Bitcoin Is Up 205% in 2019: The Masses From 2017 Are Not Here Yet (Which Is Positive)

Bitcoin, currently trading at around $11,400, is up about 205% since January 1st, 2019. However, it appears that retail interest is not quite there yet. Institutions, on the other hand, seem a lot more involved compared to the previous parabolic cycle.

Retail Interest in Bitcoin Still Missing

It appears that retail interest in Bitcoin is still not quite there, despite the serious increase in price throughout 2019.

The cryptocurrency began the year trading at around $3,700 and it has since surged an impressive 205% to where it’s currently at $11,400. However, this doesn’t appear to get retail investors interested yet.

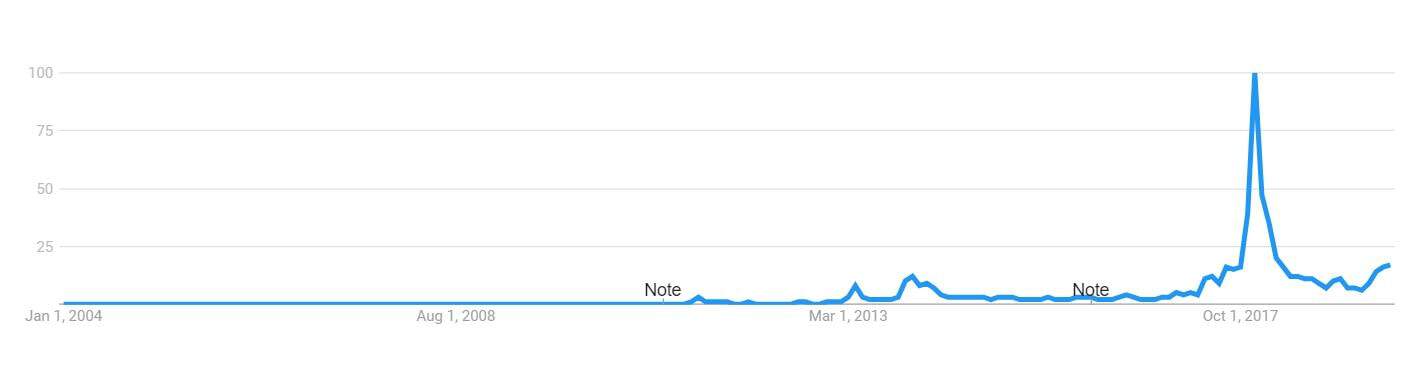

Looking at the chart, we can see that Google searches for “Bitcoin” peaked during December 2017 when the cryptocurrency reached its all-time high value of around $20,000. Now things are looking different as the interest in it is significantly lower. This was further highlighted by Dovey Wan, a founding partner at Primitive Ventures and popular cryptocurrency commentator. Wan outlined that she hasn’t heard from anyone in her circles asking about Bitcoin. This was the prevailing sentiment throughout the entire thread as well.

I’ve received 0 request from remote family members or acquaintances asking about Bitcoin this time so far, while getting a few messages reminding me to take profits

What’s the outside sentiment around you?

— Dovey Wan ? ? (@DoveyWan) July 7, 2019

Signs Of a Maturing Market?

While retail has yet to catch up, we can see that institutions are definitely getting more involved in the space.

For once, Fidelity, a Boston-based investment company and one of the world’s largest asset managers, has confirmed that they are in the final testing phase of their new trading Bitcoin platform. As Cryptopotato reported, the platform would provide services for institutional investors who are used to high-quality service that the company has offered so far.

Moreover, Bakkt, the Bitcoin futures trading platform of the Intercontinental Exchange (ICE), which is also the owner of the New York Stock Exchange (NYSE), has announced plans that it will be launching user acceptance testing for Bitcoin futures trading and custody in July. The platform also revealed that there would be two types of contracts – one which will enable customers to transact in a same-day market and one which will have a monthly settlement.

Going further, the Grayscale Bitcoin Investment Trust currently sees the price per share at $14,67. This puts Bitcoin at around $16,400 which marks a premium upwards of 30%. It’s important to understand that GBTC shares are supposed to be the very first publicly quoted securities which are invested in and deriving their value from the price of Bitcoin. They allow institutional investors to gain exposure to the cryptocurrency’s price movement without having to worry about storing, buying, or managing their private keys. Hence, the high premium.

In other words, while retail is lacking behind, institutions are seemingly getting on board. This could be seen as a sign of a maturing market – something that we didn’t have back in 2017.

The post Bitcoin Is Up 205% in 2019: The Masses From 2017 Are Not Here Yet (Which Is Positive) appeared first on CryptoPotato.