Bitcoin Marks Its Best Week Since May: Crypto Weekly Report

It appears that China is waking up and this did to the market what Bakkt’s futures failed to. President Xi Jinping urged for further adoption of blockchain-based technology and his statement might have been one of the reasons for Bitcoin’s 40% surge in the past few days.

As such, Bitcoin saw its best week since May. It’s not the first time that statements from China affect market volatility and the increase in prices is a fundamental reaction that has left most of the technical analysts surprised. It also saw a lot of short positions liquidated, especially those who were counting on a correction to $6,000. Now the market is pulling back and trying to figure out whether the trend is strong enough to keep going up or if that’s just a bull trap.

The timing of the news from China came as the market had entered fairly bearish conditions after the price lost support around $8,000. However, we also pointed out last week that Bitcoin’s sentiment usually changes in a moment. Thus, just before the end of the year, the market recalculates and marks a successful 2019 in terms of Bitcoin’s price. However, the regulatory framework is still not good enough, while the existing infrastructure still fails to enable Bitcoin’s integration in the traditional economy.

The war between Bitcoin and banks is just beginning and it will definitely take some time to see the liquidity. Banks are still having difficulties and they don’t allow companies to operate in the field because of the lack of sufficient clarity on the rules. Despite previous estimates that 2019 would be a year of regulations, it seems to have been just the opening shot in terms of cryptocurrency financial legislation.

Altcoins are also rising up and are able to maintain their value with regard to bitcoin. Some of them have even shown very impressive performance. Chinese altcoins such as NEO and TRX were especially prominent. Despite this, Bitcoin’s dominance wasn’t affected and it even increased after the sharp increase in the prices.

In conclusion, as we approach the end of the last quarter of 2019, Bitcoin continues to be volatile and unexpected as usually. We may certainly see another leap and an attempt to break the existing records or it could plummet within days. This is definitive proof that there’s never a boring day on the cryptocurrency market.

Market Data

BTC Longs (BFX): 26K BTC

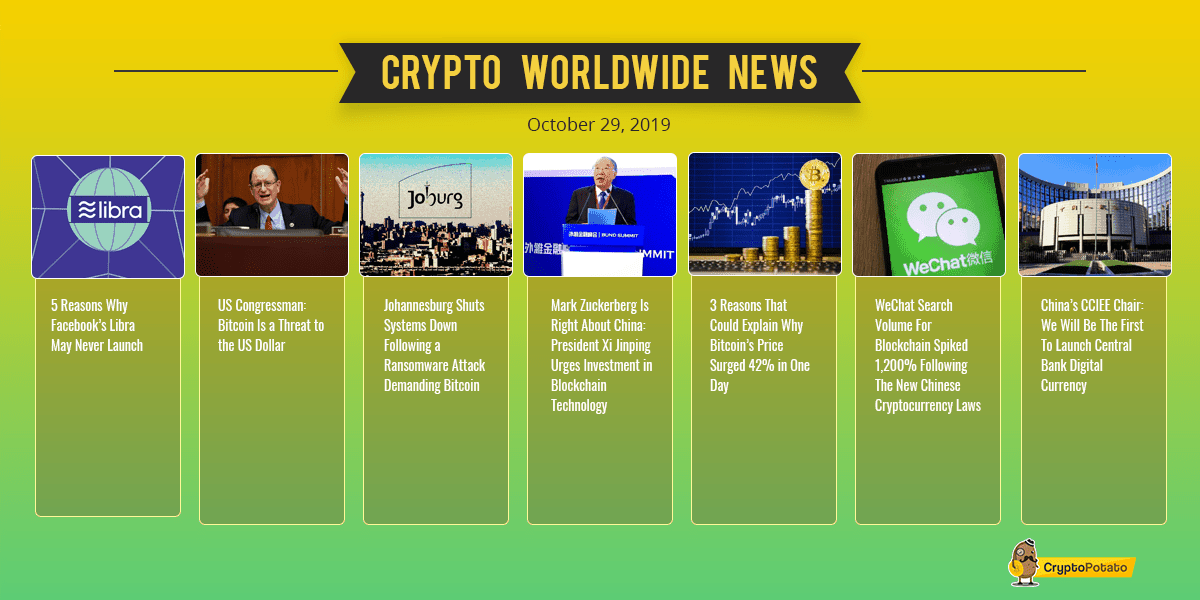

5 Reasons Why Facebook’s Libra May Never Launch. Facebook’s Libra was announced earlier in the summer. However, ever since, the company saw a backlash of negative attention as regulators and media grilled the project for a range of reasons. Here are a few of them that should be taken into account.

US Congressman: Bitcoin Is a Threat to the US Dollar. US Congressman Brad Sherman addressed the challenges that cryptocurrencies such as Bitcoin poise to traditional financial markets. According to him, Bitcoin presents a potential threat to the US dollar. He also reiterated that cryptocurrencies could be increasingly adopted by criminals for illicit activities.

Johannesburg Shuts Systems Down Following a Ransomware Attack Demanding Bitcoin. Subjected to a ransomware attack, the city of Johannesburg shut down all of its systems for a relatively brief period of time while dealing with the issues. Interestingly enough, the ransom which was demanded was in the form of bitcoins. The attackers wanted 4 BTC in order to release the harmful software.

Mark Zuckerberg Is Right About China: President Xi Jinping Urges Investment in Blockchain Technology. A day after the CEO of Facebook, Mark Zuckerberg, warned that others might get ahead of the US in terms of blockchain developments, the president of China praised the technology and urged its further adoption. This supposedly sparked a serious rally in the cryptocurrency market.

3 Reasons That Could Explain Why Bitcoin’s Price Surged 42% in One Day. Bitcoin went through one of its most notable price increases since 2011. In just a couple of days, the cryptocurrency gained more than $3,000 before pulling back slightly. During a fairly eventful week in terms of news, here are a few potential reasons which could explain the rally.

WeChat Search Volume For Blockchain Spiked 1,200% Following The New Chinese Cryptocurrency Laws. Following President Xi Jinping’s speech on Blockchain, interest towards the technology in China skyrocketed. One of the largest multi-purpose apps, WeChat, saw a surge in the search volume for blockchain-related terms upwards of 1,200%. The country also introduced new cryptography laws.

China’s CCIEE Chair: We Will Be The First To Launch Central Bank Digital Currency. The vice-chairman of China’s Center for International Economic Exchanges (CCIEE) said that the country is getting closer to launching the first-ever central bank digital currency. He also outlined that he doesn’t believe in Facebook’s Libra and its potential launch. Yet, he said that CBDC is needed because current payment methods are outdated.

Charts

This week we’ve analyzed the Bitcoin, Ethereum, XRP, BitTorrent, and NEO markets – click here for the full price analysis.

The post Bitcoin Marks Its Best Week Since May: Crypto Weekly Report appeared first on CryptoPotato.