Bitcoin Long-Term Buy Indicator Just Flashed as BTC Faces Critical Resistance (Price Analysis)

BTC has continued to push up with impressive spot volume hitting an intraday high of $45.3k even during weekend trading.

The cryptocurrency is now testing one of the most critical levels of resistance at the 200-day moving average. Successfully reclaiming this level will trigger a significant buy signal in technicals, likely encouraging large momentum traders and other market participants to enter the market, further adding to buying pressure in an already supply exhausted state.

Another critical level that must be reclaimed for further upside is the 21-week moving average at $44.5K

Overall, the BTC technicals, structure, momentum, on-chain data, and sentiment have been trending higher, showing early signs of a strong recovery. One of the biggest signals of a market reversal is BTC futures open interest increasing throughout the 3-month long consolidation while funding rates were consistently negative, implying the market was net-short BTC, increasing the probability of an eventual short squeeze.

Strong spot buying, led to a massive short squeeze and pushed BTC from the lows of $28.8k to an intraday high of $45.3k

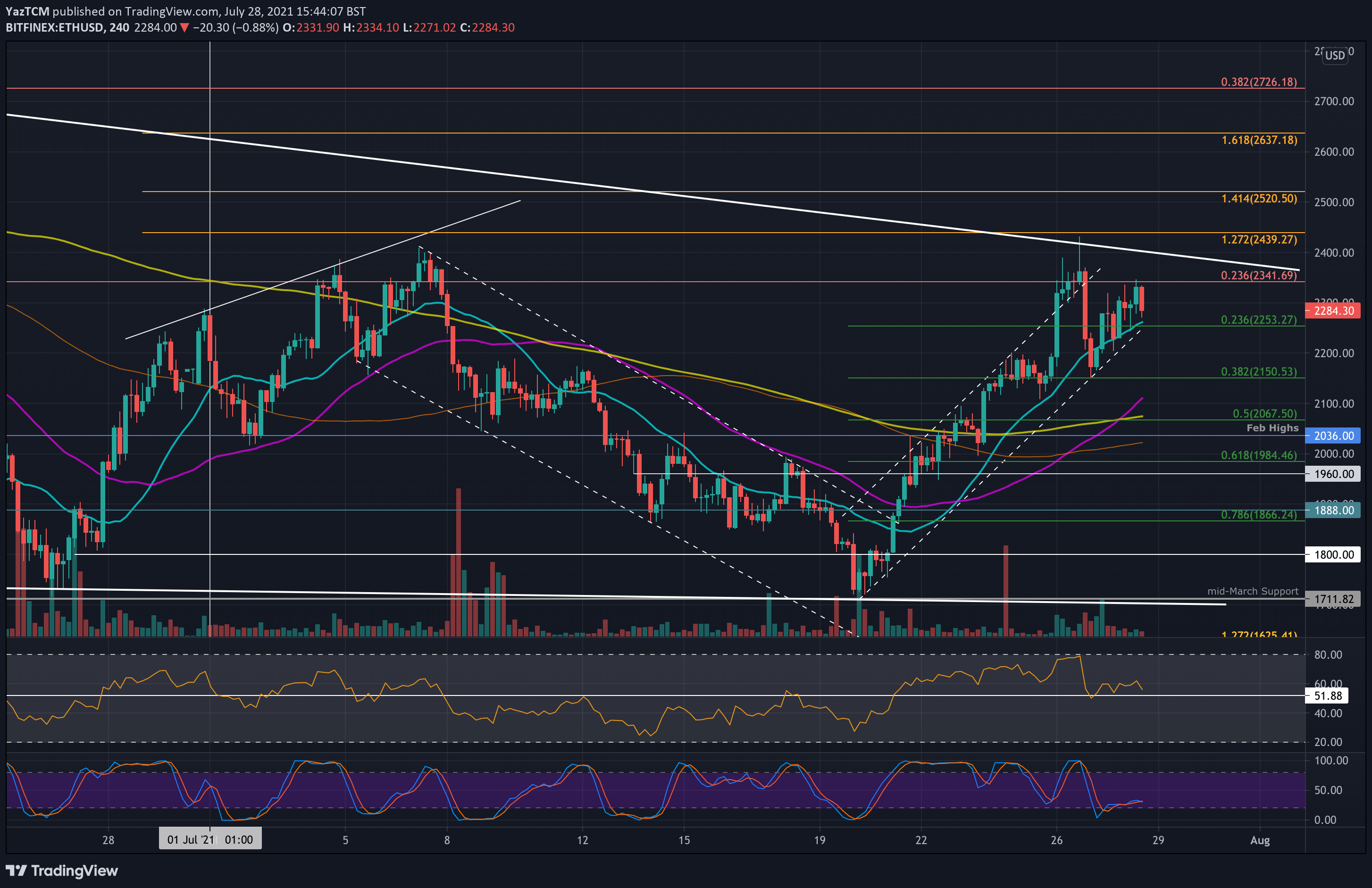

Near-Term Technicals Spell Caution

Near-term technicals appear to be overbought, with bearish divergence forming on the 4-hour chart. This suggests the BTC price could be entering a period of consolidation around current levels to prepare for the next major move.

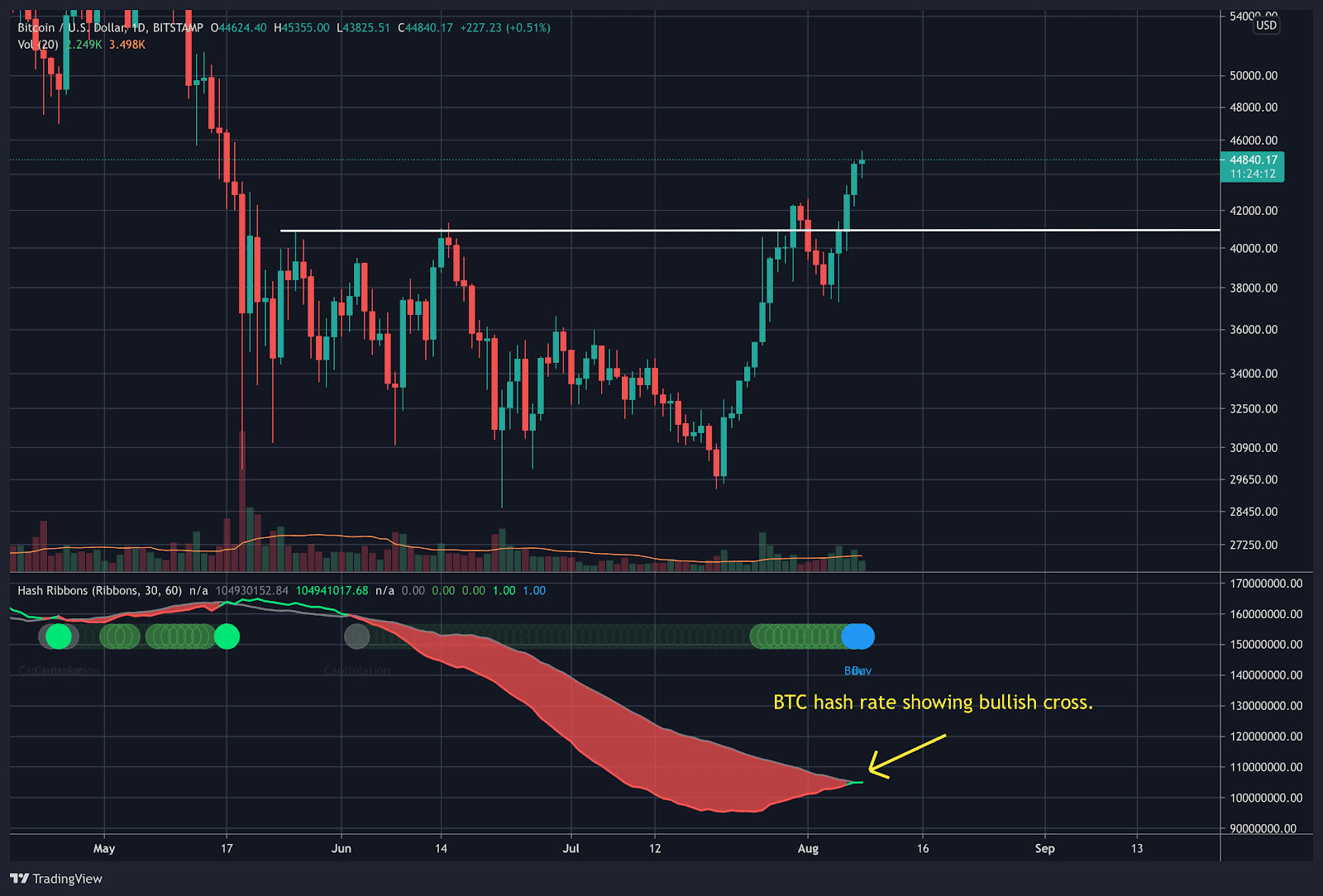

Long-Term Buy Signal Flashing

What’s very interesting is the BTC Hash Ribbon Indicator has turned bullish on the day BTC is testing the 200-day MA. The Hash Ribbon simply measures the hash rate of the Bitcoin network over a 30-day and 60-day moving average. When the 30-day moving average crosses above the 60-day moving average, this signals potential miner capitulation – an indication that strength is returning to the Bitcoin network in hashrate.

The bullish cross on the BTC Hash Ribbon indicator is considered a long-term buy signal for BTC. It’s more of a lagging indicator as BTC price does not immediately rally when it flashes. The 2 previous buy signals that flashed during major recoveries in BTC hash rate, saw near-term price consolidation, then eventually a significant rally higher.

Given the near-term overbought conditions for BTC, we could see a consolidation first, before a large rally. Ideally, a near-term consolidation would be healthier for the technical structure and make the recovery more sustainable.

The weekly close for BTC is coming up at a time where the 200-day moving average is being tested with a fundamental long-term buy signal flashing. Bulls are now waiting for one of the largest technical buy signals to flash.