Bitcoin Liquidations Drop to Lowest Since April, Indicating Waning Interest Among Futures Traders

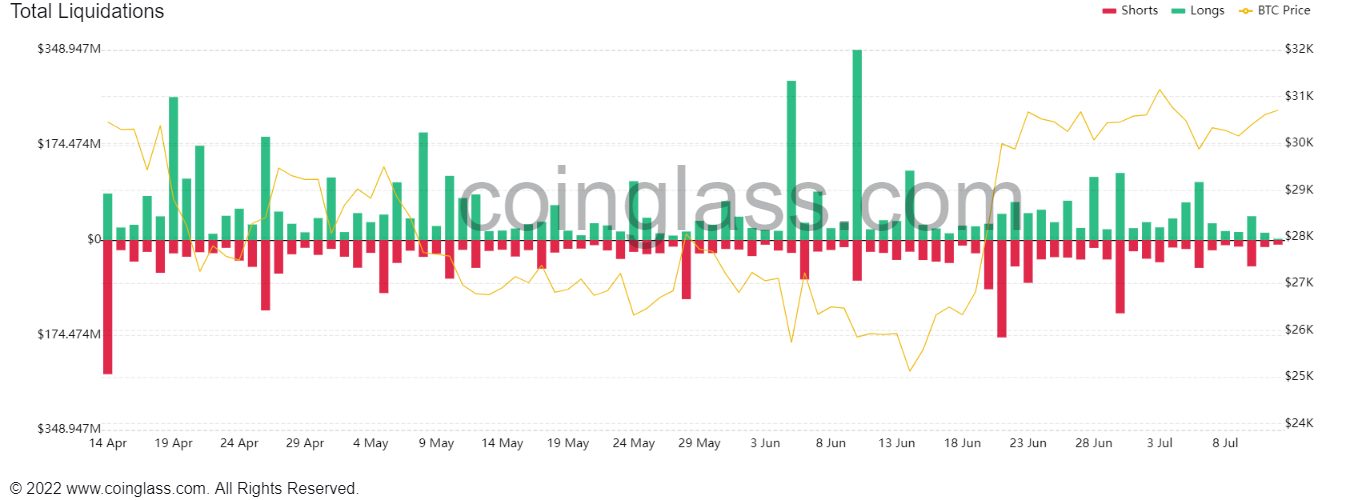

Bitcoin (BTC) futures logged the lowest liquidations since April on Tuesday, a sign of sudden waning interest among futures traders, data shows.

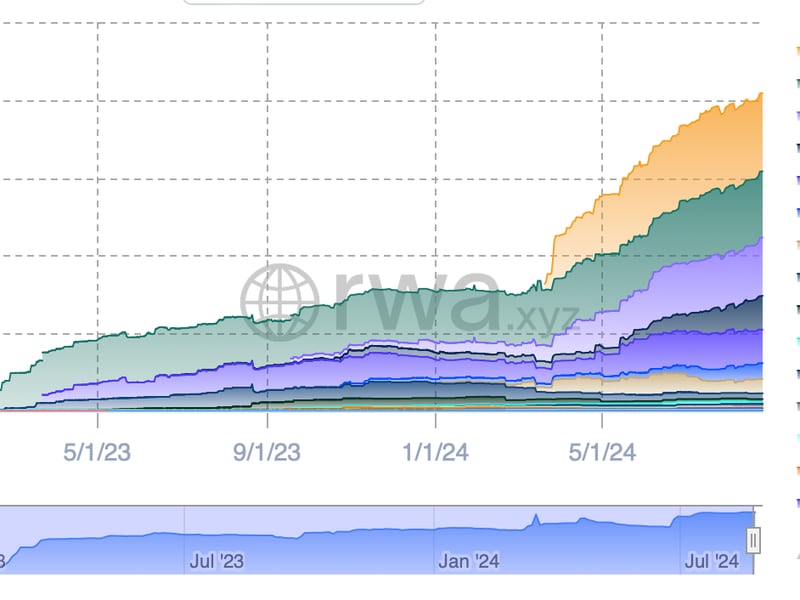

Just under $9 million worth of bitcoin futures were liquidated, Coinglass data shows. Bitcoin made up for a large share of the total $28 million of crypto-tracked liquidations on Tuesday – among the lowest levels so far this year.

Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. This happens when a trader is unable to meet the margin requirements for a leveraged position or fails to have sufficient funds to keep the trade open.

Large liquidations can signal the local top or bottom of a price move, which may allow traders to position themselves accordingly.

Futures trading volumes slumped 21% compared to Monday. Open interest, or the number of unsettled contracts, rose 1.16%, meaning traded opened more positions but ultimately used significantly lesser leverage – suggesting lesser risk-on sentiment.

Meanwhile, FxPro senior market analyst Alex Kuptsikevich told CoinDesk in an email that bitcoin could see sideways action in the coming months and, hence, lower futures trading volumes than usual, citing data.

“Bitcoin was up 0.6% in the past 24 hours and is approaching the upper boundary of its short-term range at $31.4K,” Kuptsikevich said. “Only a break above this level will indicate that the market is ready for further gains, with potential targets near $35.5K by the end of the month.”

“The market is experiencing a period of “reaccumulation”, which often occurs when halving is imminent, Glassnode notes. Previous such periods have resulted in several months of sideways trading,” he added.

Edited by Parikshit Mishra.