Bitcoin Is The Single Best Shot At Achieving Liberty In Our Lifetime

How do Bitcoin’s properties present the best opportunity to seize liberty humanity has ever seen?

What do you see when you switch on the TV or scroll through your news feed on your preferred social media platform?

You see a failed war ended after 20 years, hundreds of thousands of people dead, billions of dollars squandered, and the same illiberal regime in charge as before.

You also see inequality, rising prices and protests.

And you see pushbacks for mandates.

Bitcoiners regularly reply to all the troubles in the world by saying that “Bitcoin fixes this.” Hyperbole? No, Bitcoin is the only realistic pathway to the libertarian “bon mot,” our witty remark of “fix the money, fix the world.” Indeed, Bitcoin is the best shot libertarians have to shrink the size of government, fight inflation, curtail the debt from inflation, starve the military-industrial complex, and to avoid an ever-increasing scope for government.

How does Bitcoin achieve this?

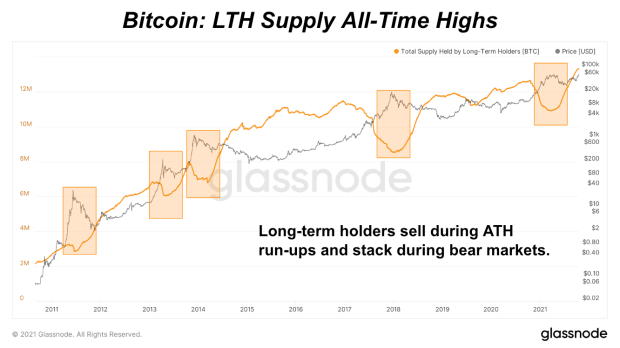

Bitcoin is a savings technology that is nascent money. Money historically has three functions: it must serve as a store of value, a medium of exchange, and a unit of account. Bitcoin, despite its volatility, is certainly a store of value but is thus far less prevalent as a medium of exchange or unit of account.

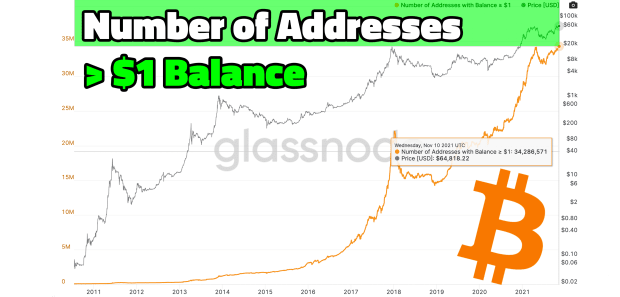

However, Bitcoin has only been around for 12 years, and its rate of adoption is already growing faster than the internet’s did. Money is the ultimate “network good,” which means that its value and usability increases with every user joining, and every user has the incentive to encourage others to take up bitcoin since it benefits them directly. As a result, within a short amount of time, Bitcoin has emerged from being a somewhat esoteric toy for cypherpunks, to being adopted by financial institutions and the country of El Salvador, as well as becoming the savings technology for tens of millions of people around the world (Bitcoin’s current user base is estimated to be around 120 million). This is absolutely remarkable.

It does not matter why people use bitcoin. It might be because it is cheaper and faster than traditional cross-border payments. It might be because it is collapsing upward and growing in value by around 200% annually. It might be because some people speculate on it. Or, it might be because it saves lives and allows people to escape some of the worst environments possible. An example of this can be seen in some great articles written by Alex Gladstein, chief strategy officer at Human Rights Foundation, on bitcoin usage in Afghanistan, Cuba, or Palestine.

Bitcoin already empowers millions, and not just the rich elites with existing access to banks, stock markets, and other financial technologies. Bitcoin empowers the billions of people who are unbanked and promises a future that takes control of money away from the government. Bitcoin appeals to millions of people and every person joining the Bitcoin network will have the incentive to attract more users.

Bitcoin presents hope for millions and presents a viable plan B to holding fiat money, which melts in your hands due to the irresponsibility of monetary central planners. Right now, the most important reason why the government can grow beyond its mandate — beyond its income through taxation — is through the power of the government to print and force everyone to use their ever-value losing money.

In just the last 24 months, the U.S. Federal Reserve has printed 40 percent of all dollars in existence. Naturally, this has translated into huge levels of inequality, since the people close to the government’s trough (such as banks) benefit from the higher purchasing power compared to the people at the bottom of the food chain (like fixed income recipients, students, etc.) who only see prices rise with diminishing real purchasing power. This is known as the Cantillon effect.

The Federal Reserve Board is directly monetizing the debt that the government takes on, and the Fed provides infinite demand for government debt, which would not be able to grow at the astonishing pace it does without the power of the printing press to buy all of it up.

The Bitcoin network itself and the personal owning of bitcoin is an act of peaceful rebellion against the fiat money system. Every day, when someone buys bitcoin, it moves money away from the fiat system and puts it into a store of value. It is put into a system that cannot be inflated. There will only ever be 21 million bitcoin issued. Bitcoin has been tested, Bitcoin has been attacked, and the protocol has remained robust against 12 years of adversaries trying to undermine it.

Many of Bitcoin’s detractors fundamentally don’t understand Bitcoin’s value proposition. And it makes sense that they don’t. We have not seen a new type of money emerge in over five millennia. Moreover, Bitcoin’s roots lie in more atypical fields such as Austrian economics, game theory, cryptography, and economic history. Thus, the frameworks through which most economists and pundits analyze Bitcoin are highly inadequate.

Another new aspect is that Bitcoin gives its users absolute control over their money. They can decide when to send money, how much, and how much they pay for a transaction. Nobody needs to be asked if you can send money to a nonprofit organization six thousand miles away, and nobody needs to confirm if you can send remittances to your family in other countries. No agency or bank can prevent this. Bitcoin allows you to become your own bank. This is incredibly empowering and such technology has not existed before.

This is a guest post by Dr. Wolf von Laer. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.