Bitcoin Miner Marathon Buys $100M BTC, Will Once Again Adopt ‘Full HODL’ Strategy

Marathon Digital (MARA), one of the largest bitcoin (BTC) miners, bought $100 million worth of BTC in the open market and said it will readopt its strategy to hold all mined bitcoin on its balance sheet.

The miner said in a statement on Thursday that it now holds over 20,000 bitcoin, worth nearly $1.3 billion based on current prices, on its balance sheet and plans to buy more in the open market.

08:52

Marathon Digital CEO: We’re Bullish on Bitcoin

07:01

Mara CEO on Raising $23M to Spread Crypto Adoption Across Africa

05:10

Mara Raises $23M From Coinbase, Alameda to Spread Crypto Adoption Across Africa

06:50

Marathon Digital ‘Cautiously Optimistic’ About Early 2023 Hashrate Guidance

“Bitcoin’s recent price decline, coupled with the strength of our balance sheet, afforded us an opportunity to add to our holdings. We look forward to continuing to leverage our technological expertise to support Bitcoin and distributed digital asset ecosystems,” said Marathon’s CFO Salman Khan.

The decision to HODL or holding onto bitcoin comes almost year after Marathon started to sell its mined digital assets to pay for the company’s operating expenses. Prior to the crypto winter, most miners adopted the strategy to hold on to all the mined bitcoin in their balance sheet, which paid off during the bull market rally. However, as market imploded last year, most miners started to sell their mined bitcoin to pay for operating expenses and Marathon was one of the last one to start monetizing their digital assets in early 2023.

“Adopting a full HODL strategy reflects our confidence in the long-term value of bitcoin,” said Fred Thiel, Marathon’s chairman and CEO. “We believe bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold bitcoin as a reserve asset.”

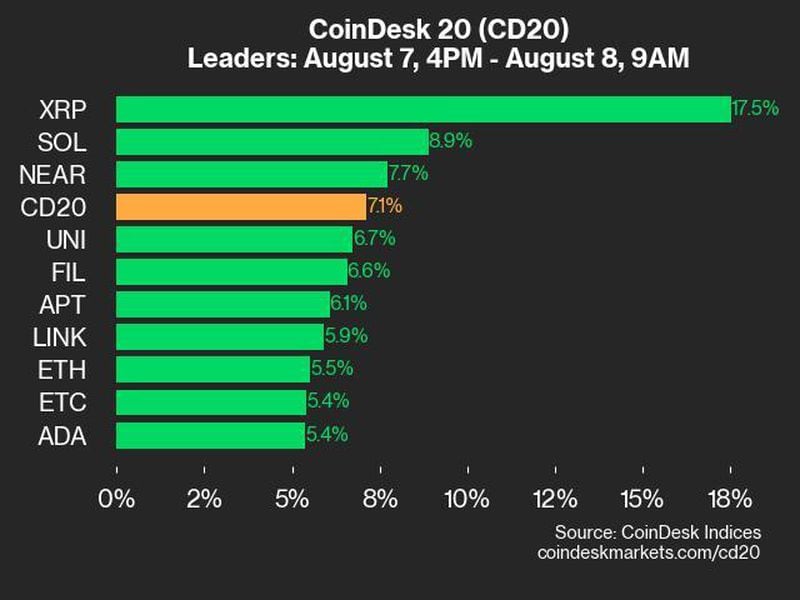

After the prolonged bear market, bitcoin started to recoup its losses this year after the likes of BlackRock got approval to offer spot BTC exchange traded-funds (ETFs) in the U.S. This move brought more investors into the market and helped the digital asset reach a new all-time-high price. Bitcoin has come off its peak of over $70,000 since then and now trading around $64,000 – still up 51% this year.

“Given Bitcoin’s current tailwinds, including increased institutional support and an improving macro environment, we are once again implementing this strategy and focusing on growing the amount we hold on our balance sheet,” Marathon’s CFO said.

Marathon held $268 million in cash in its balance sheet as of June 30 and will report its second quarter earnings Aug. 1. The shares of the miner is down about 2.5% in the pre-market trading, while bitcoin fell about the same amount in the last 24 hours. The broader CoinDesk20 Index also slumped 5.4% in the same time period.

Edited by Parikshit Mishra.