Bitcoin Is A New World Country

Bitcoin’s enforceable signature verification creates new possibilities for seamlessly and privately expressing ownership of bitcoin to another counterparty.

Sam Abbassi is Founder and CEO of Hoseki, the proof-of-assets Bitcoin service.

De Soto Dreams Of Electric Money

Countries in the Global South are not poor because of culture, collective IQ, a lack of entrepreneurial spirit or market orientation; they are poor because they lack formal frameworks around property rights. Hernando de Soto discusses these topics at length in the “The Mystery Of Capital.” The ability to formalize and express ownership of property is at the foundation of capital and wealth generation, and if you think it has anything to do with culture, try (as de Soto puts it) jumping into a taxi in Addis Ababa, Ethiopia, or walk through a bazaar in Tehran, Iran, or hustle your way to the Golden Temple in Amritsar, India without having someone try and strike up a deal with you. The notion that the people in these regions lack the creativity and the “right” culture to generate wealth is inhumane, absurd and entirely unconvincing. When you walk out the door of the Hilton hotel in Lima, Peru, you’re not leaving behind the wonderful world of mobile tech, antibiotics, internet and refrigeration. The people of Peru have all of those things. What you’re leaving behind is the magical world of legally enforceable transactions on property rights.

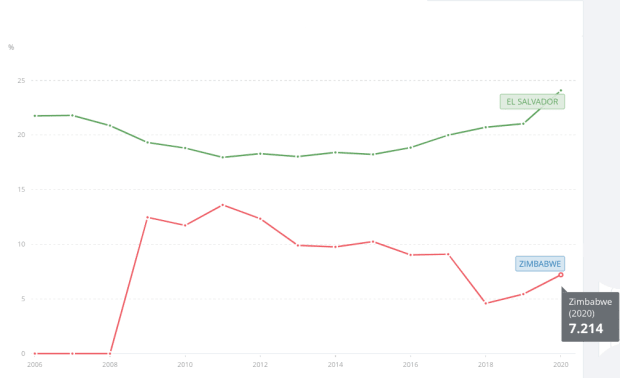

The unfortunate reality that exacerbates the condition of the people in these countries is that they are actually quite rich in their assets. The problem is that the assets in these regions are locked. Their citizens are unable to represent the assets they possess and they are unable to live the same invisible parallel lives that they are able to in the Global North. These assets, in effect, represent dead capital.

In the Global North, you can pledge your home for a loan, you can use credit ratings to get access to loans, you can hold stock in a company through legally enforceable contracts, enjoy limited liability and insurance policies, leverage property records that fix and store capital, all of which can be passed down to your heirs through hereditary succession. You can do all of these magical things in a world where the records of property you hold bestow upon you (the titleholder) and everyone else around you (other participants in the market) access to rights to general capital.

Bitcoin Is A Developing Country

Countries in the Global South don’t have these frameworks and neither does Bitcoin. Bitcoin suffers from much of the same malaise that inflicts contemporary developing countries such as massive migrations, explosions of extralegal activity, political and civil unrest and general discontent with an antiquated system. Our migrations are digital, our extralegal activity is dictated by the country we live in, political and civil unrests have a storied history that show no signs of abating and the antiquated system we are discontent with is maintained by a kleptocratic class of elites that expresses no accountability for those who enforce it.

The America of old (the America we love) itself used to be a developing country that, according to de Soto, was “trying to cope with the law and disorder of migrants, squatters, gold diggers, armed gangs, illegal entrepreneurs, and the rest of the colorful characters who made the settling of the American West so wild and, if only in hindsight, so romantic.” Like early American colonists, the prevailing system of English common law did not work. It didn’t take into account new forms of property access absent an established and generally accepted titling system. This was specifically a problem when it came to cases involving dubious titles. Property in England was so well formalized, demarcated and understood that there was no framework to handle newly-found or established property. The sheer abundance of land in British North America presented the first settlers with opportunities unfathomable back home in Europe — both in the collective psyche of the people and the law. Colonists ultimately formed their own rules that varied greatly by jurisdiction that expanded on the principles of English common law. This form of self-governance often clashed with the authorities, but as Peter Charles Hoffer emphasizes in “Law and People in Colonial America:”

“In theory they were part of the king’s personal domain [and subject to his laws], but fact preempts theory. Far from England, thinly populated, rich in natural resources and occupied by men and women who knew their own minds and grasped a bargain when they saw it, the colonies edged towards self-government.”

Ultimately, Western nations came to acknowledge social contracts born outside the official law as legitimate sources of law, making the law a tool that served popular capital formation and economic growth.

Bitcoin is at a similar point to where America was post its founding, and at the same point where developing countries are today.

Bitcoin brings Hernando de Soto’s dream to its ASIC-powered reality. Bitcoin is unique in that it natively enforces its own property rights without a monopoly on violence that enforces most other assets. Bitcoin is also without jurisdiction; its jurisdiction is cyberspace and it is not bound to the imagined boundaries that make up meatspace. What do you get when you have a jurisdiction-less asset, that enforces its own property rights irrespective of color, creed, country, language, sex or vaccination status? You get a new world.

That is what we see at Hoseki. We, like a lot of our friends — most likely including the reader — see a new world where the best money wins. We are tired of the vapid, soulless and amoral systems of money that pervade and dictate our current lives.

Human potential is limitless, and to limit it with monetary discretion and central planning is on the level of psychotic, if not genocidal. Bitcoin gives us a sound foundation to build on that avoids the pitfalls of systems of the past. It is through this foundation that we can generate sound capital. Unlike the current system which emboldens rampant debt, anesthetizes itself through bailouts for those closest to the system and sadistically brutalizes those on the fringes, Bitcoin offers something more. Bitcoin rewards good behavior, low time preference, high savings, planning and responsibility. Without strong incentives to exploit, we are embraced by a moralistic future with support beams built and maintained by a global collective, not a cabal of regional insiders. It offers a world that promotes saving for your future self and family, one that will connect you with your locality and allow you, your family and your community to plan for generations. Bitcoin promotes human potential through its emotionless enforcement of consensus-based rules that give us predictability, and by extension, reliability.

Hoseki Fixes This

Bitcoin has property rights built in. Much like services offered by brilliant Bitcoin companies today which utilize functionality that Bitcoin natively offers — namely multisignature custody quorums, Hoseki is also wrapping something that Bitcoin natively offers. After multisig, signature verification seems to be one of the most underrated functions that the Bitcoin protocol provides. We at Hoseki are taking the torch and expanding this core functionality. We want retail users to know that Bitcoin not only empowers you to be your own financial institution by taking custody of your own property, but it also allows you to express ownership over that property. A framework around expressing ownership of property is the foundational building block for robust property rights. It is also a way to unlock all of the capital that is currently captured in your stranded assets.

Hoseki is financial plumbing to seamlessly and privately express ownership of bitcoin to another counterparty. Proving ownership of an asset is a basic characteristic of any asset class, be it stocks, bonds, cash in your account or real estate. Much like our brethren in Peru, Egypt, Myanmar and Afghanistan, whose physical property is stranded, we are faced with a similar reality where our digital property, bitcoin, is stranded. Bitcoin is siloed off into exchanges, mobile wallets and hardware wallets. People hold bitcoin in different ways and in different places, and because of that, expressing ownership has become a challenge. There is no easy way for a broker, lender or underwriter to assess and verify your assets when you are trying to get a loan. You have the assets — they are quite valuable — yet you can’t get any service. You’re not expected to move or sell your stock holdings to fund your home purchase, but that stipulation exists when attempting to use bitcoin. This is particularly frustrating because you are holding the most pristine asset in existence, but much like property on the American frontier that hadn’t yet been formalized, bitcoin is missing a formal framework around expressing its natively-enforceable property rights.

Today you are shackled. Tomorrow you will be liberated. Hoseki is building a system that allows you to manifest the full potential of your bitcoin. It allows the world to benefit from Bitcoin, and it seeks to act as a bridge between the old world and the new as we shift to a global monetary regime run on a bitcoin standard.

This is a guest post by Sam Abbassi. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.