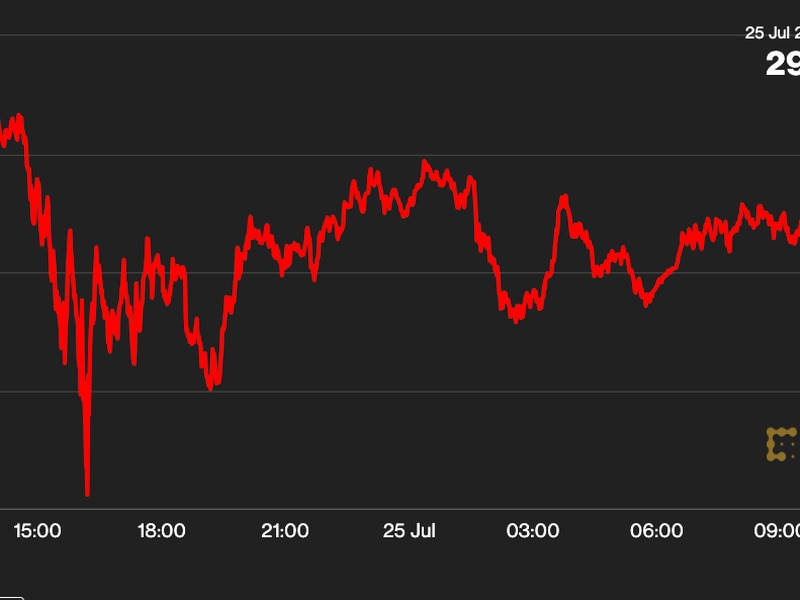

Bitdeer Technologies’ (BTDR) shares are appealing given the wide gap between the company’s discount valuation and its growth prospects, investment banking firm Benchmark said in a research report Thursday.

Benchmark initiated coverage of the bitcoin (BTC) miner with a buy rating and a $13 price target. The stock closed over 7% higher on Wednesday at $6.74.

“We view the Singapore-based company as differentiated from its publicly traded peers due to its scalable infrastructure with one of the lowest all-in mining costs in the space, diverse revenue streams including self-mining, hashrate sharing, and hosting, and its recent expansion in artificial intelligence (AI)/high performance computing (HPC) solutions and into the design and manufacture of advanced mining rigs,” analyst Mark Palmer wrote.

If management is able to deliver on the company’s growth plans it would more than double its power capacity, “paving the way for significant hashrate expansion,” he added.

The transition of hashrate from hosting to self-mining is set to “boost upside exposure to bitcoin price increases,” the report said.

Hashrate

refers to the total combined computational power that is being used to mine and process transactions on a

proof-of-work

blockchain.

Palmer also noted that Bitdeer is well positioned to take market share in the AI and HPC sector.