Bitcoin Is Not Democratic Part Three: The Separation Of Economy And Politics

Part three of the “Bitcoin Is Not Democratic” series explores the building blocks necessary to construct a civilization that transcends politics.

If you still happen to think Bitcoin and democracy are somehow related, then you’re either wilfully ignorant or you’ve missed parts one and two of this series, in which case, please read them here and here first.

You will understand exactly why tyranny prevails in the democratic state of Canada, led by its once again and recently democratically elected Prime Minister Justin Trudeau (who is supported by an entire swathe of people incapable of critical thinking; see #StandWithTrudeau).

But, if you’ve been following and have come to your own internal dismantling of the idea of democracy, and viscerally severed its relationship to Bitcoin, let’s explore what a world beyond political order, on a Bitcoin standard may look like.

By no means do I have any idea how any of it will play out long term, but I’ll do my best to inspire thought experiments across topics such as the law, autonomy, values, virtues, capital creation, violence, methods of organization and their scalability.

The Separation Of Economy And Politics

Much has been discussed on Bitcoin’s “separation of money and state.” I’ve personally done so in detail in my 2019 article “Rise Of The Individual, Fall Of The State.”

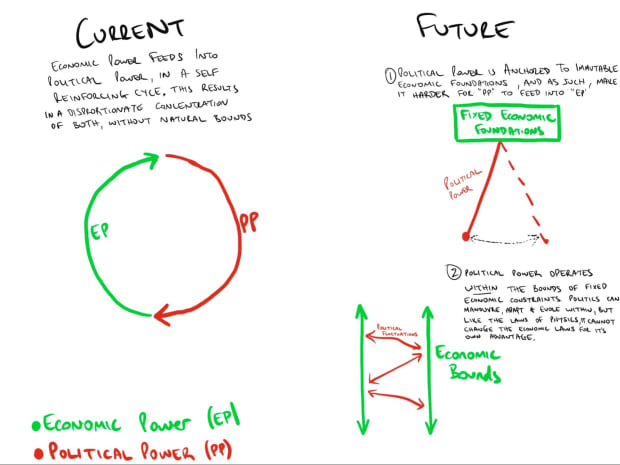

Today, I posit a potentially greater separation: The Separation of economics and politics.

Bitcoin Magazine hosted a debate between Alex Gladstein from the Human Rights Foundation and myself almost two months ago when the first part of this series came out.

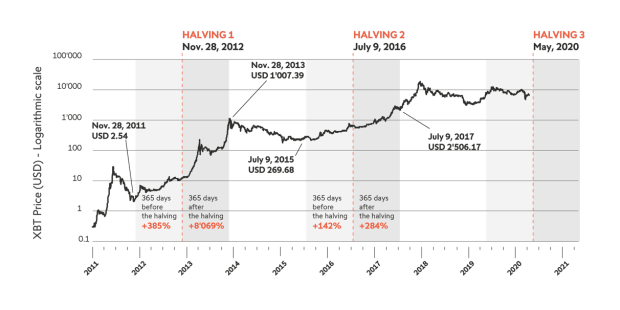

During the discussion, we built some common ground on the historical connection between economic and political power. Attaining one opens doors to obtaining the other, and in a self-reinforcing cycle, concentrates each. We agreed that Bitcoin fixes this, but I’m not sure the gravity of that truth is appreciated deeply enough.

Separating economics and politics may just be the most important socio-evolutionary step our species has made in millennia.

In a world where economic primitives can be influenced by politics, both economics and politics will be corrupted. Their corruption will last until reality catches up, forcing both both economy and politics to collapse, resulting in the emergence of a new order,, closer once again to truth.

The cycle then repeats.

Now … in a world where politics is subject to economic primitives that CANNOT by any means be changed, altered or manipulated by one player, for their own advantage (and subsequent disadvantage of others), we have accountability. And not the kind of long-term-cycle accountability experienced by the fall of corrupt institutions such as The Roman Empire, The Catholic Church or the modern State.

I mean fast, direct, clear accountability due to high fidelity feedback loops which occur as a result of there being no means by which to socialize mistakes, losses or poor economic behavior (such as taxation, unhinged debt, monetary inflation).

This sort of rapid adaptation has profound long-term implications for the very fitness of our species.

When we lie to ourselves, and have no link between economic reality and political method, we structure societal incentives in a way that morphs us into unfit, slow, weak, cheap, pathetic, sinful and immoral subhumans. These errors catch up with us on a long enough timescale, but because time preference is so high, nobody actually gives a shit when it matters.

This is why Bitcoin is so important. By reintroducing economic consequence, it makes it so that no amount of politics can ever again make us all blind men without a purpose.

Note that none of this means we do away with politics, or economics for that matter (some people are delusional enough to think that we’ll one day “transcend economics,” as if the product of one’s labor and inter-subjective value will disappear. Those same people also believe in leprechauns and the metaverse as “progress”).

What I’m talking about is something far more practical. The separation of economics and politics means the placing of politics on a short economic leash. People and the groups they form will ALWAYS have their own politics. What matters is whether or not they pay for their own mistakes and reap their own rewards.

By fusing economics and physics, Bitcoin orients the train tracks themselves (economics) in such a way that we do not fly off the edge of a cliff, no matter the train (politics) or conductor (leader).

Power, Work And Morality

The concentration of power is not necessarily a bad thing. It’s agnostic and often useful. It’s only when power is combined with hubris or stupidity that it becomes evil, and when evil can concentrate, we quickly discover hell.

This hybrid of power, stupidity and hubris runs naturally rampant in politics, because it lives in the vacuum of economic feedback. How can accurate (intelligent) value judgements be made when you’re ignorant to the feedback of your environment?

You’re like a blind, deaf man flying a plane.

This is why the concentration of political power and its use in attaining economic power always devolves into coercive means or transgressions on private property. By definition, it has to. The more rights that emerge as a function of ever-expanding politics (this is in fact what politics boils down to), the more plunder of the responsible party’s time, energy and resources must occur in order to balance the equation.

Hence Aleksandar Svetski’s “first maxim of political order”:

You cannot escape reality, but you can obfuscate it long enough to pick someone’s pocket.

As Frédéric Bastiat pointed out, labor requires an expense of energy and time. If I can acquire wealth or resources without work, i.e., a lottery, or through confiscation, whether direct or through some elaborate scheme (democracy, proof-of-stake in cryptocurrencies, etc.) then it’s relatively clear which I will generally choose (show me the incentive, I’ll show you the outcome).

Trust me I get it. We all want free things. Work is hard. Why work when it’s so easy to just take? The answer is simple:

Morality.

- Morality is work-infused, anti-entropic behavior.

- Morality and time preference are fundamentally linked.

Morality aligns with natural order (reap what you sow, Pareto distribution, property/territory, etc.) and moral behavior results in a higher probability of long-term prosperity.

It’s not just about what you can get now, but about what you can together produce over the long term. This is why collaboration and the economic means always trump coercion and the political means on a longer timescale. Morality is more robust and wins out over stupidity, gluttony and unhinged greed.

I’ve studied how philosophies, constitutions and entire religions have formed not because God told them morality was better, but because their founders and prophets sought the best meta to live by.

When the principles of the moral meta (the way) are skewed or discarded, which occurs in the process of its institutionalization, short-termism sets in, and we fool ourselves into thinking we can be immoral because “God is not watching.” Little do we realize that God is in the outcome, God is in the behavior, God is in the labor, God is in the meta.

We are so comfortable eating the fruits of labor that came from adherence to prior morality, that we only realize we fucked up when it’s too late.

Hence why continual “taking” is possible on a short enough timescale in a sufficiently wealthy and complex society. Entropy always catches up and forces the system to either correct (adopt morality) or fail.

Therefore my “second maxim of political order”:

Whilst you can obfuscate reality long enough to pick someone’s pocket, soon enough there are no more pockets left to pick, and we all suffer.

This is why Bitcoin’s relationship to work is such a significant part of its constitution.

If energy is the “universal currency,” then “work” is one of the “universal laws of economics.” It cannot be simulated, counterfeit or faked and because its existence (or lack thereof) results in immediate feedback on a Bitcoin standard, the incentive is to adopt morality as a means to wealth, power and prosperity (innate human drives we should never seek to remove lest we want to end the human race).

Work is economic.

Stake is political.

One is reality oriented.

The other is opinion oriented.

One adapts the map to reality.

The other is attempting to mold reality to the map.

The long-term liberty and prosperity of the human race depends on the separation of economy and politics

This is why we Bitcoin.

Enlightenment Values

The Age of Enlightenment (aka the Age of Reason) was an intellectual and philosophical movement spawned in the 15th and 16th centuries with the Renaissance and went on to dominate Europe during the 17th and 18th centuries.

The ideas and values that emerged during that period transformed the world and laid the foundation for the preeminence and greatness of the original “West.”

Some of the ideas, values and virtues included:

- Sovereignty of the individual

- Freedom of speech

- Freedom of association

- Private property rights

- Pursuit of knowledge

- Separation of church and state

- Reason and science

- Right to defend oneself

- Freedom of belief/of and from religion

The great thinkers of the west came to realize that the atomic constituent of a society was the individual, and that he and his private property must be held sacred above all.

They realized that in order for truth to be discovered, these sovereign individuals must be free to speak, free to explore ideas, free to challenge each other and as such either correct their errors or build upon the principles and ideas found to be true.

They sought the development of a responsible and robust society, whose members had the capacity to defend themselves, and to voluntarily organize around causes, ideas, beliefs or philosophies they personally valued.

The founding fathers made significant attempts to encode these values into what has been the greatest political Constitution to date, in particular the First and Second Amendments, and from that emerged the greatest economic and political power since the dawn of time.

Unfortunately, the values the West was built upon, and the constitutions designed to uphold them have all but vanished under the banners of collectivism, politics, rights, dependencies, entitlements, compliance and dogmatic obedience to representative government overlords.

The heroes whose shoulders we stand on are rolling in their graves right about now.

As a result, and for the sake of our future generations, the time has come for a new constitution: one that is not rooted in politics or paper, but in economics and energy.

Bitcoin is a voluntary digital constitution which operates in accordance with natural laws, has no rewind button, cannot be simulated, is beyond the reach of any organization, group or institution and treats everyone the same much like gravity, the speed of light or any other physical law does.

“Finally, Bitcoin doesn’t care what you think. It doesn’t care about anything. What you think doesn’t matter; that is the ultimate power of Bitcoin. Bitcoin is like a force of nature. You must conform to ethical standards of behavior in the Bitcoin-mediated world, or starve, since the option of violence is taken off of the table.” — Beautyon, “Bitcoin is not Democratic,” 2014

Upon this substrate, society can be rebuilt and the Enlightenment values we’ve lost in the maelstrom of the modern state can once again guide us toward a life of meaning, a life of progress, and a life of prosperity.

With that in mind, what about the walls and structures we build atop it?

Let’s now turn our attention toward a series of factors that need to be addressed if we’re to establish a more robust, truthful and sound world.

Incentives Matter

One of the simplest and most basic axioms of economics is that you will get more of that which is subsidized or incentivised, and less of that which is disincentivised.

Democracy is bound by its own aspirations to cushion everyone and create a safety net. In doing so, society must cater for the lowest common denominator of human, across almost every dimension.

On the surface, it’s a noble-sounding idea. Give everyone the same rights, give everyone a voice, give everyone a say. Remove variable risks, consequences or danger by cushioning or covering it up.

But in practice it’s a completely different thing.

It creates ALL the wrong incentives:

- Democracy ignores relative economic value or input, giving the same voice to everyone

- Democracy gives lazy people and parasites a legal mechanism (an environment) via which to feed on more productive people

- Democracy makes politicking the primary survival strategy, not productivity

- Democracy gives everyone the dangerous idea that they have a say in another’s private affairs

- places private property second to public property

In short, democracy caters for the lowest common denominator in society and thus incentivises people to continue to lower their standards in a perpetual downward spiral. A true tragedy of the commons.

Socialism and communism are similar, except instead of just creating the environment for parasitic behavior and incentivising the lowering of standards, they actually enforce equality by making sure everyone becomes the lowest, worst version of themselves.

They’re just more extreme, brutal and violent ways to get to the exact same end – obviously worse, but in some senses better because people can more quickly see it and revolt. Democracy is far more insidious.

Nevertheless, we have hope.

On a Bitcoin standard, productivity, competition, savings, accurate decision-making, efficiency, efficacy, economisation, quality, prudence, patience, profit, responsibility, work, cooperation and longer time horizons are incentivised.

Wastage, spending, consumption, mistakes, losses, sin, theft, violence, risk, dependence and high time preferences are disincentivised.

This happens at the individual and local level now, despite how early we are, and despite all of the madness, noise, scams, ransoms, theft and the like in and around the broader “Bitcoin industry.” The strength of the incentives and disincentives will only increase as we transition beyond the interregnum.

In the meantime, as I’ve discussed in “Fire, Bitcoin, Teleportation,” The Great Transition will not be a walk in the park; it will not be pretty and the incentives will be skewed toward doing everything and anything to survive as the systems of old dissolve, dismantle and destroy themselves.

None of the fallout will be a function of, or a flaw in Bitcoin, but will occur by virtue of its incompatibility with the legacy financial system, the legacy internet and legacy legislative law.

Unfortunately, this is the cold-turkey withdrawal we as a species must endure in order to detoxify our corrupt and dysfunctional civilisation. This is our rite of passage, and while it will be painful, the sooner we’re done with it, the better. The alternative is to remain on our current course and slowly construct our own gulags: an unwise option.

The question then follows, what sort of incentives do we want for society, once on a Bitcoin standard, especially if Bitcoin already naturally incentivises behavior we deem desirable?

The answer is simple … but perhaps not “easy.”

Don’t touch or play with the incentives too much. Let nature run its course, and people learn for themselves.

I believe the world must fragment into city-states because (a) local-scale governance seems to be where optimal economic performance will lie, and (b) it’s more probable for 100,000 people to have similar values than it is for 100 million.

This implies a patchwork of territories with a unique and varied set of values, principles, customs, norms, cultures and therefore incentives.

To the question that then follows, what should they incentivize?

My answer is “I have no idea. Each to their own.”

One of the many advantages (and beauties) of a fragmented, decentralized patchwork of city-states spread across the globe is that multiple “living” experiments can operate.

Some territories may want to incentivise commercial real estate and become hubs for logistics, offices, industry, etc. Others may want to incentivize leisure, and the pristine, untouched natural environment in their territory, and thus instead disincentivize “industry.”

Each method will have its own advantages and disadvantages. The difference is that on a Bitcoin standard, economic consequences cannot be escaped. Poor incentive structures will be punished, not by some “authority” but through losses and poverty (see the list of Bitcoin’s disincentives above). Good incentive structures will prosper economically and socially, for example; territories that ensure private property rights are upheld in exchange for a transparent membership fee, should in theory lead to more people wanting to participate and demand increasing, thus leading to a higher quality of member and if desired, quantity also.

This brings me to the next consideration; The Law.

The Law

“The law, then, is solely the organization of individual rights that existed before law.” — Frédéric Bastiat, “The Law,” 1850

If you’ve not yet read Frédéric Bastiat’s 1850 classic, “The Law,” then please make sure you do. It should be mandatory reading for every and any aspiring territory operator or governance provider on a future Bitcoin standard.

Bastiat makes a short, compelling and logically air-tight case for “The Law” being limited to nothing more than the preservation of private property rights. That is it. That is all.

Bastait defines “The Law” as “collective force” and as such, if it extends beyond its mandate to protect private property, then it by definition becomes the use of force for other means, which are ultimately infringements on private property rights; the very thing law exists to preserve.

“It is very evident that the proper aim of law is to oppose the fatal tendency to plunder with the powerful obstacle of collective force; that all its measures should be in favor of property, and against plunder.” — Frédéric Bastiat, “The Law,” 1850

The beautiful thing about Bitcoin is that private property rights can be protected by the immutable laws of mathematics, instead of depending on mutable laws of human agreement.

For the first time in history, we have wealth that nobody can take, assuming that one’s cryptographic keys are appropriately secured. This lowering in the cost of defense transforms the returns on violence to a degree never before possible.

With that foundation, we can then begin to think about contracts and contract law in meatspace.

A contract is a mutually agreed upon set of terms, or rules of a game, and these will definitely vary from territory to territory.

Contracts can be used as a way to establish certain incentives or disincentives, encode benefits, define limitations, and can in a sense act like modern legislative “laws” but remain consistent with the limitation of law to the preservation of private property rights.

When thinking about the contracts we want to establish, the question then becomes, which are most in line with that which is just?

Or another way to think about it, is commerciality. Contracts and relationships between entities and parties will tend toward more cooperative and mutually beneficial terms because of Bitcoin’s superior properties. You only get paid if you deliver the service. Forcefully taking everyone’s bitcoin is too expensive, and you may get away with it a few times, but it’s not a viable long-term strategy.

This is where reputation comes in, which I believe will play a large role in the future of contracts, their desirability and their enforceability.

Either way, these will all be underpinned by The Law’s restriction to the preservation of private property rights.

There’s very little I can add to this section that Bastiat had not covered in his incredible piece. As such, I will leave you with a final few paragraphs from Bastiat’s work, which are key to understanding how we should behave as we transition into a world of micro-states on a Bitcoin standard.

“What is law? What ought it to be? What is its domain? What are its limits? Where, in fact, does the prerogative of the legislator stop?

“I have no hesitation in answering, Law is common force organized to prevent injustice;—in short, Law is Justice.”

“It is not true that the legislator has absolute power over our persons and property, since they pre-exist, and his work is only to secure them from injury.

“It is not true that the mission of the law is to regulate our consciences, our ideas, our will, our education, our sentiments, our works, our exchanges, our gifts, our enjoyments. Its mission is to prevent the rights of one from interfering with those of another, in any one of these things.

“This is so true that, as a friend of mine once remarked to me, to say that the aim of the law is to cause justice to reign, is to use an expression that is not rigorously exact. It ought to be said, the aim of the law is to prevent injustice from reigning. In fact, it is not justice that has an existence of its own, it is injustice. The one results from the absence of the other.” — Frédéric Bastiat, “The Law,” 1850

Autonomy

Beyond the topic of law, we ask ourselves about autonomy and responsibility.

The disintegration of individual autonomy we’ve seen occur over the past two years has not only mired us in endless group identity politics, but it has eroded the very responsibility that makes individuals sovereign in their own right.

Autonomy is critical for this most central of enlightenment values.

This does not mean we do away with groups, associations, tribes or even nations (although I believe the latter’s days are somewhat numbered).

What it means is the autonomy of the individual comes first, foremost and before any form of fraternity. Once again, I quote Bastiat:

“We can assure them that what we repudiate is not natural organization, but forced organization.

“It is not free association, but the forms of association that they would impose upon us.

“It is not spontaneous fraternity, but legal fraternity.

“It is not providential solidarity, but artificial solidarity, which is only an unjust displacement of responsibility.” — Frédéric Bastiat, “The Law,” 1850

The Law’s role is to protect the individual from incursions by the group, not to create groups that have the legal right to plunder individuals or smaller groups.

Here once again, we see modern political institutions of all kinds fail miserably.

Democracy assumes you’re too stupid to know what to do with your own wealth, and in order to survive, you must elect some representative to pool everyone’s resources and spend it as they see fit.

It’s as if you and your family are incapable of deciding for yourself what you want and need, and that if there is no legislature written up by these “paragons of virtue” in government, that free individuals would neither feed, clothe, educate or house themselves by their own volition.

Like sheep without a shepherd, humanity would be lost, left to wander into oblivion.

But … if these sheep only got together and voted, they would somehow choose the right shepherd who could guide them to the promised land. So along came universal suffrage, giving every so-called incompetent individual who was earlier told they cannot know what to do for themselves, with the wealth and resources they’ve personally acquired, a “vote” to elect somebody who can know for sure what must be done with everyone’s resources.

This circular logic is neither profitable, nor economical and in the face of a sound economic reality, will shatter like the cheap, fragile ceramic that it is.

It will ultimately lead to the same end: autonomy and individual responsibility, not just because it’s better, not just because it’s more just, moral or desirable, but because it’s the only model of human existence that is antifragile enough to adapt to the evolutionary pressure of the complexity that is human society.

Autonomy will win out in the end whether we choose to move in that direction consciously and preserve the capital we’ve produced over the millenia, or this entire, centrally-planned edifice crashes atop us all, and we have to start from scratch.

I sincerely hope for the former, because the latter is an unnecessary waste. We have Bitcoin, we can now move away from the political end of the spectrum and back toward living in accord with natural order.

Capitalism

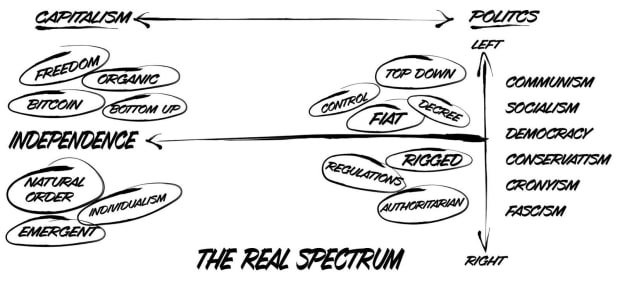

A central theme in the redesign of society will involve the movement away from politics and toward capitalism.

In the upcoming book coauthored by myself and Mark Moss, “The Uncommunist Manifesto,” we make the case for capitalism being the organic process that occurs in all forms of evolution or progress.

Capitalism is merely the production of order from chaos, through the use of time, energy and natural resources. It’s forcing functions are efficiency and efficacy and it uses experimentation and competition as drivers.

There is no escaping capitalism. It exists in all forms of politics, in all forms of social organization and even in biology and ecology. Living things and capitalism’s experimental method of transforming chaos into order are both by definition anti-entropic.

Once again, Bitcoin changes the game forever.

There has never been a phenomenon, other than life itself, that is raw, pure capitalism in action. Bitcoin just is, and like a law of nature we use it, interact with it and build a relationship with it toward ends we deem meaningful and valuable.

It’s the catalyst that moves us to the left hand side of the real spectrum:

Capitalism Reduces Uncertainty

Capitalism plays many roles, but one of its most important is the reduction in future uncertainties; a role it can play far better than any promise by a government.

Free markets reduce uncertainty via the creation, sale and purchase of products and services that individuals need, which they could not otherwise do, create or produce themselves.

Furthermore, because these transactions enable the creation of excess wealth, we are able to do what no other species on the planet can; store the wealth in a unit of account for future use (i.e., we can store purchasing power/labor across both space and time).

The key element here is of course a money that can perform these functions well. Bitcoin is once again perfect across both dimensions, space and time.

The certainty that “governments” give us through cheap words, and broken promises pales in comparison to the certainty of savings, particularly savings that cannot be confiscated.

Everyone needs to eat, everyone needs to trade, and beyond every “political order” there exists economic reality. It is inescapable.

The free markets of capitalism and their organic matching of supply and demand is how we as individuals move toward greater certainty; not politics.

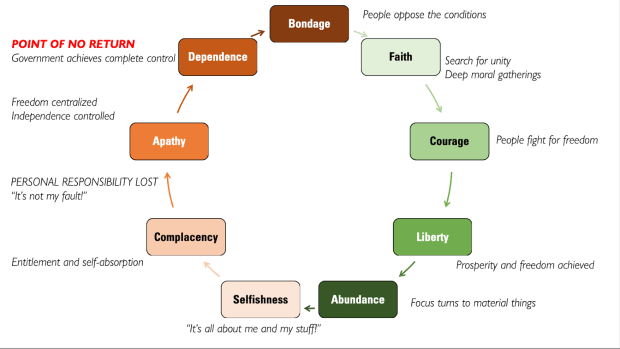

We can finally do away with these incessant cycles of political madness and decay; the Tytler Cycle being an interesting one to note:

Hierarchies Of Competence

Hierarchies are necessary to the proper function of any system because they enable selection and prioritization.

We can argue and debate about style, form and approach, but much like gravity, we can not avoid hierarchies.

The question boils down to what kind do we want?

- Hierarchies of fiat

- Hierarchies of competence

The former are political animals, designed top-down and enforced by decree. They are not a function of who can do what, but of who knows who, and who can sell what to the most people.

The latter are emergent phenomena, that neither require nor recognise empty decrees. They form organically as their participants organize themselves into complementary relationships.

They are the basis of all meritocratic forms of organization and will be central to the way the world is likely to operate on a Bitcoin standard (which we shall explore in part four of this series).

I discuss the topic of hierarchy in more depth in part one of the Jordan Peterson series I began writing in 2021, “Bitcoin, Hierarchy and Territory.”

“The government consists of a gang of men exactly like you and me. They have, taking one with another, no special talent for the business of government; they have only a talent for getting and holding office. Their principal device to that end is to search out groups who pant or pine for something they can’t get, and to promise to give it to them. Nine times out of 10 that promise is worth nothing. The tenth time is made good by looting A to satisfy B. In other words, government is a broker in pillage, and every election is a sort of advance auction sale of stolen goods.” — H.L. Mencken

Once again, we see incompatibility with democracy. In fact, not only incompatibility, but a complete inversion of hierarchies of competence. It places the lemmings and parasites in charge of the natural leaders and producers, and the slaves over the masters.

Democracy is fundamentally rule by the incompetent over the competent.

Scalability

The next area of consideration is scale. How large can the business of governance grow before it becomes economically infeasible?

What are the economies of scale, and diseconomies of scale?

These are incredibly important questions, scarcely asked in the age of the nation-state, where the push for larger government and even global government seems to be the panacea for all our collective ailments.

Either Bitcoin will buck this trend, or its own ever-increasing fragility will force it to shatter into a million pieces. I of course prefer the former because we have a chance to preserve some of the hard-earned capital our forebears and ancestors built.

We know that democracy cannot scale because the more the size of the population grows, the more difficult it is for:

- Everyone to have skin in the game

- Values to align

- Expenses to be managed

- Bureaucracy to be restrained

- Individuals to be differentiated

- Merit to be rewarded

Equality replaces excellence, dependence and entitlements replace independence, rights replace responsibilities, politics replace productivity, macro replaces micro and empty suits replace entrepreneurs.

The same goes for all forms of larger-scale government, whether republics, communist states or fascist states.

“Alas, you can detect the degradation of the aesthetics of buildings when architects are judged by other architects. So the current rebellion against bureaucrats whether in DC or Brussels simply comes from the public detection of a simple principle: the more micro the more visible one’s skills. To use the language of complexity theory, expertise is scale dependent. And, ironically, the more complex the world becomes, the more the role of macro-deciders “empty suits” with disproportionate impact should be reduced: we should decentralize (so actions are taken locally and visibly), not centralize as we have been doing.” — Nassim Taleb, “Skin In The Game”

Bitcoin fixes this once again by virtue of the reintroduction of economic consequence. When real economic cost is associated with actions both at the individual and collective level, we think twice about what we do. I believe this will place natural, upper bounds on the size of both “governance” and “big business,” and instead of centralizing decision making into the hands of “macro actors,” it will push it toward real entrepreneurs, producers and service providers with skin in the game.

So what will the future look like? I personally keep coming back to commercially viable, economically sound, patchwork city-states run by CEO-kings, and my guess is that they will only grow in size to the extent they can be adequately defended and funded.

I don’t believe this looks anything like modern democracy, medieval feudal states or any other incarnation of the state – it will be something new. There will be little room for error, arbitrary hierarchies or bureaucracies, and on a Bitcoin standard there are no bailouts.

Operators will by definition have skin in the game, in stark contrast to anything that’s come before, especially present day democracies.

Returns On Violence

“Now, labor being in itself a pain, and man being naturally inclined to avoid pain, it follows, and history proves it, that wherever plunder is less burdensome than labor, it prevails; and neither religion nor morality can, in this case, prevent it from prevailing.

“When does plunder cease, then? When it becomes more burdensome and more dangerous than labor.” — Frédéric Bastiat, “The Law,” 1850

The cost of defense and the cost of offense (potential for damage inflicted) is a calculus that runs in the subconscious mind of every living, territorial being.

This idea of “returns on violence” was popularized in the 1997 book by James Dale Davidson and Lord William Rees-Mogg, which if you’re a reader of mine, you’re surely familiar with: “The Sovereign Individual” analyzed history through the lens of “returns on violence”, and postulated that the rise of the “digital realm” alongside mathematically sound (cryptographic) means of private property and wealth preservation would mean that the locus of control and decision making in the postmodern era would swing back into the realm of the individual – the “sovereign individual” in fact.

This poignant, far-sighted book is a must-read because it was able to forecast not only the mega-political changes we’re seeing in society today but also the most important aspect of it all; the creation and adoption of something like Bitcoin.

Perhaps the only critique of the book (other than the Y2K alarmism in the beginning) is that more emphasis could’ve been placed on the significance of a digital bearer instrument as money. But this would be harsh, for hindsight is 20/20, and such foresight on the part of the authors is likely unmatched.

Bitcoin, once again, changes everything. On a long enough timescale, the calculus of all living, territorial beings will make trends toward cooperation over coercion. Bitcoin is the answer to Bastiat’s question of “when shall plunder cease?”

Yes – the risk of having your home, farm, food, business and physical property confiscated will always exist, but being in a position where your money can perish with you changes the possibility of profitability on the part of the aggressor. Furthermore, because of Bitcoin’s digital nature, it’s impossible for an aggressor to know how much you do have and accurately measure the potential cost of attacking you.

I know this all sounds sci-fi, and of course, during the transition, it won’t be like this for most bitcoin holders. What I am talking about is the long-term trend. I have no idea when, or how this plays out, but specific factors point to what.

Borders

How will borders, welfare and immigration work?

Once again, these are problems that will be solved by the market, and by the operators of said territories. I believe there will be a diverse approach and an opportunity to learn from internal and external experimentation.

My feeling is that we will have a blend of “reputation” and “webs of trust” as a replacement for nation-state passports, probably alongside some sort of either multisig bitcoin deposit functioning as a “security deposit” or maybe a signed message proving you have control of a certain amount of bitcoin before you can enter.

I believe state welfare will over time be completely eradicated, and replaced with more functional, efficient and effective private philanthropy.

I believe that families, communities and tribes will once again don the responsibility to care for disadvantaged people, and will do so with a higher degree of care, insight and love than any ridiculous, poorly funded, no-skin-in-the-game state institute could ever do.

With the removal of welfare will come the desire for immigrants because to provide services, territory operates will require workers. And with multiple territory providers, we’ll have more competition for workers and we will likely even see transferability of skills and experience across these jurisdictions as leagues and alliances form.

The pointless discrimination based on race and nationality will also dissolve because territory operators will see you as a customer, and not as a foreign alien looking to leech off the state.

So many things change as the world comes to terms with the specter of Bitcoin’s economic gravity, consequence and reality.

Risk And Skin In The Game

Inequality is normal to a degree but is exacerbated when skin in the game is systematically removed and corruption runs rampant.

That’s why Bitcoin is so powerful.

As an incorruptible money, Bitcoin has changed the game.

Metrics can also always be gamed when economics is subject to politics. A politician can load the system with debt to “improve growth and GDP,” and let his successor deal with the delayed results. He can make deals with the central bank to bail him and his friends out of bad decisions and he can unilaterally increase taxes “because we’re all this together.”

The problem, as we’ve discussed ad nauseum, is the fact that no politician (or very few) suffer the consequences of their decisions. In fact, very often the worse the character, the greater their theft or payout in the end.

When you can jump off a cliff and somebody else dies in your stead, you will have no reservations about continually jumping off a cliff without a parachute. You live in Super Mario Land where the game just restarts.

Unfortunately for the rest of us, because we live in the real world, we must bear the burden and foot the bill for our representative’s stupidity, and incessant parachute-less cliff diving.

This removal of risk and skin in the game is a bit of a historical anomaly also. In prior epochs, we had guillotines, daggers, poisons, lords, nobles, generals and greater concentration of power, where corruption often led to usurpation or removal from the throne.

In this sense, monarchies are far superior to democracies, and I believe the essence of this idea (personal accountability) will once again emerge on a Bitcoin standard. We will explore this in the next and (for now) final installment of this series.

For now, in the spirit of much of this essay, I would like to close out with one final quote from Bastiat. I echo this stance, and believe that on a Bitcoin standard the reality of this assertion will one day come true. The future private property owners (or soon-to-come territory operators) will have to contend with the reality of footing the bill for their own experimentation.

Mistakes will surely be made, collateral damage will surely occur, but what’s most important is that the trend will tend toward improvement or correction. It’s only in this way that the human race can progress and evolve.

“You must observe that I am not contending against their right to invent social combinations, to propagate them, to recommend them, and to try them upon themselves, at their own expense and risk; but I do dispute their right to impose them upon us through the medium of the law, that is, by force and by public taxes.” — Frédéric Bastiat, “The Law,” 1850

Thank you once again, and I will see you for the fourth and final installment of “Bitcoin is Not Democratic.”

This is a guest post by Aleks Svetski, Author The UnCommunist Manifesto, The Bitcoin Times and Host of anchor.fm/WakeUpPod. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.