Bitcoin Miners’ Revenue From Fees Rises Suggesting the Onset of Major Bull Run

Fees are a function of transaction size and network volumes (how congested the network is). Transactions are processed in blocks, storing up to 1MB of data. Hence, a sudden spike in activity often leads to network congestion – transactions waiting to get verified. In such situations, miners target transactions with higher fees first. In other words, the more a user offers in fees, the faster their transaction is likely to be verified.

Related Posts

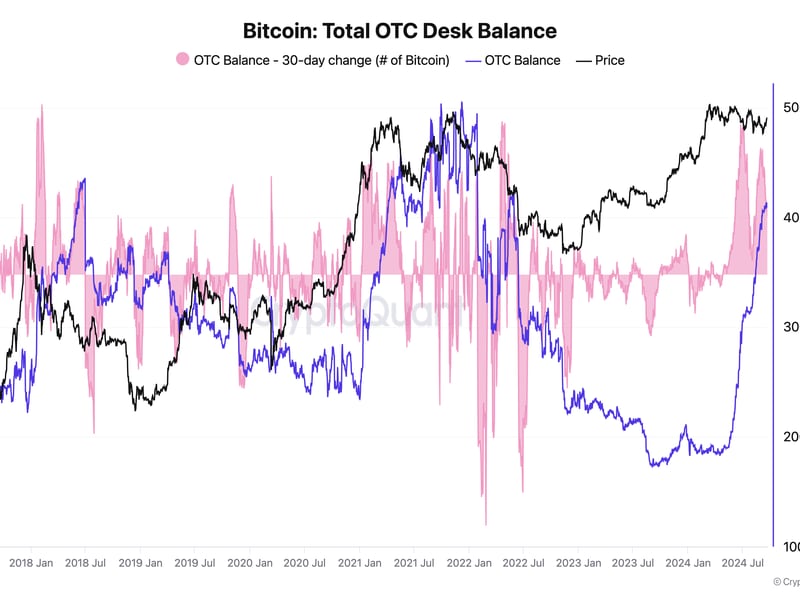

Bitcoin Bull Run in Question as Balances on OTC Desks Rise to 410k

The OTC bitcoin balance has reached a 2.5 year high of 410,000 tokens. The run-up is similar to that which took place during the bull run of late 2020 into early 2021. A decline in bitcoin balances will likely be necessary for a continuation of the recent bull run. One possible headwind to the idea

Venezuela’s Maduro Mandates Petro Use in Funding of Housing Project

news Venezuela’s president has ordered that his pet cryptocurrency, the petro, must be used in funding an ongoing social housing initiative. According to a news announcement on the government’s website Thursday, President Nicolas Maduro mandated that the oil-backed petro token must be used for constructing new homes under the Great Housing Mission Venezuela – a project set…

Bank of Korea: CBDCs Are Fiat Currency Not Virtual Assets

Some legal changes would be needed before a potential central bank digital currency launch in South Korea, research indicates.Feb 8, 2021 at 3:13 p.m. UTCBank of Korea: CBDCs Are Fiat Currency Not Virtual AssetsThe Bank of Korea (BOK) has published the results of research it conducted last year on the legal issues surrounding central bank…

Hive Blockchain Orders Another 6,500 Bitcoin Mining Machines From Canaan

Hive Blockchain Technologies ordered another 6,500 Avalon bitcoin mining machines from manufacturer Canaan (NASDAQ: CAN).The order comes after the Canadian company (NASDAQ: HIVE) bought 4,000 units in August and 6,400 in January.Canaan is a China-based manufacturer best known for its ASIC mining machines that, during boom times, have seen demand skyrocket as more mining businesses…

Overstock Hit by Two More SEC Subpoenas in December

Mar 17, 2020 at 13:28 UTCUpdated Mar 17, 2020 at 13:36 UTCOverstock, the bitcoin-friendly retail company and the parent of security token marketplace tZERO, was subpoenaed twice by the Securities and Exchange Commission (SEC) at the end of last year.As disclosed in Overstock’s annual report filed with the SEC on March 13, the company received…

Bitcoin Drops $1,000 In Value Amid Market Sell-Off

news Bitcoin, the world’s largest cryptocurrency by market capitalization, has once again come into contact with a greater crypto market sell-off slashing its price by more than $1,000. On May. 17 at 2:00 UTC, bitcoin (BTC) dropped by 16.7 percent to find a bid below $7,000 at $6,600 before rising once more on the back of…

U.S. Judge Lets Most of SEC Case Against Binance Proceed, Dismisses Secondary Sales Charge

A federal judge dismissed part of the U.S. Securities and Exchange Commission's (SEC) lawsuit against crypto exchange Binance and founder Changpeng Zhao, but allowed other charges, including charges against the holding company for Binance.US, to proceed. In a late Friday order, Judge Amy Berman Jackson, of the District Court for the District of Columbia, ruled

IRS Enlists Coinbase in Latest Crypto Tracing Deal

Jul 16, 2020 at 20:49 UTCCoinbase CEO Brian Armstrong has tried to downplay the significance of his exchange's government ties. (CoinDesk archives)The Internal Revenue Service has become the second U.S. government agency to license Coinbase’s cryptocurrency tracing software, Coinbase Analytics. On Wednesday, the tax agency agreed to pay the cryptocurrency exchange up to $237,405 over…