Bitcoin Miners May Be Due a Breather After Spot ETF Approval, JPMorgan Says

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

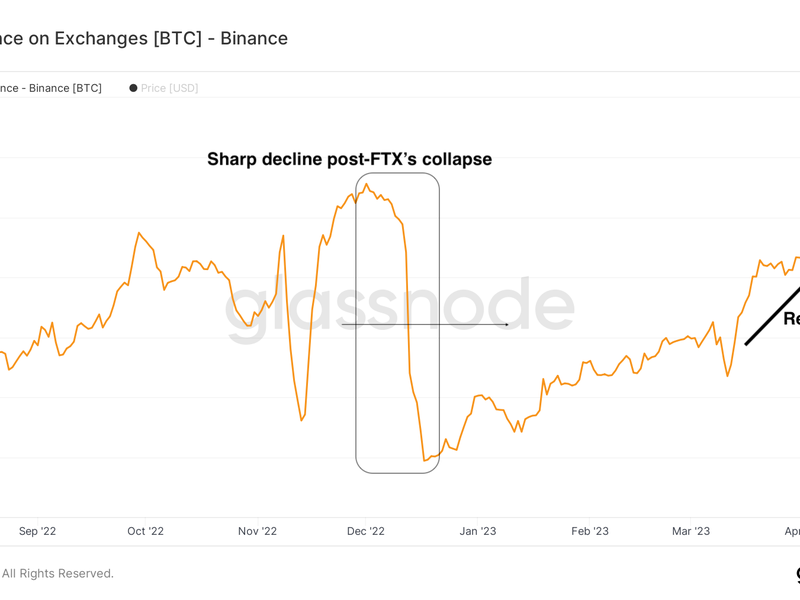

The Securities and Exchange Commission (SEC) yesterday approved the first U.S.-listed spot bitcoin (BTC) exchange-traded funds (ETFs). The move was widely expected as reflected in the buying pressure in both bitcoin and the bitcoin miners in recent months, JPMorgan said in a research report Thursday.

“It is unclear whether the announcement will spur further near-term upside in bitcoin and mining stocks, or if investors will sell the news,” analysts Reginald Smith and Charles Pearce wrote. “Our sense is mining stocks are due for a breather, but expect stock performance to track bitcoin prices over the coming weeks.”

The two noted that bitcoin mining stocks have surged in the last three months, and as of yesterday, the total market cap of the fourteen U.S. listed miners under coverage was almost $17 billion, representing a 131% increase from the end of September versus a 71% gain in bitcoin over the same period.

“Miners are trading near record highs relative to our proved reserve and four-year rolling block reward revenue estimates,” the analysts wrote, warning that there could be selling pressure in the sector if investors decide to rotate out of crypto-related stocks in favor of more direct exposure to bitcoin via an ETF.

Still, the bank sees any sell-off as a buying opportunity, as the ETF does not “directly impact mining economics or change competitive dynamics.”

JPMorgan says it maintains the view that the “stars are aligning for a big year in bitcoin mining.’. Overweight-rated Iris Energy (IREN) is the bank’s top value pick.

Edited by Stephen Alpher.