Bitcoin Is The Best Explanation For The Way Money Is

A Weekly Series Of Essays About The Language Of Bitcoin by Alex McShane

Lingua Contra Imperium

The Language Of Bitcoin: 1

TL;DR – We have dug ourselves in trouble by way of varying measures of monetary expression. Bitcoin gives us, at the very least, a standard unit with which to measure the distance to the surface.

The two substances, bitcoin and U.S. dollars, are so unalike in composition that one can scarcely call them by one name. And thus, bitcoiners refer to U.S. dollars for what they are: fiat, meaning by decree, by arbitrary order. Mandated per force.

To me, the word “money” means bitcoin. I use it to solve for the coincidence of wants. I trade for it at every moment willingly. Bitcoin is a choice we make.

By introducing Bitcoin, like numerals, we have introduced a difference in kind to our language.

Namely, we have ushered in the first objective set of facts in the universe.

The difference in kind is much more obvious when we set Bitcoin beside all other moneys, all looking more or less alike when deployed.

Government money printing is in part a language problem. The absurdity of government money printing is that of classifying the word “one” with “two,” “two” with “three,” etc.

Imagine a world where the government incorporated “0” with the other natural numbers, as a sort of universal basic income gift.

Is this so hard to imagine?

Instead, think of a world where negative account balances read as positive integers.

In this obverse, Alice asks Bob, “How many dollars do we have?”

And Bob begins to count other people’s money.

Bob begins to count things that are not dollars, such as their mortgaged home, his leveraged stock portfolio, and his leased car.

Bob calls out to Alice a positive integer that is in fact the inverse of their wealth.

Alice responds, “Well, how many dollars are there?”

And Bob replies, “The government ought to be able to tell us that.”

But they can’t. No one can.

Bitcoin will cure you of the temptation to look to your government for answers, or for some object which you might call meaning.

One way to avoid the government’s occult process of monetary thinking is to look at real objects.

Numbers in Bitcoin are strictly and indefinitely delineated by virtue of their function.

Imagine a play where Alice asks, “How many bitcoin?”

Bob counts them all and answers with a numeral.

Which world do you want to inhabit?

The Center Cannot Hold

The government has been in monetary conversation with itself. The government would that it could do well to replace speaking to itself with speaking aloud to another.

Namely, the people who chose to opt out and adopt a harder money in bitcoin.

It is an unusual thing, for a person to use two moneys. And in the beginning most bitcoiners lapse from one form to the other. Although, over time, the relative advantages of holding bitcoin over dollars make themselves apparent.

Bitcoin doesn’t require the hodler to understand it before benefitting from it. Outside of the state of the public ledger, Bitcoin itself is essentially incapable of conveying anything to anyone.

Bitcoin is politically and linguistically agnostic. But it does give our universe of monetary discourse a defined set of parameters, i.e., a space, an objective fact set, and a time chain in which to parse it.

That is to say the rewards of deeper learning on the subject of Bitcoin are intrinsic to the eyes of the behodler, who is enveloped in space and time by Bitcoin. When viewed through the lens of Bitcoin, everything is illuminated.

The language of Bitcoin has no neighbor. Bitcoin is the best explanation for the way money is.

And while I must admit there is nothing easier than to think of what is not the case, an objective truth, when rarely it beckons, comes in your head to stay.

Don’t Trust, Verify

The scientific method is a way of finding the best explanation for the ways things are. That is all. Science is a language problem, and everyone alive wants answers.

You might say, “Wait Alex, this is outside the scope of Bitcoin.” But we will talk of inside and outside later. There is nothing outside the scope of Bitcoin.

Without objective measures you have nothing to point with, no way of knowing whether there’s anything out there to point to.

Today, what most would call science I would call pseudoscience. Most government-funded research findings are false, moreover, they are not focused on finding the best explanation for the way things are, but rather in pumping out irreproducible research that supports a myriad of agendas.

The margin of error for universities’ research (both private and public, largely funded by the government) on increasingly arcane topics is so large that it ought to be ignored completely.

And for the most part, it is.

The vast majority of professors’ work at your local university is irrelevant and meaningless. They are lost in childish language games and contribute next to nothing of value to the real world. But this is a conversation for another time.

Measurement Requires Interaction

Regarding language, the language of measure is of great importance. The more broadly adopted the unit of measurement, the more collaboration and progress can be made on any given front.

Without standardized units of monetary measure, international trade becomes computationally intractable, if not impossible. Global trade today is functional magic. There is no one person who can claim to understand it.

Americans are people without measure or meaning, a people whose wandering hive mind gives rise to conspiracies, such as the idea of a shadow government.

There are several origins to this idea of a shadow. One of them arises out of our collective wish to give meaning to nouns for which no defined objects correspond — for example, a soft money whose definition is without bounds.

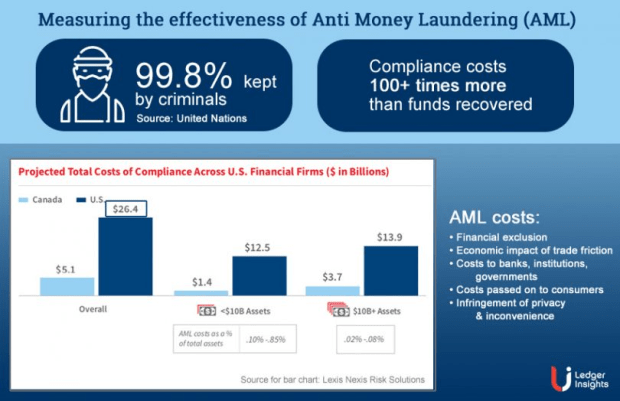

The money printer knows no limits. There’s no end to the promotion of debt. The measure of success for many businesses today is to a large extent determined by whether and to what extent they can get their customers into debt with them.

Money has become everything. And every moment has become monetizable. If not here then in the digital realm. If not through credit then through debt.

Your perceived success as an American is directly proportionate to how much debt you have access to.

Debt is not only encouraged, it is almost requisite to finance life here. One is encouraged to go into debt for every expense and use debt to pursue every desire.

There is a strange in-between space occurring now where the most savvy of fiat institutions are encouraging you to go into debt to receive a pittance of bitcoin as your cash-back reward.

Do not get confused, that is a lowly fiat scam.

It doesn’t have to be complicated. You don’t need debt. It is infantile.

If you do not have the capital to afford something, try providing a good or a service of value to the world in exchange for bitcoin.

Fiat is drunk. It can’t distinguish between moneys present, past, or future.

Bitcoin is sober. It is sacred simple. You either have possession of the coins or you do not.

As far as I understand, Bitcoin is here to deliver us from the convoluted credit and debt system.

On Ownership

When people say that we can’t use Bitcoin to buy things it is hard not to smile.

You are a moneyless people.

You own nothing, at the cost of everything.

You’ve wagered all your time later for time now.

You have a room in the house of another, money in the safe of another, a ride in the garage of another, data on the cloud of another, work in the office of another, and an identity in the body of another.

The whole thing is abject. It’s a transgression of boundaries. It’s a childlike probing at the porousness of certain borders.

Now, there’s no reason to police these boundaries, however, if we are to progress in tandem, I think it would be strategically sound to first agree on what money is, and how much of it there is. Bitcoin solves this.

Inhabiting Language

There are several differences between the Bitcoin universe of discourse and that of fiat. In this analogy, fiat, as a universe, is expanding. It is spreading thin and far outside our realm of understanding. It contains, say, just one atom of hydrogen per meter. This universe is untenable, because it is mostly vapid and empty. There is nothing one can know for a fact about fiat.

The language of Bitcoin, however, has strict parameters. I think of Bitcoin as a cold and reliable vessel. What is known about Bitcoin is known to all, if not readily available. Through this vessel we can travel wherever we like as a species in agreement, with the simple confidence that our money is sound.

Mempool, as a word, is akin to “etc.”: a contraction that means expansion.

The mempool is “and”: a collecting gesture.

The validation of blocks is “not”: a dismissing gesture.

On this latter ground I submit the problem with dollars.

The language of dollars doesn’t include the word “not.”

Fiat is a false promise for more. Everything can be financed with dollars. American money, as an object, has lost its definition.The lines have all been blurred. We cannot measure anything economically. We have no property.

But do we have a right to property?

No. The harms of nature can’t be tamed. All fortunes amassed must disperse. The alpha-most have no guarantee, but rather must vie for capital possession. Not even the government has an inherent right to property.

You may keep what you value enough to defend for a while. That is all. The simplest property to amass and defend is without a doubt bitcoin.

Through acquiring Bitcoin we can irrevocably strip the government of property and power.

So there is no birthright to anything, and as the circle of things we know and own expands, so too do the circumferences of what is unknown and unowned?

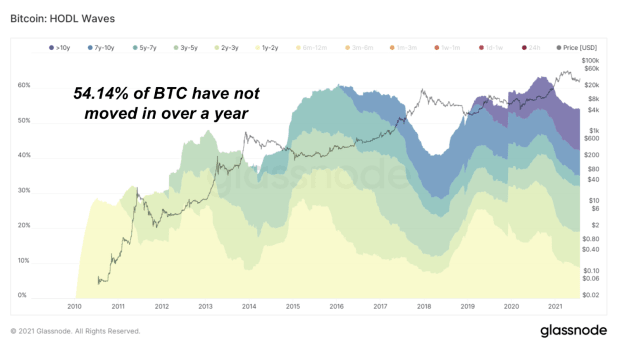

Actually as the circumference of bitcoin you own grows, the amount you do not own ultimately shrinks. This is the essence of fixed supply.

What owning is, I only know from owning bitcoin myself. I have only learnt the word “owning” to mean bitcoin only.

The process of adopting Bitcoin is a systemic admission of uncertainty and fallibility. If you can’t admit you knew nothing about money, you know nothing of Bitcoin.

In this country we have rather poor methods for handling uncertainty. Our monetary policy is written on the whims of brittle and ungrounded symbolic representations.

It’s the height of knowledge winter, and there is a scarcity of sound monetary data. Bitcoiners cope by way of indefinite retrenchment.

The fiat dwellers are stuck in a local optimum they can’t perceive.

Bitcoin is the shortest computer program that generates a complete description of the monetary world.

There is a shrinking set of possible financial futures that remain consistent with the evidence. Among these possible worlds, the simplest always have a greater probability.

Bitcoin is the simplest explanation for the way money is.

When measured with the objective, immutable yardstick of Bitcoin, we can begin to assess markets with better precision. We can actually accumulate sound capital, and collaborate on sound financial foundations, at increasingly greater scales. We can progress.

The integrity of our unit of account will not erode after all 21 million bitcoins are mined.

Through money printing, the government is supplying the road they walk, and they dismantle that road here and there where they choose. They simultaneously print and tax, credit and debit.

Buying bitcoin, however, is like leaving footprints in cement. The path is clear, open and accessible to all.

Transparency

Bitcoin is inflating according to schedule, in a transparent and measured fashion, at a far slower pace than the U.S. dollar. Hundreds of thousands of coins are removed from the conversation every year as they are lost or put into cold storage indefinitely.

Historically bitcoin has risen in price dramatically when weighed against U.S. dollars. In the future Bitcoin will rise or it will fall. That is all. The moment afterward it might not go up, and the moment after that not either.

Number go up is beside the point. The point is that we have an honest money, a hard money, and freedom.

People who enjoy technical analysis are really just enjoying learning and using what one might call a “special technical language.”

In my view, technical analysis is a game of language nothing. Did not the Bible teach us what the fate of reckoners will be?

One cannot accomplish so much with language games, unless one has forgotten how to speak.

But there is much fraternity to be found in learning and using special technical languages. The childlike joy of them is not lost on bitcoin hodlers at all.

While we speak of language it is worth noting that the “bitcoin” vs “bitcoins” plural form debate is irrelevant. Only a prescriptivist would make a rule about which to use.

Language rules that are prescriptivist are inherently fascist. Fascists prescribe language to populations through dictate, through fiat, they prescribe rules which can only be enforced by or under threat of violence.

The great thing about fascists is that they’ll tell you what to think. But that is the only great thing about fascists.

Bitcoiners in general, have decided not to recuse themselves from thinking. Bitcoiners are among the most literate, self-educated, curious people one will ever find.

Bitcoin itself is inherently descriptivist in nature, meaning that its universe of discourse arises from its network of users, and develops over time. Such a language can only be described in retrospect.

If I am to look for differences between Bitcoin the network and bitcoin the money I am not able to find any.

Memetics

We must be very slow and careful when considering changes to Bitcoin. As a global final settlement layer, it has no neighbors. On that front, there’s no pressing need to change it.

Systemic risk will build up in a system as new elements are introduced. Look at every other form of money; all have been convoluted beyond function.

You can use bitcoin to value objects. You can make unforgeable transactions for goods and services, and then you’ll know something definite about those things. You can build a sound monetary worldview by knowing the unforgeable, the costliness of Bitcoin.

Before Bitcoin, such knowing was a gap that couldn’t be bridged. Before Bitcoin, we had only contented ourselves with conjecture.

All evils are caused by insufficient knowledge. There is nothing one can know for certain about fiat.

The government prints intransitively. They do not know for what they are longing. But it’s already here. And the people are asking for a name.

15 August 2021