Bitcoin Miner Bitfarms Sinks to Fourth-Quarter Loss as Difficulty, Costs Rise

“Looking ahead, we plan to leverage our existing infrastructure in Argentina and utilize equipment credits to prudently expand our EH/s to 6.0 with our existing assets by year end 2023,” President and CEO Geoff Morphy said in the filing. “With our strengthened balance sheet, we are actively evaluating potential acquisitions that we expect to be accretive and complement our geographically diverse mining operations,”

Related Posts

What Visa’s ‘Organic’ Stablecoin Report Misses

What do we talk about when we talk about bots in crypto? Although crypto advocates often think about the suite of these peer-to-peer blockchain-based tools and currencies as advancing human freedom and financial liberty, for years it’s been known that only a small percentage of crypto transactions actually happen between people.This is an excerpt from

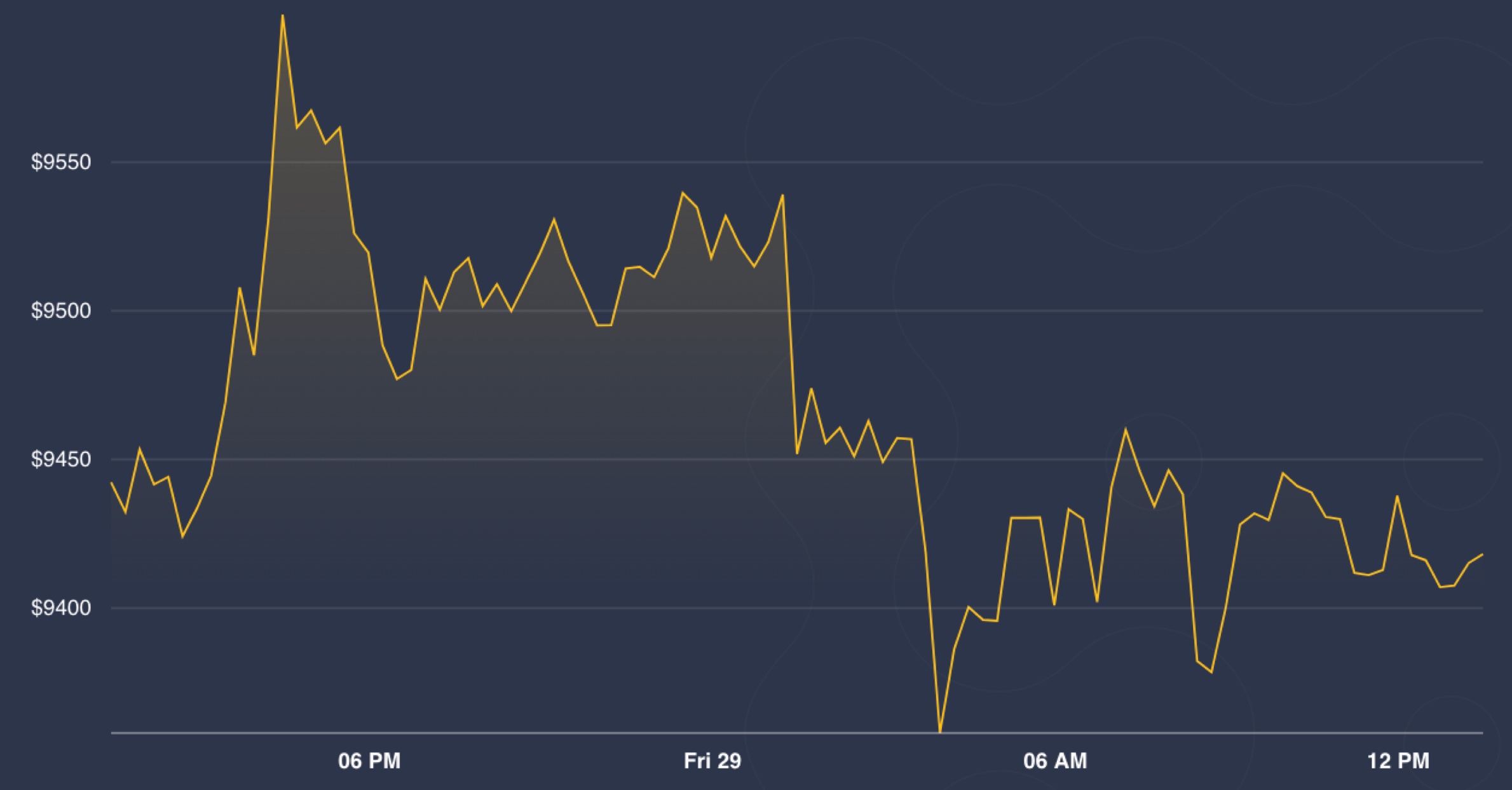

Market Wrap: Bitcoin Slides, Stocks Tread Water on Trump China Comments

May 29, 2020 at 21:22 UTCSource: CoinDesk Bitcoin Price IndexMarket Wrap: Bitcoin Slides, Stocks Tread Water on Trump China CommentsBitcoin declined for the first time in three days as traders in digital-asset markets and more traditional stocks considered the implications of U.S. President Donald Trump’s latest broadsides against China on the coronavirus and Hong Kong. …

GitHub and Slack Bans Are Hurting Iranian Bitcoin Businesses

feature Iranian bitcoiners are showing the world what censorship resistance really looks like. Starting last weekend, Microsoft’s GitHub started identifying and banning Iranian accounts based on U.S. trade restrictions. As such, blockchain developers are hindered from participating in software projects that include private repositories or paid services for commercial ventures. “The majority of serious crypto/blockchain projects…

ASX Delays Launch of DLT System Over Coronavirus Trading Volatility

Oct 28, 2020 at 09:56 UTCAustralia’s largest stock exchange operator, ASX Ltd., has once more opted to delay the rollout of its in-development blockchain-based trading platform.As reported by Reuters on Wednesday, the operator of the Australian Securities Exchange said it was eyeing a new date of April 2023 due to higher levels of demand than…

Hong Kong’s Central Bank Starts Regulatory Sandbox for Stablecoin Issuers

Hong Kong's central bank is inviting businesses interested in issuing fiat-backed stablecoins to join a regulatory sandbox.The regulator plans to use the sandbox to shape its plans to regulate crypto pegged to real currencies.The Hong Kong Monetary Authority (HKMA) started a regulatory sandbox to give potential stablecoin issuers an environment for developing and testing certain

Bitcoin News Roundup for March 9, 2020

For early access before our regular noon Eastern time releases, subscribe with Apple Podcasts, Spotify, Pocketcasts, Google Podcasts, Castbox, Stitcher, RadioPublica or RSS.Today's news:For early access before our regular noon Eastern time releases, subscribe with Apple Podcasts, Spotify, Pocketcasts, Google Podcasts, Castbox, Stitcher, RadioPublica or RSS.Disclosure Read More The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial…

Vanguard Ran Its Digital Asset-Backed Securities Pilot in 40 Minutes

Jun 23, 2020 at 07:00 UTC(Piotr Swat/Shutterstock)Vanguard Ran Its Digital Asset-Backed Securities Pilot in 40 MinutesThe full life of a digital asset-backed security (ABS) on a blockchain can be settled in 40 minutes versus the 10 to 14 days it would take in a paper-based setting. That was the outcome of a pilot first revealed…

Blockchain Bites: JPMorgan on Bitcoin, South Korea on CBDCs and the Porn Industry on Crypto

Jun 15, 2020 at 16:36 UTCBlockchain Bites: JPMorgan on Bitcoin, South Korea on CBDCs and the Porn Industry on CryptoTop ShelfView From the BanksIn an investor note, JPMorgan Chase & Co. analysts noted bitcoin’s success in outperforming traditional assets in March on a volatility-adjusted basis, and also found liquidity on major bitcoin exchanges was more resilient…