What happens if the market realizes that kicking the can down the road is delaying the inevitable? A sustainable form of insurance in this event would have to be bitcoin.

This article is a collaborative piece written by Greg Foss and Seb Bunney. Therefore, when the word “we” is used, the authors are referring to themselves.

In “part one” of this article, we provide a high-level overview on options, the components that make them valuable and how these components are priced in order to come up with a comprehensive value for any particular option. Readers who are not familiar with options and option pricing are encouraged to read “part one” before moving on to the rest of the article.

For more option-savvy readers, you may jump immediately to “part two,” where we will explore why we believe bitcoin (BTC) is a long volatility position. Since most other assets in a diversified investment portfolio are in fact short volatility positions, bitcoin can offer portfolio hedges in the event of increased volatility in tangential markets.

We then extend the analysis to determine why bitcoin is in fact a very valuable “exotic” option. Moreover, as an exotic option with no term, there is no time decay on your long volatility position. Finally, in a world where exotic options generally require a contract with a defined counterparty (they are not generic, thus don’t trade on exchanges per se), the fact that bitcoin has no counterparty risk leads to the conclusion that bitcoin is the perfect option that, over time, will come to be embraced by investors as a hedge to a short volatility-biased investing world.

*Don’t fret if this introduction went over your head, instead just start with “part one” below.

Part One: An Introduction To Options

Before we can truly comprehend why bitcoin may be the “perfect” option instrument, we must first go over a little options theory. This will help us more easily grasp the concept of bitcoin as a long put option on the fiat ponzi.

What is an option?

In the most simplistic form, an option is a derivative that derives its price from its underlying asset. An insurance contract is very similar to an options contract and is a great starting point for understanding options. With any options/insurance contract, you have two parties looking to achieve different outcomes. For instance, with house insurance, you have:

- The buyer, who is looking to pay a premium upfront to obtain monetary protection in the event of a fire, flood or any other adverse event

- The seller, who is looking to obtain cash flow upfront and believes that the probability of payout due to an adverse event is less than the premium received from the buyer

As a buyer of an option, you would say that you are long the option, and as a seller, you would say that you are short the option.

Now, it should be noted that this article isn’t intended to be about teaching options 101, and therefore moving forward, we will focus on bitcoin as a long put option. With that being said, we will circle back once or twice to the house insurance example, as it’s a good analogy for trying to grasp the mechanics of a long put option.

You may have noticed that the term “underlying” is mentioned above. We don’t blame you if you don’t know what this jargon means… you’re not alone. Essentially, with an option being a derivative, the option’s value is based upon several factors relating to its underlying assets. In the house insurance example, the underlying assets would be the house and the premium paid for the insurance is based upon, as well as things like:

- How long you are looking to insure your house

- Where your house is situated (flood plain, landslide zone, etc.)

- The condition of your house

How is bitcoin a long put option?

Although bitcoin isn’t technically an option, one of the main narratives behind its rapid growth since inception is that bitcoin is effectively an insurance contract in the event that the fiat currency system were to become immersed in a credit deterioration that includes many eventual failures.

With that in mind, you could liken buying bitcoin to buying a put option on the fiat system. If we were to see a failure of the fiat system, bitcoin will most likely disproportionately benefit. However, bitcoin is unique as it comes with many of the upsides of an option without some of the traditional downsides, which we will get into.

Let us delve deeper. When analyzing an option, different options provide benefits under different conditions. You can determine what conditions impact an option’s price by studying what are called the “option greeks.” These metrics help you determine an option’s sensitivity to a multitude of factors such as time, volatility, interest rates, etc. With that said, we will dig into four of the more well-known greeks: theta, vega, gamma and rho.

The Greeks

Theta: measures an options change in price as we pass through time. Bitcoin is theta neutral.

One of the major downsides to being an option buyer (long the option) is that you are confined by a time limit. When you initiate an options contract, you set an expiration date for when this contract will expire. At this pre-defined expiration date, you no longer have insurance/protection against the adverse event you initially paid for. In the options world, this creates something called “theta decay,” which means that, as time moves closer to expiration, your option decays in value as there is a decreased amount of time for an adverse event to happen. This is why the longer you are looking to insure something, the more costly it’ll be.

Although bitcoin has many of the same benefits as a long option, bitcoin is unique in that it is not a time-constrained contract; it is its own asset. Ultimately, as bitcoin is not time-constrained, there is no loss of value over time due to theta decay. By owning and holding bitcoin, you have an indefinite immutable insurance contract that will reward you greatly in the event of a significant collapse of the fiat system.

Vega: measures an option’s sensitivity to an increase or decrease in volatility. Bitcoin is long vega.

If someone says they are long an option, that means they benefit from disorder and increased volatility. In our house example, if our house were to burn down, our insurance policy would pay out — we are benefiting from increased disorder and volatility. How does this relate to bitcoin? With bitcoin being a long put option on fiat, which is built upon debt, being long bitcoin means you are essentially short credit and benefit from disorder and volatility in the credit markets.

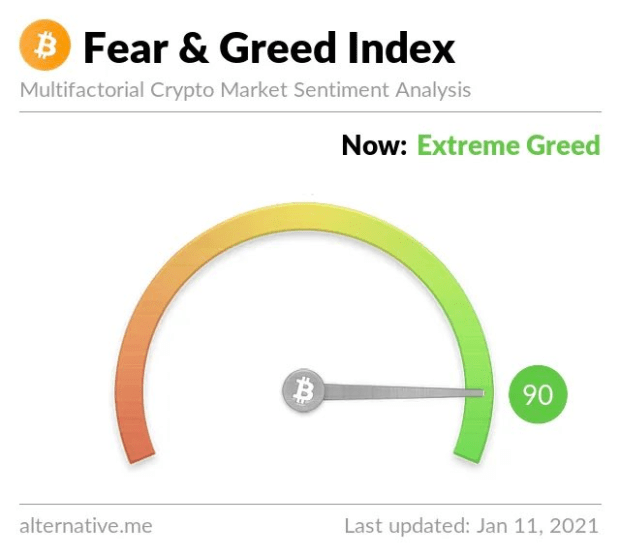

With greater monetary and fiscal intervention causing an increase in the money supply and debt burden while decreasing the dollar’s purchasing power, we see greater economic instability. With greater instability comes greater uncertainty for the security of the dollar and the looming debt burden. This uncertainty leads to greater volatility and disorder. As bitcoin is a long put option on fiat and credit, it benefits from increased volatility and uncertainty.

Gamma: measures the rate of change of delta. Bitcoin is long gamma.

In the options world, gamma is a measure of something called “convexity.” More specifically, when you are long an option, you are exposed to something magical called positive convexity. In financial jargon, this is the non-linear return profile of the option. Let’s do some simple math to explain this:

If we were to see continued inflation and the suppression of rates push 25% of bond holders to exit the $120 trillion credit market and step into bitcoin, valued at $1 trillion, most would expect to see a 25% rise in the value of bitcoin due to the 25% drop in the notional value of bonds.

However, we would instead see the value of bitcoin increase by $30 trillion ($120 trillion * 25%) (this simplified equation doesn’t consider the non-linear effect that $1 flowing into bitcoin usually equates to greater than $1 of value creation). In percentage terms, this is a 3,000% increase. This non-linear return profile or asymmetry in upside potential is called “positive convexity.” It is a risk manager’s dream as you can hedge your portfolio with a small allocation to bitcoin while also gaining exposure to outsized returns.

Over time, as we see further monetary expansion and the suppression of interest rates in order to quell the looming debt burden, more and more assets will start to lag inflation. Rough estimates put global assets excluding derivatives at $532 trillion ($12 trillion gold, $100 trillion equities, $120 trillion bond market, $300 trillion real estate). As investors look to exit these poorly performing assets and move to greener pastures, bitcoin is in prime position to benefit, and due to the long gamma exposure explained above, the upside potential is unchallenged.

Rho: measures an option’s sensitivity to a change in interest rates. Bitcoin is both long and short rho.

Bitcoin is unique in that it is one of the few assets that can benefit regardless of the direction interest rates move. Due to the excessive debt burden in most countries, if interest rates start to rise, people will no longer be able to service their debt payments, contagion will increase, leading to a quickening of the collapse of the current financial system. This will increase the number of traditional asset holders looking to exit their positions in search of assets that offer them protection with no counterparty risk, such as bitcoin.

On the other hand, if rates start to decrease, borrowing costs decrease, which encourages debt consumption and spending, increasing inflation and the availability of capital in the economy. In this event, we would see the purchasing power of the dollar collapse. This would push smart money out of the risk curve into positions that hedge their portfolios against this collapse of purchasing power. Where better to protect purchasing power than in bitcoin?

Bringing it back to the greeks, as rho measures an option’s sensitivity to interest rates, bitcoin benefits regardless of the direction that rates move.

Now that we have the option greeks out of the way, and we have laid out the framework for bitcoin as a long put option, what should be evident is bitcoin’s unique properties as an exotic option. In “part two” we will look at why bitcoin may be the perfect option instrument.

Part Two: Bitcoin Is The “Perfect” Option Instrument

Bitcoin Is A Long Volatility Position

Foss has stated in previous research that bitcoin is akin to owning credit insurance on a basket of sovereign issuers. He has calculated an intrinsic value for BTC using sovereign credit default swap (CDS) spreads and shared it with Bitcoin Magazine here. It is important for readers to understand that when you own credit insurance, you are “short” credit and thus you are “long” volatility. It is easy to appreciate this relationship as described below.

When credit conditions are worsening — reflected by increasing credit spreads and reduced lending confidence — the knock-on effects always result in equity markets being dragged lower, and at a faster pace. This results in a reach for equity option “insurance” or “protection” and as such, the VIX index increases in lockstep.

If credit conditions continue to deteriorate, and the VIX exceeds 25% annualized volatility for an extended period of time, it has been Foss’ experience that new issue markets shut down and financial conditions worsen. In other words, the contagion continues to bleed into other markets. Remember, credit is the dog, and equity is the tail. Due to the priority of claim in credit relative to equities, if the creditworthiness of the debt becomes a concern, a credit trader can always hedge their risk using a short position in the subordinate claim — the equity.

Credit markets are also far larger than equity markets. Any equity investor who is not aware of the trading value of the senior claim (the debt) has only done partial research and is potentially flying blind to the signs coming from the credit market evaluation of the company.

There is no question that the current level of understanding of most bitcoin investors is that bitcoin performance is directly correlated to equity markets. Accordingly — today — in a “risk-off” move in equities, the price of bitcoin likely falls in sympathy. However, as the level of sophistication of investors increases over time, and those investors come to appreciate the true beauty of the long volatility characteristic of bitcoin, we believe there will come a time when bitcoin price will be inversely correlated to equity market and credit market moves.

Bitcoin As A “Put” Option On The Fed Put

When Alan Greenspan was chairman of the Federal Reserve, he openly monitored the performance of the equity markets as an indicator of the performance of monetary policy. If equity markets were to fall by 20%, it became widely accepted that the Fed would step in to stabilize the markets and return the market to being open to new issuance of debt and equity. Hence the term, “the Fed put.”

Since we argue that bitcoin can also be considered a long put option on the stability of the financial system, Bitcoin becomes a “put on a put.” This is an exciting angle that further increases the optionality of bitcoin.

In essence, it has heretofore been assumed that the Fed would always be there to rescue markets. The tool chest includes quantitative easing, asset purchases and interest rate relief. But what happens if these tools do not work in the future? What happens if the market loses all confidence that continuously kicking the can down the road is only delaying an inevitable collapse, and that collapse starts to happen and cannot be stopped by any of the Fed’s tools?

A suitable form of insurance in this catastrophic event would have to be an asset that is not fiat based. It would be an asset that is “short” credit on all fiat currencies, that is not centralized, and that is portable and transferable over time and space on payment rails that are not controlled by the legacy financial system. Enter stage left: bitcoin.

A “put on a put” becomes a second derivative position. The Fed has essentially sold a put to the market. As the seller of a put, the Fed would use a technique called “delta hedging” in order to manage risk. If you recall from the explanation of “gamma” in “part one,” if the Fed is exposed to the gamma squeeze, in the event that the tools of the conventional Fed put do not work, and investors rush to exit traditional assets, what is the Fed to do? We argue that the Fed would have to buy the “put on the put,” i.e., the Fed would have to buy bitcoin.

This opens an interesting game theory conundrum. When the global markets (finally) figure out that all central banks are also counting on the Fed put, and since all other global central banks will fail before the Federal Reserve fails, then shouldn’t all other central banks commence buying bitcoin as soon as possible? Moreover, when the Fed does the same exercise and realizes it could be forced to buy bitcoin in a catastrophic leverage unwind — gamma squeeze — that cannot be stopped by any Fed fiat action, perhaps it would be wise to start buying bitcoin in the here and now, too.

Bitcoin, The Perfect Exotic Option

In general, standardized option contracts trade on an exchange where the exchange will guarantee the settlement of the contract as an intermediary. This ensures that individual counterparty risk between the various buyers and sellers of the contracts is non-existent. The players would still be exposed to the failure of the exchange, but this is a much-reduced exposure.

Generally, exotic options are individual contracts struck between buyer and seller. Since these options are not standardized, there is no exchange, and thus the players are exposed to counterparty risk.

Since bitcoin possesses all of the attributes that are desired in a Fed put gamma squeeze, and since bitcoin has no counterparty risk and there is no time restriction (no theta) on the contract, it can reasonably be concluded that bitcoin is the perfect exotic option and the perfect insurance against an unravelling of the global fiat system.

If you own zero bitcoin, you are exposed to insurance risks that are huge relative to the costs of the insurance. Every investor with exposure to short volatility biased assets, as well as all investors who require the ultimate in insurance protection against a global fiat collapse, need to hold a portion of their portfolio in bitcoin.

This is a guest post by Greg Foss and Sebastian Bunney. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.