Bitcoin Jumps 5% on Grayscale Ruling, While Crypto-Related Stocks Soar More Than 10%

Bitcoin (BTC) has gained about 5% to top $27,000 in the last hour after a federal appeals court ruled that the U.S. Securities and Exchange Commission (SEC) must review its rejection of Grayscale Investments’ attempt to convert its Grayscale Bitcoin Trust (GBTC) into an ETF.

GBTC is higher by 17%, narrowing its discount to net asset value (NAV) from 25% to 17% as traders place bets that the ruling could pave the way for an ETF conversion that would entirely eliminate the discount.

The legal victory potentially opens the door for a spot bitcoin ETF in the U.S. Advocates have long argued that allowing this type of product would enable a greater swath of the general public to invest in bitcoin without having to go through the trouble of buying the crypto directly or deal with potential issues like their custody providers collapsing.

Circuit Judge Neomi Rao, writing the D.C. Circuit Court of Appeals’ opinion, said that federal agencies are required to “treat like cases alike.”

“The Securities and Exchange Commission recently approved the trading of two bitcoin futures funds on national exchanges but denied approval of Grayscale’s bitcoin fund,” said Rao. “Petitioning for review of the Commission’s denial order, Grayscale maintains its proposed bitcoin exchange-traded product is materially similar to the bitcoin futures exchange-traded products and should have been approved to trade on NYSE Arca. We agree.”

Among publicly-traded crypto names moving higher are Coinbase (COIN), up 13% and MicroStrategy (MSTR), up 9%. The thoroughly roughed-up miners are posting even bigger moves, with Marathon Digital (MARA) ahead 24%, and Riot Platforms (RIOT) and Hut 8 Mining (HUT) each gaining 16%.

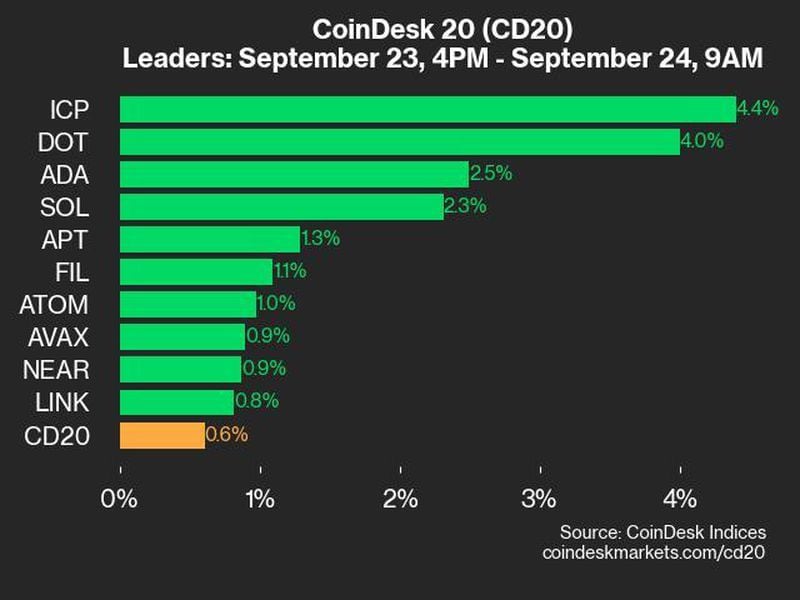

Altcoins are posting sizable gains as well, among them ether (ETH), cardano (ADA), dogecoin (DOGE) and solana (SOL) all ahead by roughly 5%.

According to data from CoinGlass, there were $87 million worth of shorts liquidated in the past 24 hours, with $76 million of that coming in the hour following this morning’s news.

“Bitcoin’s immediate price surge post-ruling underlines the market’s anticipation and the profound impact such a decision holds,” said Ji Kim, general counsel and head of global policy for the Crypto Council for Innovation. “As spot bitcoin ETFs are now closer to a potential launch, we’re witnessing real-time investor confidence in the crypto space amidst this court’s ruling.”

Edited by Stephen Alpher.