Bitcoin Jumps $500 as US CPI Clocks in at 5% for March 2023

The initial expectations for the CPI numbers for March showed a decline in the inflation rates to 5.2%.

In reality, the third month of the year saw an increase of 5%, shown by the Consumer Price Index.

- At the same time, the core CPI, which excludes more volatile niches such as food and energy, was expected to be somewhere between 5.5% and 5.6%.

- The Core CPI has actually matched the expectations, standing at 5.6%.

- The CPI for February stood at 6%, which was a decline compared to January. However, dropping by another 1% had an immediate effect on bitcoin’s price.

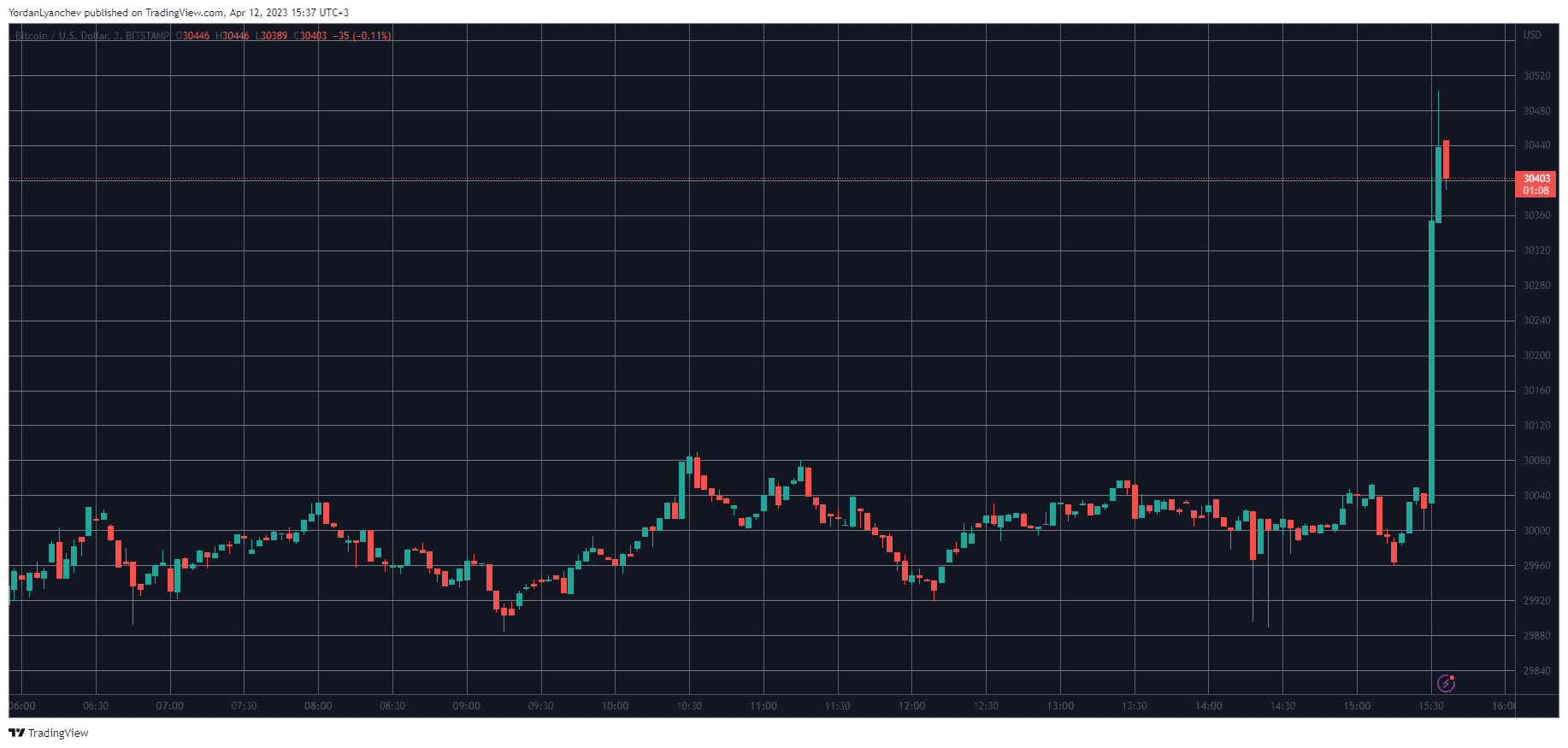

- The cryptocurrency skyrocketed by almost $500 in minutes after the numbers went out. Bitcoin traded calmly at $30,000, as reported earlier, but jumped to $30,500.

- Being considered a risk-on asset, BTC’s short-term price performance is strongly correlated to the CPI data.

- This is because the inflation numbers determine the monetary policy undertaken by the US Federal Reserve and whether it will continue spiking the key interest rates.

- The declining inflation YoY shows that the Fed’s actions have an effect and the central bank could start reversing its strategy soon.

The post Bitcoin Jumps $500 as US CPI Clocks in at 5% for March 2023 appeared first on CryptoPotato.