Bitcoin Miner Canaan’s Q2 Mining Revenue Surges by 43%, Net Loss Increases by 31%: Report

Nasdaq-listed Bitcoin mining firm Canaan’s total revenue increased to $73.9 million in Q2 2023, marking a quarter-on-quarter climb from $55.2 million. This figure comprised $57.9 million in product revenue and $15.9 million in revenue generated from Bitcoin mining operations.

Canaan’s growth in revenue coincided with its expansion into new mining projects in both Africa and South America.

Revenue Growth

According to its unaudited financial results for the three months ended June 30, 2023, Canaan’s mining revenue amounted to $15.9 million, reflecting a 43.3% surge from the $11.1 million recorded in the first quarter of 2023 and a substantial 105.1% rise from the $7.8 million in the same period last year.

Commenting on the development, Canaan’s Chairman and Chief Executive Officer, Nangeng Zhang, highlighted the company navigating the challenges in the second quarter of 2023 and exceeding surpassing the topline guidance to achieve figures.

“Despite the relatively stagnant bitcoin price in the second quarter, our endeavor to drive sales across various fronts, including major clients, channels, and retail, yielded encouraging results. This effort propelled our total computing power sold to a remarkable 6.1EH/s, up 44% sequentially. Our mining revenue further set a new historic high in the second quarter of 2023. “

The exec also noted that the recent collaborations with channel clients yielded positive results, while Canaan’s online retail store continued to attract customers from various geographical regions.

Despite a net loss of $110.7 million, Canaan’s product sales increased by 31.3% quarter over quarter, driven by jumps in total computing power sold.

In addition to Canaan’s sales performance, the company’s mining operations displayed growth, leading to a 115% sequential increase in cryptocurrency assets on its balance sheet. Of those, 747 bitcoins were owned by the company.

Owing to the incessant crypto winter and fall of several prominent crypto firms, Canaan’s year-over-year revenue experienced a significant downturn in 2022. The ASIC maker disclosed a substantial 82% drop, resulting in a revenue of $56.8 million.

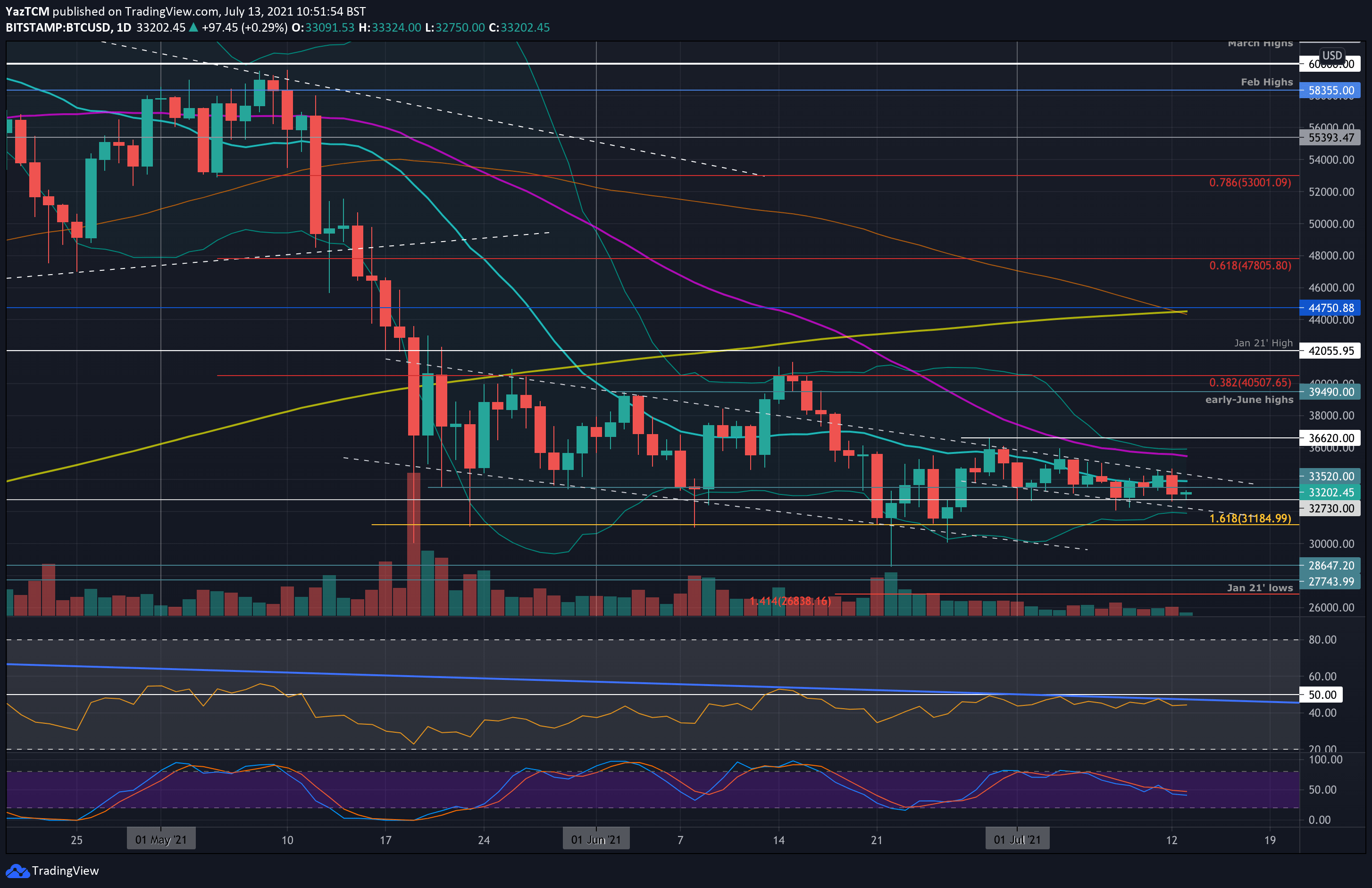

Bitcoin Price Appears Frail

The Grayscale victory against the SEC did manage to propel the price toward $30k, but the subsequent sell-off quashed the uptrend and wiped off all the gains. At the time of writing, Bitcoin slid below $26k.

Even as the price of the world’s largest crypto-asset is yet to recover, its hash rate and difficulty levels are hovering near fresh peaks, reflecting miners’ confidence.

The post Bitcoin Miner Canaan’s Q2 Mining Revenue Surges by 43%, Net Loss Increases by 31%: Report appeared first on CryptoPotato.