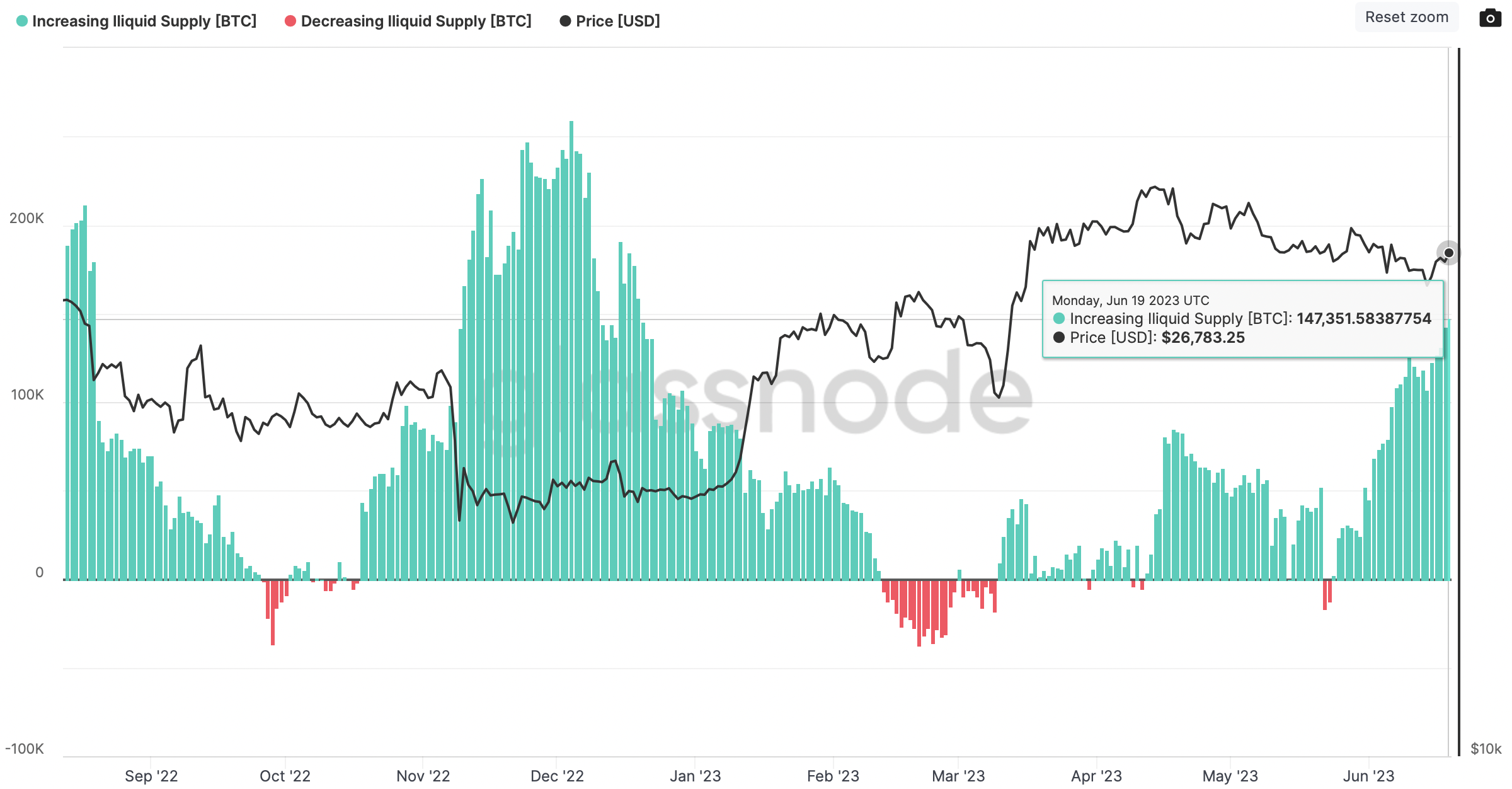

Bitcoin Is Becoming Illiquid at 147K a Month in Signal of Steady Accumulation

Bitcoin (BTC) is flowing into wallets controlled by illiquid entities, or network participants with little-to-no spending history, at the fastest rate in six months, indicating a bias for accumulation from long-term investors.

Glassnode’s illiquid supply change metric, which measures the number of coins held by illiquid wallets on a specific date compared with the same day the previous month, rose to 147,351.58 BTC ($3.9 billion) on Monday, the most since Dec. 19. The total held by illiquid entities has jumped to a record high 15,207,843 BTC, with the tally increasing by 215,000 BTC in the past four weeks alone.

The data shows investors remain confident of bitcoin’s price prospects despite continued macroeconomic uncertainty and heightened regulatory risks.

Last week, the U.S. Federal Reserve kept interest rates unchanged, pausing a 15-month rate-hike cycle. The bank, however, ruled out rate cuts this year while keeping the doors open for more increases if required. The so-called tightening was partly responsible for last year’s crypto market swoon.

Early this month, the U.S. Securities and Exchange Commission filed lawsuits against prominent digital assets exchanges Coinbase and Binance, accusing them of offering a number of alternative cryptocurrencies as unregistered securities. The lawsuits did not mention bitcoin, triggering a rotation of money out of altcoins and into the leading cryptocurrency by market value.

The rate of flow into illiquid wallets is “supporting the case for a gradual and steady accumulation taking place,” Glassnode analyst James Check said in a weekly report published Monday, noting the record balance held by illiquid entities and the dwindling exchange balance.

“Overall, the market appears to be in a period of quiet accumulation, which suggests an undercurrent of demand, despite the regulatory headwinds of late,” Check added.

The illiquid supply change indicator turned positive on May 24, signaling renewed accumulation, and has increased sharply since then.

Other things being equal, faster accumulation means weakening supply in the market and potential for price rise. Technical charts suggest scope for bull revival as long as crucial support at $25,200 is held intact, that is the bitcoin price doesn’t drop below that level.

Bitcoin changed hands at about $26,750 at press time, having put in a high above $27,150 during the Asian trading hours, according to CoinDesk data.

Edited by Sheldon Reback.

Disclaimer: This article was written and edited by CoinDesk journalists with the sole purpose of informing the reader with accurate information. If you click on a link from Glassnode, CoinDesk may earn a commission. For more, see our Ethics Policy.