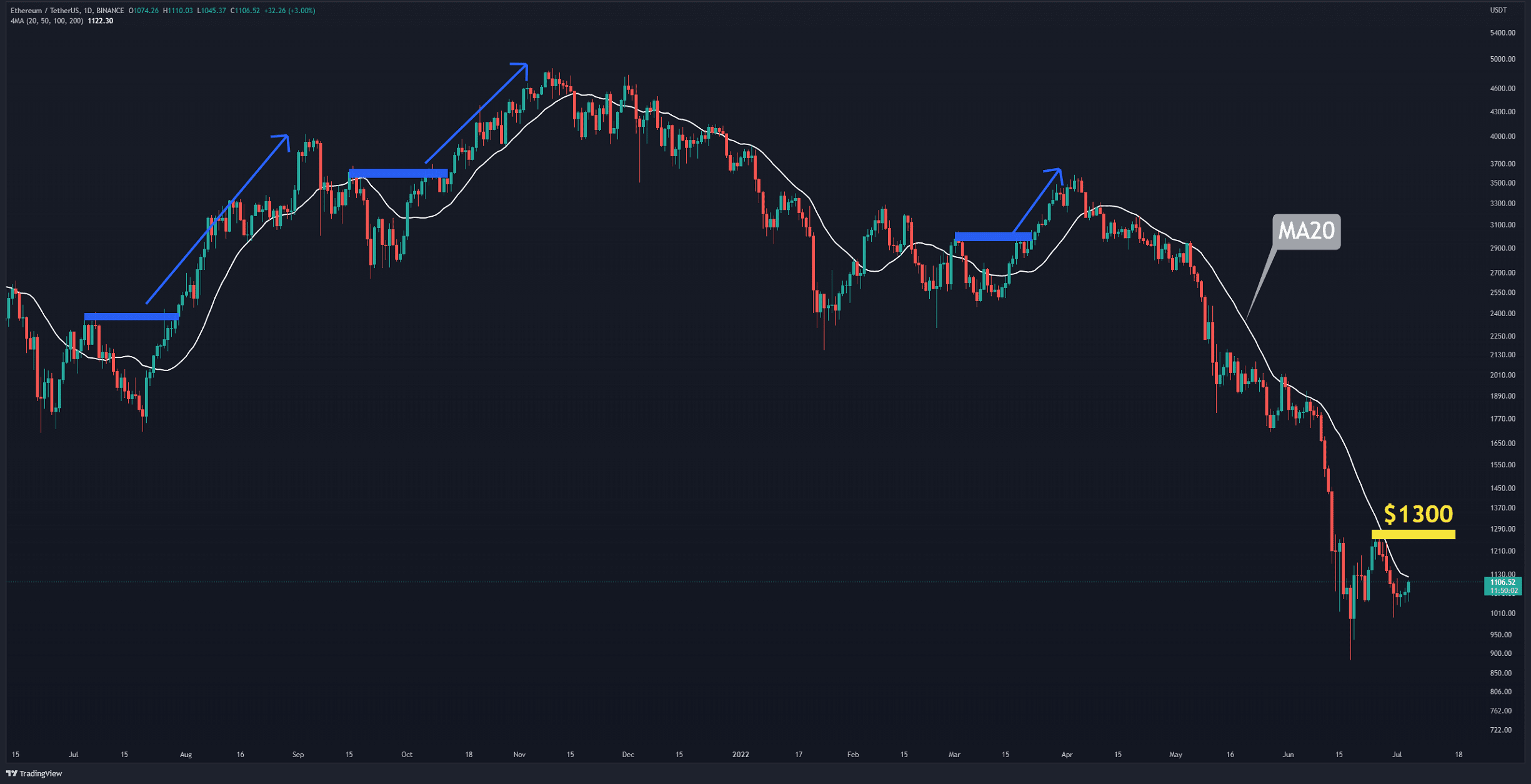

Bitcoin Looks Bullish, But Could This Action Lead to a False Breakout? BTC Price Analysis

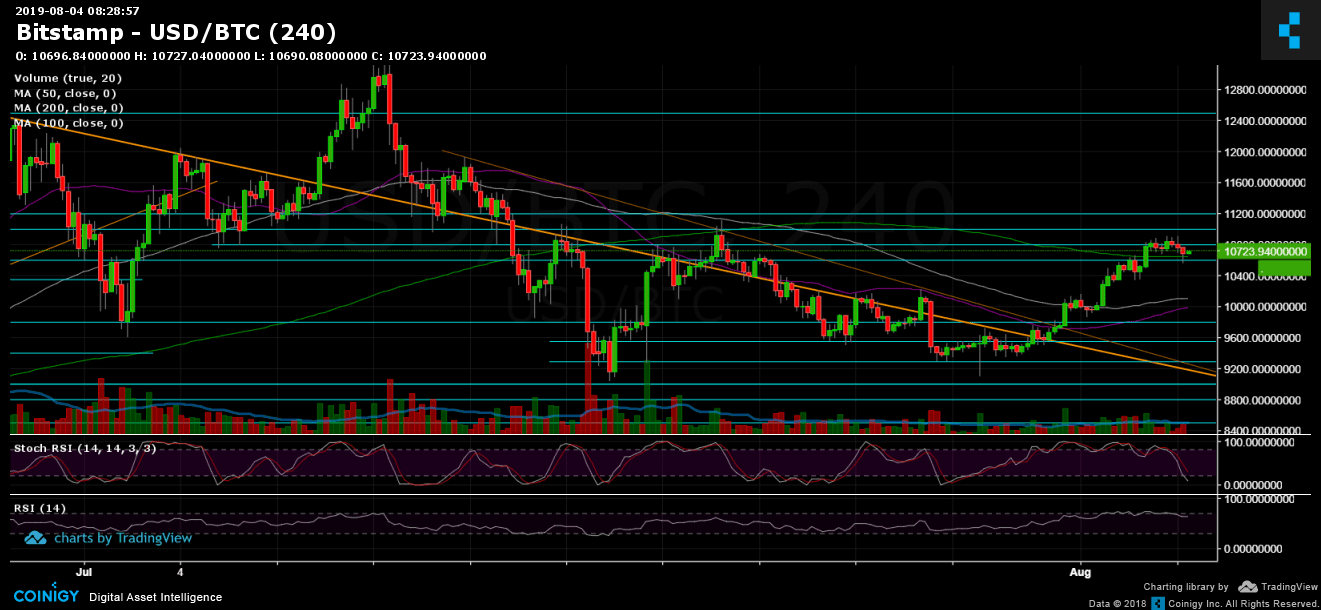

Following the colossal price rally, Bitcoin continued in its explosion above the 5-digit mark. Following a day of consolidation at the significant $10,500-$10,600 resistance level (along with the daily MA-50), the coin’s price broke impressively into the next resistance zone of $10,800-$11,000.

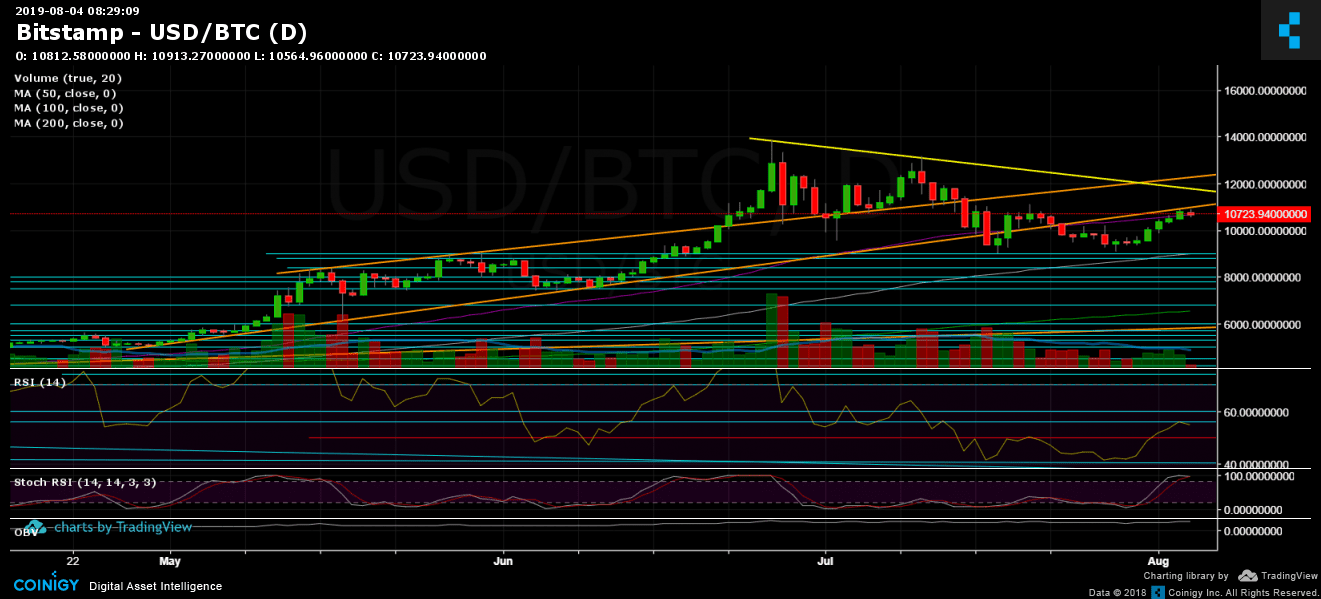

However, after recording a new 14-day high at $10,919 on Bitstamp, Bitcoin encountered the long-term ascending trend line. That line had supported Bitcoin since the beginning of May, and Bitcoin only recently broke below it. Yesterday was the first attempt to get back above the line, testing it as resistance.

The strength of the descending trend line was proven by the fact that Bitcoin touched the line, got rejected, and quickly lost around $350 of its value, returning to test the $10,500-$10,600 area as support.

The RSI momentum indicator (shown on the 1-day chart below) finally broke above 50, entered bullish territory, and turned around precisely upon reaching our marked resistance at 56 RSI.

A word about the altcoins – well, when you don’t believe things can get any uglier, new floors are discovered. It will be hard for the altcoins to generate any momentum in the face of Bitcoin’s high volatility. As we mentioned in our altcoin trading guide, the vast majority of those coins will simply bleed to death over time. It doesn’t matter whether Bitcoin’s price goes up or down.

Total Market Cap: $287 billion

Bitcoin Market Cap: $191 billion

BTC Dominance Index: 66.6%

*Data From CoinGecko

Key Levels to Watch

Support/Resistance: After being rejected from the daily long-term ascending trend line (drawn in bold orange below), Bitcoin experienced the latter as the latest significant resistance level, along with the $11,000-$11,200 area. In the case of a break up, the next possible resistance levels are $11,500 (along with the 2019 high descending trend line marked in yellow on the daily chart), $11,800, $12,000, $12,200, and $12,500.

From below, the nearest support area is $10,500-$10,600 (resistance-turned-support), which also contains the significant 50-day moving average line (marked in purple on the daily chart). Further below lies the support zone at $10,000-$10,200, which contains the 4-hour chart’s MA-50 (purple line) and MA-100 (white line). The nearest levels of support below $10K are $9,800 and $9,550.

Daily chart’s RSI: discussed above. The Stochastic RSI oscillator is about to cross over to the downside and enter oversold territory. If this plays out, Bitcoin will likely experience a deeper correction before trying again for those higher levels (remember, we are in a bull market until proven otherwise).

-Trading Volume: As mentioned in our previous price analysis, the last spike didn’t carry high trading volume levels. This was reflected in the rejection upon reaching the ascending trend line (acting as resistance). If Bitcoin wants to firmly conquer higher levels, it must be backed by more significant numbers of buyers.

BTC/USD Bitstamp 4-Hour Chart

BTC/USD Bitstamp 1-Day Chart

The post Bitcoin Looks Bullish, But Could This Action Lead to a False Breakout? BTC Price Analysis appeared first on CryptoPotato.