Bitcoin Miners Are Selling Less BTC

Bitcoin miners are the most profitable they have been in more than two years, and they’re holding more of their produced bitcoin.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

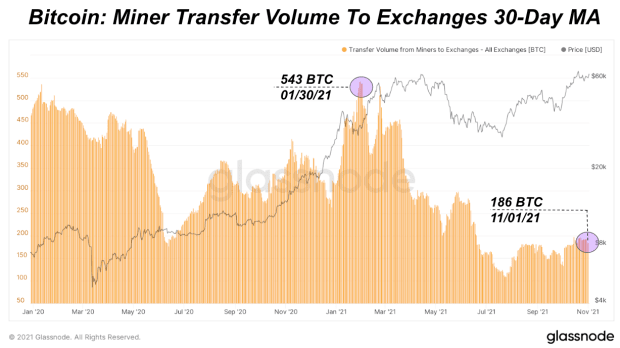

One of the most stable trends over the last few years has been the constant sell pressure on the market from bitcoin miners as they are forced to sell new bitcoin to fund their operations. That sell pressure still exists today, but it has been diminishing over the last few months as miners start holding more of their produced bitcoin.

Right now miners are the most profitable they have been in the last 2.5 years and have more access to legacy equity and debt markets than ever before. The cycle is also primed for another bullish leg up which incentivizes miners to hold as much bitcoin as they can in anticipation of higher prices.

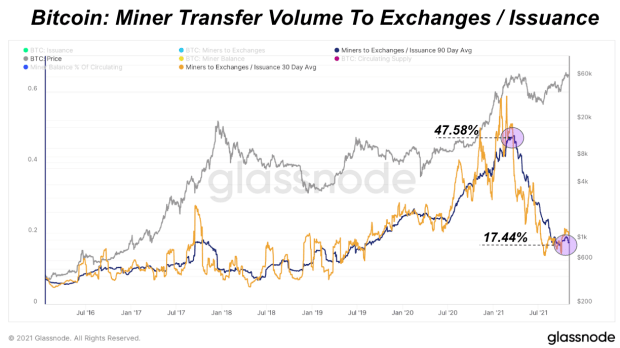

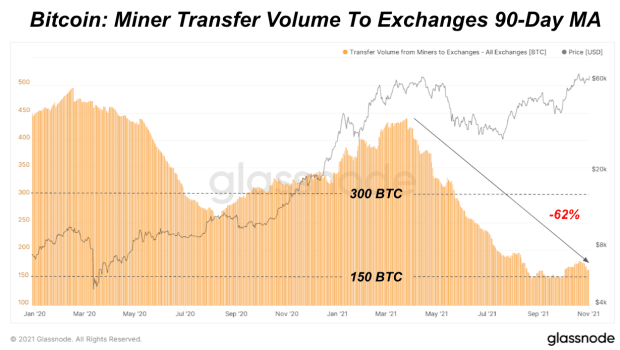

The below chart shows miner transfer volume sent to exchanges as a 30-day moving average. Prior to the previous all-time high run up, miners were sending bitcoin to exchanges at their highest levels over the last two years. Now miners are sending 65% less in transfer volume to exchanges than they were at that previous peak. The 90-day average tells the same story emphasizing the decline over the last six months.

Another way to look at this trend is to normalize miner transfer volume to exchanges by the number of newly-issued bitcoin. This matters more when comparing the transfer volume across halving cycles when the block reward has changed. Using a ratio of the 90-day average of miner transfer volume to the 90-day average of new bitcoin supply, the top of the previous all-time high coincided when miners were selling the most bitcoin as a percentage of newly-issued supply. That percentage has been declining since falling to two-year lows with declining miner transfer volume to exchanges.