Bitcoin Is A Pyramid Scheme According To A Popular Economist

Despite the extremely positive last decade, Bitcoin has also received a lot of criticism and negativity. Such is the case with an economist from Lending Tree, calling it a pyramid scheme that has no real utility in the world. At the same time, a Chief Market Strategist noted that he actually owns five cryptocurrencies, but people need to be familiar with the possible risks.

Bitcoin – A Pyramid Scheme?

In a recent interview with Yahoo Finance, Lending Tree Chief Economist Tendayi Kapfidze spoke about several investment options, including the largest cryptocurrency. He seemed rather skeptical of Bitcoin, and even mentioned a lack of usage in the real world:

It’s a pyramid scheme. You only make money based on people who enter after you. It has no real utility in the world. They’ve been trying to create a utility for it for ten years now. It’s a solution in search of a problem, and it still hasn’t found a problem to solve. – He said.

In the same time, Bruderman Asset Management Chief Market Strategist, Oliver Pursche, admitted that he owns five cryptocurrencies, without specifying which ones exactly. He thinks that buying such assets would allow someone to get educated on the matter. He also says that he purchased them with a specific thought – “there’s something here. I just don’t know what it is.”

However, Pursche also warns of the possible risks, saying that people shouldn’t expect to become millionaires overnight and that they should understand such investments could lead to a potential loss.

Bitcoin’s Response

Bitcoin managed to prove people wrong over the last decade. A recent report showed that Bitcoin had been the best performing investment asset in the previous ten years, as it has delivered an 8,900,000% ROI. For reference, in the same timeframe, Netflix is the biggest stock gainer from the S&P 500 with a 4,181% return on investment.

Furthermore, Bitcoin has become much safer now with the hash rate recently recording a new all-time high.

As far as the lack of usage goes, that might not actually be the case. As Cryptopotato recently highlighted, several large industries are accepting Bitcoin payments today. People can use it to book flights and hotels, buy food, purchase technology, and even cars.

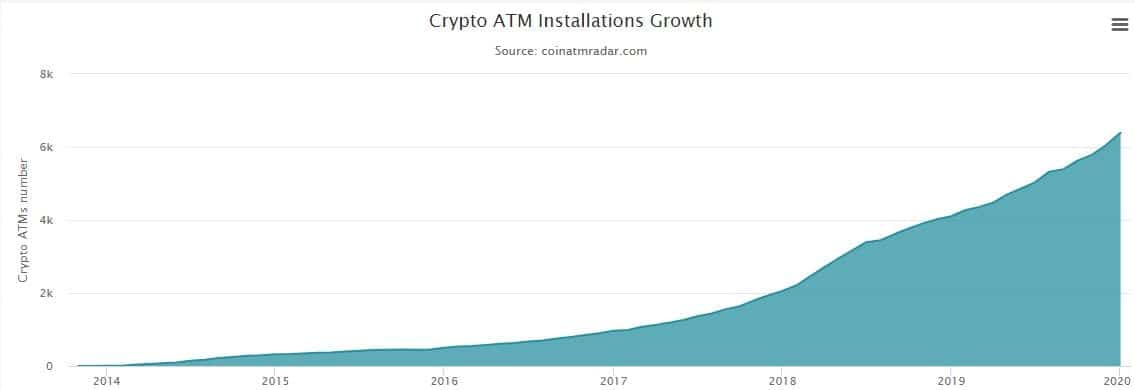

Additionally, adoption appears on the rise as well, as Bitcoin ATMs have increased with 56% during 2019 to 6,387.

The post Bitcoin Is A Pyramid Scheme According To A Popular Economist appeared first on CryptoPotato.