half years.

The majority of the altcoins are also in the red today as Bitcoin continues to eat away at their market shares. There were larger losses for Dogecoin (DOGE), Shiba Inu (SHIB), Sui (SUI), and most of the meme coins as altseason hopes dwindled. Now, though, most have managed to recover a big portion of the recent losses.

The post Bitcoin Nears $98,000, Just 2% Away From Six Figures appeared first on CryptoPotato.