Bitcoin Is Freedom’s First Line Of Defense

On Memorial Day, we remember fallen soldiers and their sacrifice made toward protecting freedom. Like Bitcoin, freedom requires proof of work.

Mickey Koss is a West Point graduate with a degree in Economics. He 4 years in the Infantry before transitioning to the Finance Corps.

In my first article, I compared Bitcoin to the U.S. Constitution and spoke to the characteristics of the asset that made it such a great fit for service members. On this Memorial Day, I would like to take a moment to explain what the day is all about. More than just another federal holiday marking great sales on refrigerators and mattresses, it is a day meant to remember those who have fallen while in service to the country. Certainly a solemn tone, but I think a day best served with a cold beer and some friends. The service members I knew would have appreciated that.

The U.S. military is the last line of defense for freedom, defending the Constitution against all enemies, both foreign and domestic; Bitcoin can serve as a first line of defense for freedom — a nonviolent tool which can disincentivize violence and control. It is not only a hedge against currency devaluation, but a hedge against tyranny as well.

Freedom As Responsibility And A Moral Imperative

Owning bitcoin allows you to be your own bank, and much like maintaining freedom, it’s a hefty responsibility. Ironically, on this hallowed day, the banks we rely on to hold our money for us are typically closed for the day, extending those weird and inconvenient weekend hours, keeping us from what we own. Bitcoin never sleeps. It trades 24/7/365 on a network that is more reliable than the Federal Reserve’s own wire system.

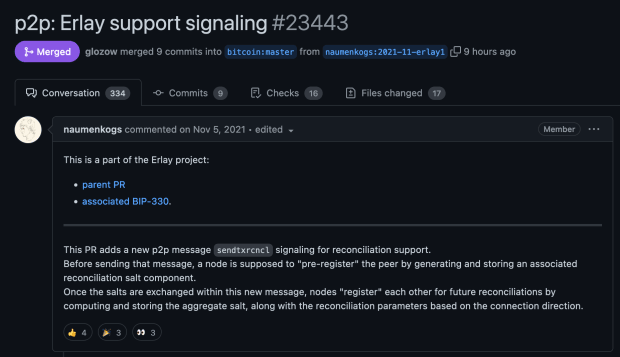

While it may be far too easy to leave your coins on an exchange, if you simply buy bitcoin but never take custody, you are leaving yourself open to a multitude of attacks. One of the most insidious, in my eyes, is the potential for a self-custody ban or some sort of regulatory capture of the exchanges, effectively turning bitcoin into another meme stock that must be held by a third-party custodian. In the process, the peer-to-peer decentralized nature of the network gets degraded for millions of potential users across the country, if not the whole world.

The Freedom Convoy trucker protest in Canada was a starting illustration of something along these lines. Protestors’ bank accounts were frozen and wallets were flagged, making living everyday life nearly impossible. Furthermore, ancillary individuals who donated as little as $50 saw their accounts frozen as well. Some were doxxed and even lost their jobs.

You see, when you have your money in banks and investment accounts, it’s not really yours. It belongs to the banks — the custodians — and it’s granted access to you at the behest of them and the government. To these custodians, granting you access to your money is an inconvenient privilege that can be rescinded at a moment’s notice. It’s a testament to how powerful western nations have become and a cautionary tale for what could happen if you ever see yourself in the outgroup in the event of a heated disagreement.

While the First and Fourth Amendments of the Constitution guarantee freedom of speech and protect against unwarranted searches and seizures, these things are still a possibility and are largely the purpose of the legal and court system. Even if you are well within your rights, it could cost you months if not years of court cases and millions of dollars in lawyer fees to see justice brought to bear.

Anarcho-capitalists to Communists alike, whatever your views, whatever your political proclivities, Bitcoin has your back. It is a completely voluntary system of censorship-resistant, peer-to-peer, electronic money. It is a digital bearer instrument if you use it correctly. It is simply a tool; a tool that does not discriminate and does not care who you are or what you believe. Bitcoin is a tool that just is; a tool that just does. It exists everywhere and nowhere, simultaneously. All you need to do is learn.

While the Second Amendment types will tell you that it exists to protect all the other rights through the implicit threat of violence, Bitcoin is fundamentally different. It actually disincentivizes violence because it cannot be coerced out of the population at scale. Large-scale search-and-seizure becomes prohibitively expensive. It is perhaps the largest peaceful protest in the history of mankind, and it is your best way to preserve freedom. Loss of freedoms typically require violence to reinstate; opt in to peace through buying and holding bitcoin.

Freedom Requires Proof of Work

One does not simply buy bitcoin and HODL through the roller coaster ride. About a month after my wife and I decided to start saving our money in bitcoin, we experienced a pretty nasty crash. The most interesting part of the crash was not the fear and uncertainty that I was experiencing, but rather the excited indifference of my wife, suggesting that we should buy some more.

When I first pitched the idea to her, she had her reservations to say the least. She pushed back, asked great questions and made me dig. I researched more, we dug together and after doing the work, we were able to make the decision together. This was a necessity to build the conviction and trust to hold though the storms and build the base of freedom. I could not have done it without her skepticism. I would not have been able to hold on without her support.

If you can’t orange-pill your wife, you probably don’t understand bitcoin enough to hold on through the storm. You will inevitably sell during the times of peak opportunity whether out of your own fear, or theirs, locking in losses and sealing your fate. You have to do the work first and build conviction if you want it to last, if you want to become your own bank. Better yet, if you are married, it’s probably best for you to do it together.

Reviving The Dream: Bitcoin And The American Spirit

It’s no secret that, to many, the American dream feels harder and harder to attain. Millennials especially are feeling the squeeze as they delay milestones like marriage, having children or buying their first home. I see it every day with friends and coworkers.

Buying bitcoin can and will help you move closer to your goals. It just takes some work and requires work — proof-of-work — to hold on long enough to make a difference. So where to start? Do your homework. I like to recommend Bitcoin-only companies now to help stave off marketing and trickery. River Financial and Swan Bitcoin are two of the best. I also like BlockfFi’s credit card along with Lolli and Fold to get bitcoin back on money I was going to spend anyways. An example would be buying Amazon gift cards through Fold with my BlockFi card, stacking cash back at a 3% total bitcoin-back rate on all our Amazon purchases.

Another challenge I have for you is to build a habit of historical and financial literacy. Once you build your baseline, you can graduate to holding your own keys. BTC Sessions taught me everything I know about that and has helped me help others do the same. Only after holding your own keys and understanding the past will you truly be able to HODL through the storms and become a sovereign and free individual, making it that much harder for your freedoms to be eroded over time.

Every purchase you make is a vote for the future that you want. Through buying and holding bitcoin, holding your keys and taking back your self-sovereignty, you move the country back toward a sound money standard that can do much to fix our divisive problems. Furthermore, you are making it harder for tyranny and government overreach to take hold. You are sowing the seeds for a better tomorrow. You are revitalizing the American dream.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.