Bitcoin is More Attractive Than Gold and ETFs to Americans: Survey

Months after Russian survey participants placed bitcoin above gold in terms of attractive investment assets, so have done investors from the United States. BitFlyer’s recent research on the people’s perception of the crypto industry also showed that Japan-based investors have a significantly more negative opinion when compared to US citizens.

Americans Prefer BTC Instead Of Gold and ETFs

Founded in 2014, bitFlyer is among the largest Japan-based cryptocurrency exchanges. The privately-owned company reached out to over 3,000 people based in the US and Japan to review their sentiment towards the digital asset industry and their investment approaches.

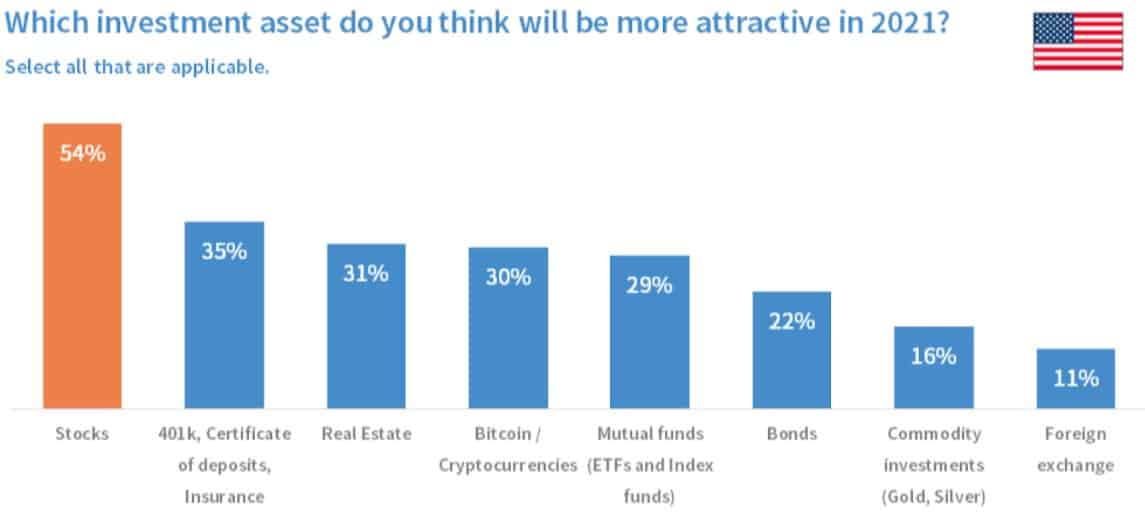

The final results, shared with CryptoPotato, showed that US-based participants had placed stocks as their most preferred investment assets (54%). At the same time, the typically regarded as safer options of 401k and certificate of deposits came second with 35%.

Real estate has taken the third spot with 31%. Interestingly, bitcoin and other cryptocurrencies came just behind real estate with 30%. This is a higher spot than mutual funds, such as ETFs and index funds, with 29%, and bonds (22%).

It’s worth noting that digital assets have attracted almost twice as many voters as commodities like gold and silver.

“Crypto was two times more popular than gold and also the 4th most popular asset, as 30% of Americans believe it will be an attractive investment opportunity. In Japan, crypto was the 5th most popular asset, as people favored other investment vehicles such as mutual funds and FX.” – concluded the paper.

As reported in October 2020, a similar conclusion came from the world’s largest country by landmass. Russian study participants placed cryptocurrencies as their 5th most preferred investment tool, while gold came at 6th place.

US’s Positivity Vs. Japan’s Negativity

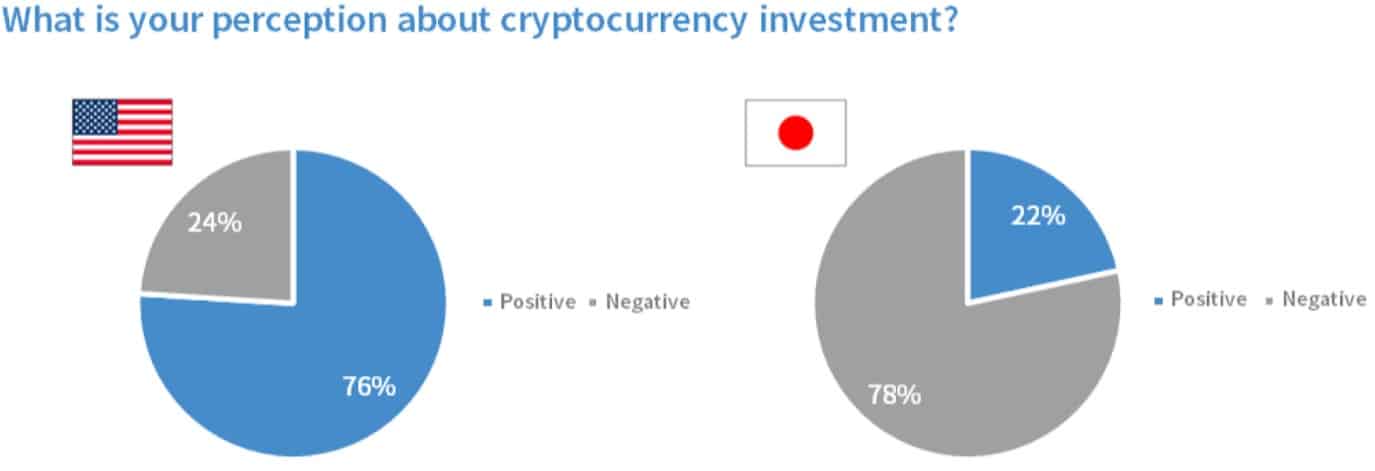

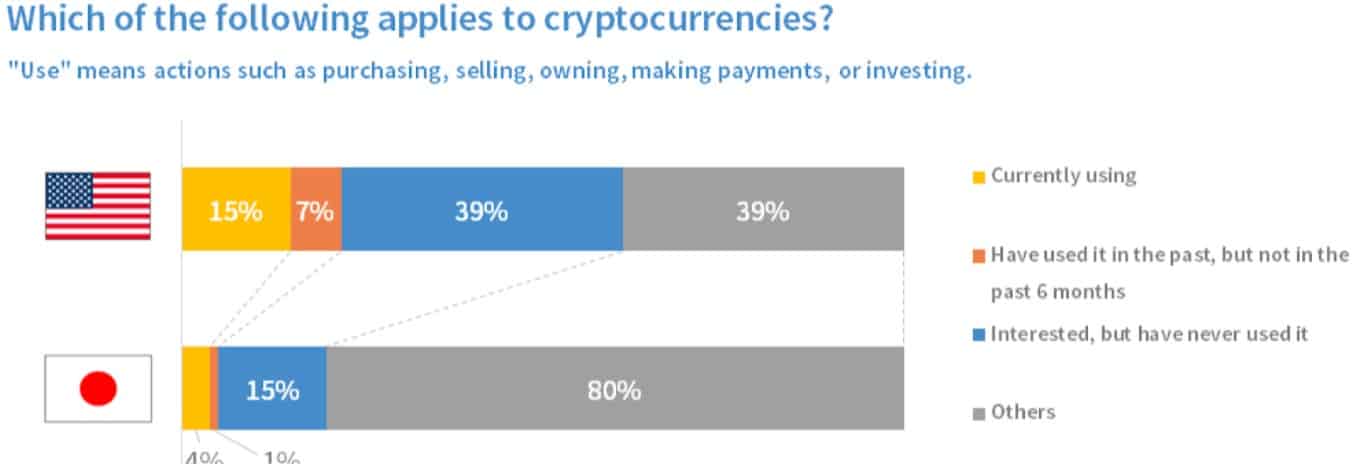

The survey also noted that the majority of US and Japan participants had heard of cryptocurrencies. However, there was a significant difference between their sentiment and adoption rates.

For instance, 15% of US-based participants answered that they are currently using various digital assets for purchasing, selling, or simply owning portions. The percentage in Japan was just 4%.

Furthermore, over three-quarters of people who have heard of cryptocurrencies in the US have a positive sentiment, while nearly 80% of Japanese have a negative perception.

“Similarly with investing, the sentiment towards cryptocurrencies is a lot stronger in the US than it is in Japan. 76% of respondents in the US who have heard about cryptocurrencies have a positive perception about cryptocurrencies as an investment, while in Japan it was the complete opposite.”