Bitcoin Is The Solution To The World’s Trade Problems

Global trade needs to be built on an incorruptible standard that has no political or nationalistic affiliation.

This is an opinion editorial by Heritage Falodun, a Bitcoin analyst and computer scientist based in Nigeria.

I believe humanity deserves a detailed elucidation of the aggravating concerns facing our economies today. Solutions to world trade problems won’t suffice if engaging in transnational commerce, promoting social progress, multilateralism, influencing bilateral exposure and enabling bottom-up prosperity isn’t of the utmost importance to human existence.

The liberty to implement and foster free, fast and unbiased trades on an individual, community, province and nation-state capacity in a seamless approach irrespective of the entities involved will be the first step towards achieving a global, friendly, effective and competitive trading mechanism.

This is all bearing in mind that the liberating innovation capable of solving and breaking world trade barriers cannot be anything short of a solution enabling instant and transparent cross-border transactions. This will fuel freedom from oppressive restrictions imposed by authorities on people’s way of life, behavior and economic prowess within the world marketplace. Ease around building long lasting importing and exporting rails is better achieved by materializing free and fully decentralized trading technologies and tools against protectionism. We live under an archaic and centralized trade policy, particularly known for hurting the people it’s intended to protect, by slowing down economic growth and increasing inflation on a global scale. This is an issue that became even more evident post-COVID-19 prior to the Russia-Ukraine conflict, and of course more so now.

The traction being displayed in the international trading system has been accumulating over decades reflecting the actions, policies and posturing of different world unions. Many people are concerned that not everyone is playing by the agreed multilateral rules. High levels of state support and protection remain in key sectors, while new multilateral rule-making is not keeping pace with the business realities of today. These are just but a few problems facing today’s economy.

The question before us is, “How do we address and solve these trade barriers created, planned, organized and backed by human errors masquerading as governing rules?”

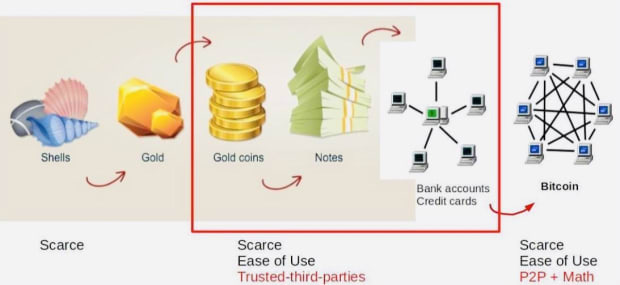

We actively need to reclassify economies and enable integration of a monetary structure free of flaws and human incompetence. There’s never been a better time for positive transmogrification towards the globalization of trade and transaction techniques than now. Emphasizing the education of what money was, what money is and what money should be is imperative, as it’s the cornerstone upholding all trading activity. The more impeccable money becomes, the more seamless it is to achieve a sustainable economy accompanied with an unerring trading mechanism. Money has taken many structures throughout human history. Gold and cowrie shells served as money in the 14th century but couldn’t meet up with all the characteristics and functions of what money should be. Gold and cowrie shells were scarce but the supply capitalization was not limited while the ease-of-use feature wasn’t achievable because of the weight of these commodities. More gold and shells were easily discoverable which in turn leads to a level of market saturation.

As a way of correcting and solving demerits of these previous commodities known as money. Money was developed and transmogrified into gold coins, fiat notes, bank accounts’ value and credit cards. Sounds interesting and innovative right ? Feeding your curiosity, this improvement has been able to get rid of some of the previous problems such as ease of use, but they haven’t been able to address the unlimited supply problem. The unchecked and consistent production of money(fiat) remains persistent as everyone hangs in the air of trust with third parties called banks. Not surprisingly, banks remain subject to federal regulations. Pathetically, this new form of money serves as a gateway to new trading problems. Some examples of these are the “non-uniformity of money,” long settlement procedures and strict regulations amidst under-collateralization in some jurisdictions.

These problems remain evident and glaring after the transition of money to fiat, hence the need to cushion the effects. Some of the approach of addressing that setback despite the acclaimed optimization of money for easy use necessitated the existing monetary body known as the “Society for Worldwide Interbank Financial Telecommunication,” or SWIFT. SWIFT addresses a portion of this problem by facilitating cross-border money transfers in a way that can be classified as quick in a structured messaging manner, but not exactly instantaneous as transactions should be.

That incomplete solution also brings considerations of keeping in line with the centralized economic regulations governing each jurisdiction. Principally, the blatant refusal of the World Economic Forum (WEF) to enable the decentralization of money is masterminded by greed. I disagree it’s due to the experts’ inability to understand the concept of decentralizing money and democratizing trades. The WEF refusal is an economic concept guided with full focus to sustain governments’ power-drunk addictions — by spicing trade and investments with local currency barriers to slow the flow of products and services between nations.

Some of the consequences of the fragmented global economy and central banks’ autonomy towards consistent and increasing supply of local currencies is indelible and evident in our society:

- Declines in wages and currencies purchasing power in both high- and low-income economies.

- Facing the trade-offs between the risk of debt crisis and the securing of food and fuel in countries with developing economies.

- Worsening food insecurity over time– especially in the Middle East, North Africa, Sub-Saharan Africa and South Asia.

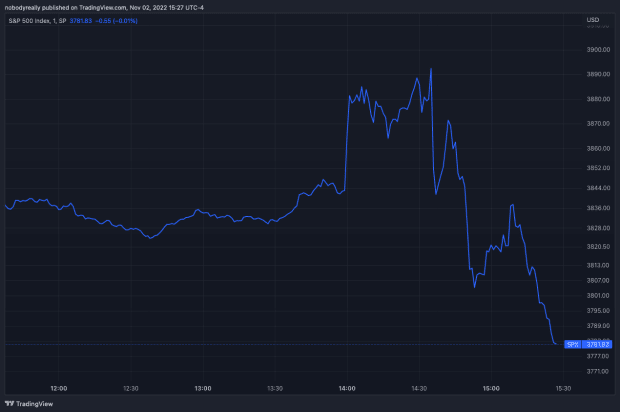

- The highest inflation rates in history affecting numerous countries not excluding the world trade powers in each continent.

Permit me to ask “Can the root cause of these challenges be tackled in order to revolutionize the contexts of money for fostering global trades without blemish?”

Quick response — yes it can, let money be money and all trade problems will become obsolete.

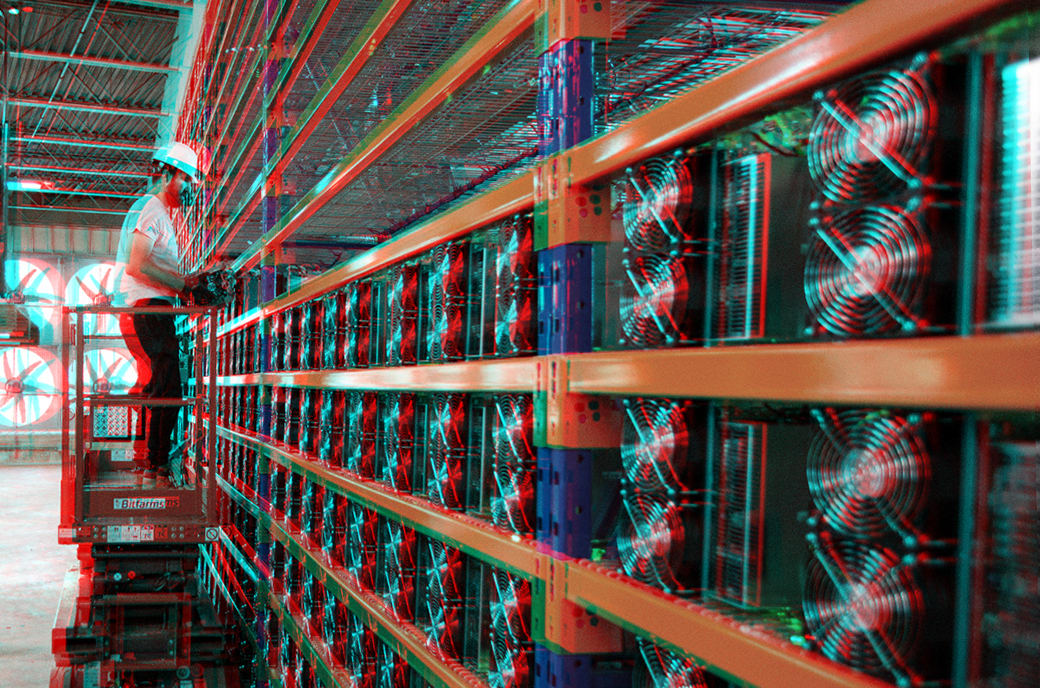

To solve the trade problems, considering the root cause is attached to all these previous incompetent monies, a monetary innovation called Bitcoin was created to address the flaws of the present day. A lot of the features it possesses such as its limited supply, immutability, transparency, ease of use, censorship resistance, divisibility, fungibility and portability. The juicy and most efficient part of it is its ability to get rid of trust through a decentralized peer-to-peer trading mechanism backed by mathematical computations rather than physical properties like gold or cowrie shells. The characteristics of sound money are durability, portability, divisibility, uniformity, limited supply and acceptability. Bitcoin possesses all. I noticed “Satoshi knew better,” when he created Bitcoin in 2009 as sound money in response to the 2008 financial crisis. Trades should be carried out with money which the corrupt can’t abuse or influence. Global and local trades should be done with money that has its purchasing power determined by markets, independent of governments and political parties. Satoshi Nakamoto said, “The root problem with conventional currency is all the trust required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” Truth be told, the ball is now in every individual’s court to determine and accept this innovation as a solution to the long existing trade problems.

I had the pleasure of interviewing Nikolai Tjongarero also known as “Okin,” who is a business mogul and bitcoin advocate in Namibia. I wanted to find out, despite the central bank of Namibia’s public declaration of Bitcoin as an acceptable payment option, does the government implement policies to enable it as an official currency for importing and exporting purposes? He said “No.” After a long brainstorming session, I concluded that policy makers in countries that have not yet moved away from import-substitution policies and direct governmental controls should implement structural adjustments rapidly in order to restore their growth, foster quick trades and resume creditworthiness. These countries can grow by amending bitcoin into policy, achieving open and free trade by utilizing and adopting global currency as its medium of exchange, unit of account and store of value. Bitcoin is the global money for an interconnected world. Utilizing and adopting money that doesn’t care about religion, country, race or creed is the first step towards solving trade bias. Interestingly, the only method towards the madness of this content is to understand, digest and implement the message rather than tackling the messenger.

This is a guest post by Heritage Falodun. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.