Bitcoin Jumps to Just Shy of $68K, Highest Since Late July

The price of bitcoin (BTC) quickly popped higher during early morning U.S. trading hours on Tuesday, rising to levels not seen since late July.

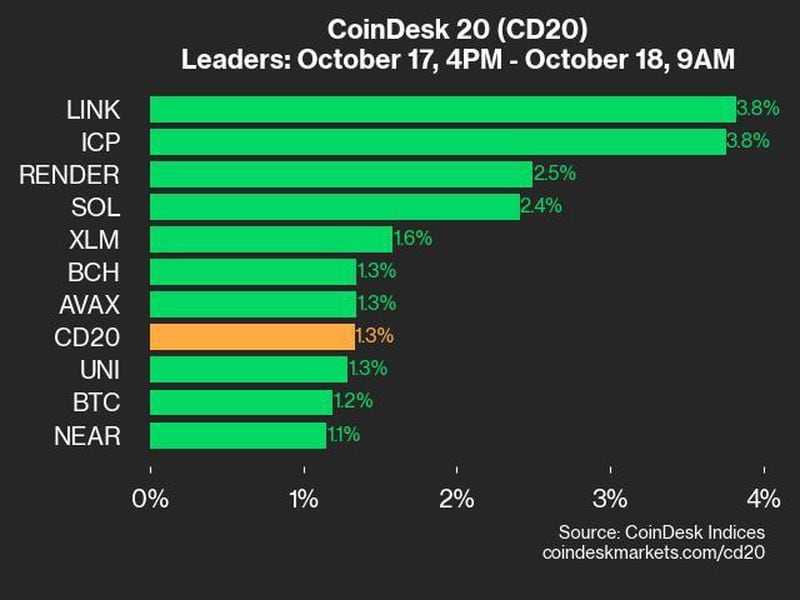

At press time, the world’s largest crypto was trading at $67,500, ahead 3.7% over the past 24 hours and just off its session high above $67,800. The broader CoinDesk 20 Index was up 2.5% over the same time frame, with solana (SOL) and cardano (ADA) among the index constituents underperforming BTC.

Continued momentum for crypto-friendly Republican presidential candidate Donald Trump might be the behind the rally over the past week, said Standard Chartered analyst Geoff Kendrick in a Tuesday note. The former president now has a 56% chance of winning in November, according to Polymarket, said Kendrick (now 56.9%). It’s his highest probability of winning since Joe Biden dropped out as the Democratic candidate.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZNLHENUE5BA4LFE3YITMY7RQ5M.png)

The odds of a GOP sweep of Congress are also on the rise, Kendrick pointed out. According to his calculations, if Trump wins the presidency, there is a 70% chance he will be dealing with a Republican-led House and Senate.

Liquidations

Bitcoin’s rise over the past few weeks has been very gradual, but the quickness of this morning’s gains led to over $127 million in shorts – or bets against higher prices – and longs – or bets on higher prices – to be liquidated over the past four hours. Liquidation happens when a trader has insufficient funds to keep a leveraged trade open, leading to the forced closure of bullish long and bearish short positions – causing a brief spike or plunge in prices.

Traders at QCP Capital attributed the spike to several reasons from earlier this week. The firm said in a Telegram broadcast that the rally may be election-driven, initially sparked by Republican Donald Trump’s lead in prediction markets and polls, and further boosted by Democrat Kamala Harris’s pledge for a crypto regulatory framework signals a friendlier stance toward the industry.

“Disappointment with China’s latest stimulus may have led some speculators to shift capital from Chinese equities back into Bitcoin—a scenario we first anticipated in our October 8,” QCP added. Finance Minister Lan Fo’an promised new steps to support the property sector and hinted at greater government borrowing at a Saturday briefing. However, the announcement fell short of expectations and suggested a low probability of continued outflows into China-linked assets.