Bitcoin Miner Riot Posts Mixed Q2 Earnings Report, Sees Growing Consolidation in Industry

Riot Platforms (RIOT), one of the largest publicly-traded bitcoin miners, reported mixed earnings in its second-quarter earnings release on Wednesday. The miner reported an adjusted earnings per share loss of $0.17, beating FactSet consensus analyst estimates for a loss of $0.20 per share, but revenue came in $76.7 million, short of analyst estimates of $84.6 million.

Quarterly revenue consisted of $49.7 million from bitcoin mining, $7.7 million from data center hosting and $19.3 million from engineering. The quarterly revenue compared to $72.9 million in the year-ago period, with the rise driven by a 27% increase in bitcoin production, offset by lower bitcoin prices.

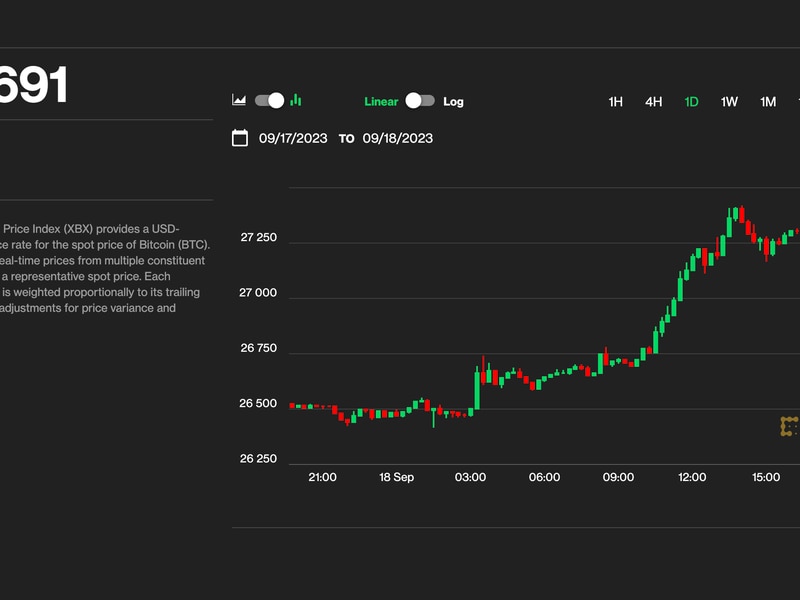

Shares of Riot were falling 0.4% to $16.28 in after-hours trading on Wednesday. Riot shares are up more than 383% this year, having benefited from the strong performance of bitcoin.

“Riot’s core business is Bitcoin mining, and the scale of our vertically integrated operations and financial strength allowed us to execute on our power strategy at unmatched scale this quarter, driving our average cost to mine to $8,389 per Bitcoin in the second quarter, compared to an average Bitcoin price of $28,024,” said Jason Les, CEO of Riot, in a statement.

The company noted in its filing that it expects to benefit from growing consolidation in the bitcoin mining industry this year.

“We anticipate companies in our industry will continue to experience challenges, and that 2023 will continue to be a period of consolidation in the Bitcoin mining industry, and, given our relative position, liquidity and absence of long-term debt, we believe we are positioned in the competitive landscape to benefit from such consolidation,” the company wrote.

Riot also reiterated guidance given in its July update that its total self-mining hash rate capacity is expected to reach 20.1 EH/s by mid-2024.