Bitcoin Is A Net Benefit To The Environment

Bitcoin mining incentivizes energy usage that is better for the environment by easing the transition from fossil fuels to wind and solar energy.

Watch This Episode On YouTube

Listen To The Episode Here

- Apple

- Spotify

- Libsyn

Transcript

[00:00:04] Q: What is up guys. Welcome back. P can you introduce our next guest? [00:00:09] P: AB so fucking, absolutely Troy Cross is a fellow with the Bitcoin Policy Institute and professor of philosophy and humanities at Reed college, where he teaches courses on time, time, travel, philosophy of religion, color, and philosophy of mind, as well as lecturing in the humanities program.Prior to going to read, he held positions at Yale and Merton college. Oxford crosses philosophical research centers on foundational issues in metaphysics and EPIs,

[00:00:34] Troy Cross: epidemiology epistemology. What epistemology? No, you got it. [00:00:39] P: Epistemology. All right. Epistemology. You’ve also been involved in Bitcoin for over a decade.You reminding Bitcoin like way the fuck back in the day you have. Blown a ton of Bitcoin buying socks, bit of alpacas. And you are an expert in the environmental aspect of Bitcoin and the considerations they’re in.

[00:01:01] Troy Cross: Man. That is quite an intro. I sound like a Fiat academic I have to say with all that.Yeah, I’m a philosophy professor. I’m on a leave right now just to do Bitcoin stuff and I’m really pleased to be here. Thank you so much for having me. I love talking about Bitcoin, especially with you guys.

[00:01:20] P: Amazing. Yeah, you and I have had many conversations over the months in Twitter spaces and I always am super impressed and enjoy your, your thoughts. [00:01:31] Troy Cross: Thank you. Feel, feel the same way [00:01:34] P: You you’re too kind. Fun fact. I was accepted to Reed college and I was like this close to going there. And the reason I decided that I needed to go to Reed college was because it was one of the only, I think it was the only university in the United States that gave undergraduate access to a nuclear reactor.And yeah, I went and I saw the I think it’s the, is it the railway scattering from, from the blue glow coming out of this giant, like 30 foot deep pool. And I was like, I have to be here, obviously. am I interested in nuclear energy? Not particularly, but I will become interested.

[00:02:08] Troy Cross: yeah, the reactor is awesome.It puts out. Such a tiny amount of energy. It’s like minuscule, really. They just use it. They don’t use it to power, anything. They use it to, you know, create materials for other experiments. But yeah, it’s the only student run. It’s, it’s not just that students have access to it. It’s that students actually run and operate the reactor and it’s you have to get training for it.

And then you get certification. Like when you graduate, you’re like a certified nuclear reactor operator. If you go through that program and you know, that, that That’s how I know a little bit, that’s gives me some insight into nuclear as a I guess as a energy source and, and, and a Bitcoin mining possibility because I always have students who are in that program and I get contacted by the federal government like twice a year with these vague and weirdly intrusive little notes.

Like, do you have any information that we should know about about so and so, and then they list my students who are working on the reactor and I’m like what exactly are you looking for? You know, and I, so anyway, I wrote the administration, like, what are they looking for? And they wrote the agency that oversees it and that agency.

Gave some information about what they’re looking for. And it’s also just like super open ended. It’s basically, I’m a spy on my own students on behalf of the government. Like, are you, what are you doing with this information? And I, I realize that like, since we get visited by the, whatever it is, the atomic commission or whatever, and like yet all these notes that nuclear, I’m a huge fan of nuclear basically for its basic physical properties.

I think nuclear is, is, is the future. But I am somewhat troubled as a coiner by how in your, in your business, the regulators are for this tiny little reactor that can’t even power a light bulb. And so the dream of like, you know, just all Bitcoin mining being done on nuclear reactors, there’s some tension with it also being decentralized because I think it is the most heavily regulated and sped upon form of energy production that there is.

Okay. That was way more than you wanted to hear, but sorry.

[00:04:15] P: No, I like all of it. [00:04:16] Q: My first question in the moment, I’ve never heard of Reed college having a nuclear reactor. This is news to me. You learn something new every day. That’s the thing I learned today, what I genuinely wanted to ask is, so why doesn’t the federal government reach out to the professors or the students there to understand more about nuclear energy?Because it’s being tested and worked on, on a daily basis and low and behold, of course they do. They do. And of course, of course they ask the wrong questions.

[00:04:42] Troy Cross: You can see why they do it, right. Nuclear proliferation is identified by many people in government as the number one threat to the security, the safety of humanity and, and, you know, think about where we’re coming from.From the cold war. That was obviously top of mind for literally everyone. So when these regulations were first drafted, we were just concerned about nuclear proliferation. And, you know, we have a lot of students here from all over the world and the thought is, I mean, it’s obvious you’re gonna learn about nuclear energy and then you’re gonna take it back to wherever you’re from.

You’re gonna build a bomb, you’re gonna use it on us. And then post nine 11, things got amped up to another level. So, you know, I think I see exactly where it came from. It’s like, basically like imagine a flight training school and the government’s up in your business. And you’re like after nine 11, I can see why they wanna know this stuff because it was a failure to, to keep tabs on that that looked utterly stupid afterwards.

But this is exactly how the surveillance and security state becomes a behemoth. Each one of these things is like a one way ratchet, you know, you, you have a security threat. You address that security threat. You don’t want to be the bureaucrat who doesn’t surveil hard enough and something slips through your grasp.

So you always overreach when you draw the legislation in response to that, and you basically like, look at what we have to go through at the airport now, you know, look at like how our lives are. So, guarded in these stupid and, and inefficient ways. And you’re like, how did we get here? We got here because people brought knives onto a plane and hijacked hijacked it and flew into the world trade center.

That’s how , you know, it’s like, okay, I see it. So I, I, I’m not like I I’m nots apologize. I get it. Like, I totally get how it happened. It’s just that here we are. And where we are now is really I think, you know, it, it, it really. It, it really sets us on a path and who’s gonna undo it. Who’s gonna be like, no, we should, we should stop checking in with read props about their students and asking whether they’re decent people.

Like it’s no one’s gonna do that.

[00:06:46] P: No, it’s never gonna happen. It’s I think within our lifetimes, we’re gonna have to strip entirely naked. Like cover ourselves in petroleum jelly and like slide through like an Organo mechanical, you know, Orus, that’s like a G [00:06:59] Q: You’re telling me you don’t do that when you go through TSA, you’re as dark as I am.Look, I’m part of the, the extracurricular program at the TSA. But you and I go through that, but most people dunno about that yet.

[00:07:10] Troy Cross: Actually, I think somebody actually did in port, in the Portland airport where I live, somebody did strip down, going through TSA in some kind of protest made local news. [00:07:19] Q: So honestly,I love it. Troy, there was something that you said though, that I think feeds into what my belief around a lot of this nuclear stuff is. And it’s the idea that, you know, people of a certain age, U N P no offense, unlike me grew up in the cold war era, hearing about it and, and like really feeling this fear around a potential nuclear war.

You guys also were alive during Treno. I mean, P was an old man then just, you could see how long he is now. But like these are not events that necessarily feel very close to me. Like. Hate me all you want for saying it like this, but it didn’t really click in my head until I was much older. That Cher noble was not very far removed from when I was born.

And I wonder if part of this hesitation to adopt or go and explore nuclear energy is because the leadership, the people who can make those decisions were in fact alive during that time and biased to a point of fear almost rather than. Through a viewpoint of opportunity or prosperity that this new technology could provide.

How much of that do you buy or am I just still a little high from the weekend?

[00:08:29] Troy Cross: I mean, first of all, Pete doesn’t look half my age, but yeah, I did live through those things and I remember the Berlin wall coming down and my mother grew up in Washington DC. And when she was a little girl, like her big fear was the nuclear war, you know, that was the era of Dr.Strange love and the Rand Institute. And I think of course that shaped us, but on nuclear safety, it’s more than just the cold war. Shaping us it’s on the one hand, the proliferation of, of nuclear weapons. I mean, I, I, I think it is a concern. Nuclear weapons are definitely a concern. I, I wouldn’t say I’m concerned about that at all.

In fact what’s weird is that we were a lot safer in the cold war, I think, than we are now on the nuclear Warfront because we just, it was just in the hands of two superpowers, both of whom had a lot to lose. Whereas now it’s in the hands of a lot of rogue actors and it’s a little less secure, but on the, on the part of nuclear energy, there was of course, a huge movement that kind of coincided with the cold war that wasn’t so much about.

It wasn’t so much about geopolitics as it was about meltdowns, like Cher, noble the plant in New York, It was these little accidents and it was also about what do we do with FCI material spent material and not having a really good place to store it and having a long half life. And of course you do remember Fukushima.

I hope you know, that that’s an ongoing disaster. I made, I made some money on that in the prediction markets. I made good money on Fukushima. Oh yeah. I’m detail. Tell us how well it was on this prediction market in Ireland, which has now been closed. And you could bet on basically the scope of the disaster.

Like how big was it and how much, how large would the disaster area be declared and at what level. I made two calculations. First of all, I calculate the government was lying and it was worse than it was. And that was true. And then my second calculation was just looking at the rings of devastation possible that some of those larger rings, geographically encompassed large population centers.

And I knew they would not evacuate those population centers. Like I just knew it like basically no matter what, because it would just be too much of a paint. So I bet that this, that the circle would be bigger than they were initially saying and smaller than these outlying ones. And I bet, like I bought up the whole market.

I mean, it’s not a big market, so I just like bought up every available trade. And you know, I felt weird about profiting on nuclear disaster, information, you know, the market is there to get information. I wanted to get people information . Absolutely. Yeah. That was pre Bitcoin by the way, I think, I think, no, I can’t remember.

No. When was Fukushima? What was I already trading Bitcoin? Yeah, maybe I was okay. All right, whatever

[00:11:18] Q: Fukishima was 2011, but by the way, none of this is financial advice. [00:11:22] Troy Cross: None of this is financial advice. Do not bet on anyway, the site is shut down. You know, it’s like a gambling thing, like anything centralized, right?It’s it’s free market and it gets gonna get shut down. So, but, but anyway, back to the question, like I think these disasters and the problem of long term storage, you know, it galvanized a movement that went together with the no nukes movement for war. And that was like, not my generation really, but like my parents’ generation, they weren’t really part of that.

But, you know, that was the no nukes thing. And what’s weird is to see how the long tail on that movement. And we’ve got much better safety in reactors now in their design, in their fundamental design, but also in their placement in their regulation, like basically we have addressed the safety problems in nuclears by far the safest form of power production now, and that’s hard to stomach, but it’s true.

You know, just like the air pollution. A coal plant kills more than nuclear ever, ever has by causing lung issues and stuff. So I, I think nuclear and, and, and of course, I mean, this point’s been made all over Bitcoin, Twitter and all over energy, Twitter, but basically decommissioning nuclear fleets around the world is what is keeping coal plants online.

And for Bitcoin’s critics who point at Bitcoin, which is less than a billion dollars a month in total revenue. And, you know, probably you know, $200 a month in, in, in energy spend to fossil fuels. If that like maximum, maybe a hundred million dollars a month is the total global spend on fossil fuel energy worldwide to say coal plants are staying open because of Bitcoin.

Meanwhile, we are shutting down nuclear plants. That produce you know, orders of magnitude, more power around the world, you know, it’s happening like that New York state legislation, there’s a plant being closed down in New York at the same time that that legislation is being forwarded and discussed.

There’s a plant in Michigan that just got shut down. There’s a gas plant across the street that is of course taking up the slack. So like, basically shutting down the nuclear fleet is eating up all of the gains that are being made by adding green energy and keeping fossil fuels around when they otherwise wouldn’t be, nuclear has amazing features as a producer of power has this incredible capacity factor.

It has a very small footprint, unlike solar, you know, it’s, it’s fantastic. It, it overruns its budgets all over the place. It’s expensive right now. It’s centralized, it’s regulated but it is safe and it’s steady and it, it it’s you know, and it’s carbon. It’s, it’s not considered renewable because it uses uranium, but it’s sustainable.

It it’s, it’s a carbon free production of, of energy. So like, it, it, the, it’s almost like the game with, with Bitcoin. It’s like a distraction game. Like everybody look here at 0.001, 2% of global energy. Meanwhile, ignore the fact that we are shuttering the, the most innovative and forward looking and decarbonizing form of energy production that humanity has ever had.

It. It’s almost like a, you know, I get conspiratorial at this point, like who’s behind this, like, you know, who’s behind this because it seems just too irrational for it to be organic, but then, you know, people are irrational. No, I mean,

[00:14:34] Q: I, I could not agree with you more. It is so disheartening to, to have so many people believing the lies that are constantly repeated.About nuclear energy and honestly, so many other things, but specifically around nuclear energy and its effects on the environment and what it does for humanity. I mean, it’s just lie after lie, after lie and the policy decisions that are made reflect those lies. It, it’s

[00:15:05] Troy Cross: a really, really instructive thing for Bitcoiners because we’re the anti-nuclear campaign of misinformation and the anti Bitcoin campaign bear a lot of resemblance, but it happened a long time ago with nuclear.So we’re looking into our own future. When we see the present, you know, we look at the president of nuclear, that’s our future. Like where, where, where are these right now? Bitcoiners are like the nuclear advocates of. Seventies and eighties and, you know, look at the long tail of that misinformation, these a few key players, right, who have created the story around Bitcoin fashioned it and fed it to the media who lapped it up into politicians who also lapped it up, you know, Alex Dre, who I’m gonna, I’m going to a conference on Wednesday.

He’s gonna be the keynote speaker there created this dig economist, the the central bank employee for the Netherlands created the site, dig economist, originally doge, economist, and spread just a, an incredible pile of FUD about Bitcoin. Like that person, Camila Mora professor at university of Hawaii wrote.

Or didn’t really write, put his name on a paper that is repeated everywhere that says Bitcoin alone is gonna heat the globe more than two degrees. Like these two people and a few other key players at the very, very beginning of Bitcoin’s life shaped a narrative that is not based in fact, but which will dog us for decades.

And it’s it’s because it’s because there wasn’t a counter narrative that caught on fast enough. And it’s because it became an identity feature, right. Rather than just like, oh, how does this brand new technology work? Like the electricity or the internet? Let’s figure it out. How it could be used to, to further human ends.

It was what kind of a person am I am. I, I know it’s so, you know, am I am like, you know what I mean? And so that’s the same with nuclear. It’s like once you’re a, a nos person and you’ve got, t-shirts saying that and you’ve protested it, how easy is it gonna be to change your mind? Very very freaking hard, which is why we just have to wait for the hippies to die for that narrative to die.

We’re not gonna change their minds. Right. So we gotta wait, we gotta work on the next generation. And so those two in particular, but others are, you know, Elizabeth Warren, they are trying to do the same thing for Bitcoin, cement a narrative and, and intertwine it with an identity so that it cannot be shed at the pain of, at, at the cost of your own, your own ego.

That’s admitting that you’re, I, you, you, aren’t the person that you say or you’re one of those bad people, so we have to stop it before it gets to that phase, because we’re just gonna be dealing with this FUD, like, like for decades.

[00:17:41] P: Yeah,man, I, I have said similar things in, in a far, far less eloquent way that like the way I thought about it is when you’re talking about, when you’re talking with people about environmentalism specifically around ESG narratives, one of the, one of the experiences that I’ve had personally is that it is so difficult to.

To have a conversation based in fact or reason, because as you say, people’s identities are wrapped up in this idea and I’d never thought about the idea, or I had never thought about it from the perspective of people trying to establish that identity around Bitcoin. And certainly not around the idea of nuclear energy, but you’re absolutely right.

That’s exactly the, the attack vector

against it.

[00:18:24] Troy Cross: And, and, and when I talk to people and I’m not very good at this, no one is, you know, but you of have to work with the identity you already have. , you know, you’re not gonna be able to tell people like you identity sucks, who you are sucks, be a different kind of person.It doesn’t work that way. People don’t work that way. So you have to try to get inside their. Figure out what they value and how, you know, Bitcoin can connect with what they already value and who they really are. The deeper values, like, okay, you’ve got the t-shirt that says no nukes, but what are you really afraid of?

You’re really afraid of, you know, thermonuclear war you know, meltdowns at plants. And what you’re, what you’re afraid of is a kind of techno pessimistic vision of the future. An I radiated landscape a hellscape postapocalyptic, that’s what you’re afraid of. So if I can then show you that you are actually creating that hellscape, that the technology has advanced in the past decades, but you.

Where you’re you are keeping coal plants alive, and those coal plants actually have radiation and admit radiation more of it than escapes nuclear plants famously. Right. So do bananas. A lot of things have radiation, if I could show you that, that you’re creating a world that is worse than the one than the one that you’re trying to prevent with your actions and do it with empathy, you know, maybe, maybe we get in, but like I said, the hippies have to die, you know, I say this with affection.

I mean, I met Reed college. It’s basically like F you know what I mean? It was like hippy central, I think, 30 years ago. Oh my God.

[00:20:01] P: Yeah. It’s yeah. So I’d love to hear more your thoughts around how you combat those narratives. And I guess also taking a step back sort of, what is your position on kind of ESG narratives in Bitcoin and how we can. [00:20:18] Q: Can I, I’m gonna cut you off P cause I, I, I want to go down the ESG rabbit hole, but I want to go a different way because Troy, what you said, I agree with, however, then you look at something like ESG, where at its court is essentially just telling people, Hey, what, what you’ve done for all these years is bad and stupid and you have to change it.And this is what you have to do differently going forward. And for whatever reason, a lot of people bought into this narrative. A lot of it was pulling on the heartstring of finding what these people valued. Like, Hey, your kid is probably not gonna have the same planet that you have. Like that was like the advertisement running when I was a child, somehow that is still the advertisement and I’m kids.

My age are now having children now. So did it actually work or not remains to be seen, but why was ESG such an effective way of changing people’s minds about their consumption happens to what they were doing and changing it into the mess. See now.

[00:21:19] Troy Cross: Yeah. It’s interesting to use the word ESG because it’s a fairly new acronym.You know, people didn’t use the word ESG even five years ago. I’d never heard that phrase. And it really came out of the investing world. ESG stands for environmental, social and governance, and those are sort of three criteria for ethical investing. But I would say ESG grew out of the ethical investing Mo movement.

And then with people trying to sort of break down what ethical investing meant. So, you know, there’s environmentalism as a movement, which is, I think of it simply as having a low time preference. I think of the heart of environmentalism as just caring about, like you said, your kids, I, I don’t think that’s a Fiat thing.

I think that’s a human thing. Thinking about Thinking about using resources and building a world that where our grandkids are better off than we are. And you know, that means not just like dumping pollution everywhere, for instance. And it, it means generally building a better world. I think it it’s just identical with having a, a, a load time preference, letting your grandkids happiness be as important to you as your happiness.

If we had that. And if Bitcoin can achieve that, then environmentalism wins. That just is environmentalism in my book. Now what exactly that consists of something different. Now, what happened with ESG is you know, people had this thought like, Hey, I’m just throwing money into the market. And this, this is more Fiat thinking, right?

What happened was you cannot save anymore without investing. I think, you know, you go back a hundred years ago. We didn’t have a, a sophisticated stock market. You, you, you go another 20 years, we start to get a sophisticated stock market, but not everybody participates in it. It’s and it’s speculative, but sometime in the eighties or whatever, everybody’s retirement gets hooked up into investments.

Everybody’s investing all the time and it’s in a way it’s 1971, right? We start printing money everywhere. You cannot save in, in money. Money is not a savings vehicle anymore. Everybody knows that you have to gamble in the market in order to even stay, even with inflation, you can’t do that with cash anymore.

So everybody starts giving their money to, to the market. And then we also get the rise of these index funds rather than picking out stocks or having your broker pick out stocks. You just invested an index, you just brought buy the whole broad market, whether it’s the Vanguard total market fund or whether it’s just the S and P 500.

So now your savings vehicle, every, every day, a middle class Americans, their retirement vehicle and their savings vehicle, we’ve all become investors. We’ve all become speculators because the dollar has forced us to do that. And now people start thinking like, wait a minute, what am I kind of funding with my savings while I’m funding, basically the entire economy however, these fund managers decide to do it.

And that depends on, you know, what goes into the index that I’m investing in. Let’s say it’s all gonna be decided by the centralized operators. Maybe that stuff doesn’t actually reflect my values rather than me investing in say my family business, my town, people, I know land that I know about.

I’m suddenly investing in this very detached way into just the broader economy in ways that certain central planners basically whoever’s running these indexes and funds, whether that’s BlackRock or fidelity or whether it’s you know, the NASDAQ deciding who’s listed those people are determining where my money goes.

So I think this is a very non Fiat thought underneath so-called ESG, which is like, I wanna decide how my money gets invested and I wanna make sure it reflects who I am and my vision of the future. I think that is just. I don’t think that if that in any way as Fiat thinking, I don’t think of that in any way as flawed thinking.

I think it’s, it’s free market. That is a free market where people want better control of their cap, their own capital. It’s the capital they worked hard for and they wanna control it. So that’s the good current underlying, you know, ESG. It’s like, you want my money? Tell me what you’re doing. And whether it aligns with my values.

Now the games begin once we have that general virtuous underpinning firms are like, oh, we can monetize that. Like you want information about companies so that you can invest in ways that are concordant with your own values. We will sell you a product. And our product will basically measure how well companies are doing on metrics of value that we establish.

Then we will rank about, we will rank those for you and we’ll put funds together that just bundle them and we’ll decide we’ll, we’ll basically do the hard work for you. And then you can just come along and see ESG fund and put your money there. So that’s where, that’s where the fraud begins. I mean, ESG is like, like full of fraud and misrepresentation and just stupid accounting.

As, you know, Elon Musk point pointed out when Exxon is an ESG company and Tesla is not, you know, the whole thing is a joke. What happened basically is ESG became bullshit metrics. Like the rest of the world we live in. And then people, companies like devote wings of administration and bureaucrats and middle managers to like maximizing those metrics, those ESG metrics.

In, in ways that will bump them up various scales. And that becomes a barrier to entry for small companies. It becomes emote around big companies. It becomes one more kind of like feather in the peacock tail where you’re signaling fitness by doing all this bullshit that doesn’t really add any value.

It, so I, I think the system of ESG is an investing system. It is seriously corrupt and fucked up now. And maybe I can link some sources on that afterwards. You know, the head ESG guy from BlackRock wrote an amazing, massive expose in medium about what it was like to be the ESG guy at BlackRock and how much bullshit it is and how it accomplishes nothing.

And I can simply forward that onto you, but there are many, many such critiques. And so in short, if I can step back I think the underlying impulse for ESG is noble. It is free market. It is bottom up. It is people wanting to control their capital in way, rather than give it to other people who invest it in ways that do not match their own desires and values.

And I can’t imagine anybody fighting that unless you really want opacity and you want central central control. But then ESG is as a product is, is bullshit and fraud that has designed that is designed to part people from their money and basically greenwash stuff that pays to be greenwashed. And so that I Don think is horribly destructive and, and what, what I, what I don’t like that sometimes Bitcoiners do some Bitcoiners do is just use this word, the ESG narrative, when it, for me, it covers both of those things, both the impulse to, you know, spend your money as UC fit’s your freaking money.

And. Also these games on wall street, which then also of course are looping in Washington. It’s not just wall street, but it’s Washington too. Now that the SCC is requiring ESG reporting, they’re going to determine the metrics and values the S C ultimately it’s gonna be the SCC in BlackRock, and then there’s gonna be like tax stuff.

That’s gonna be tied into this. I know it’s so, and uh, you know, so, so it’s, I oppose all of that. I oppose all of the top down impositions of of metrics on the economy. I think that is the quickest way to kill an economy and stifle innovation, you know, is to come, is to have a bunch of bureaucrats in DC.

Come up with arbitrary metrics of value, where we all have different values, you know, ESG is gonna be different for all of us. And they’re gonna come up with bullshit metrics that reflect one set of values in which are gameable and then tie in a bunch of other bureaucracy with it on the tax and reporting front, and then reward people for maxing that out.

I mean, I see disaster lying in that direction, but I do want people to be able to invest in the way that they see fit. And that’s a noble impulse and you know, I, I, I think I, I, I would like to further that end for people if I can. Yeah,

[00:29:53] P: absolutely. I guess one thing that’s interesting to me is the, as you, I think what you’re saying is ESG is just one flavor of a thing.The, the, that it’s one flavor of a thing that you could care about when you’re investing your money. And I guess I’m curious why. There’s the attachment to that specific term, because it feels like it’s been it’s I hear what you’re saying. It feels like it’s been completely co-opted at this point, right?

It, it, it, it stood for something reasonable and noble, which is like free markets. You should be able to do whatever the fuck you want with your money. And it has now been turned into this, this, like, it’s like that you know, in forget which alien movie it was, but one of the last one with Ney Weaver, where she goes into the room and there’s all the clones, you know, and she it’s like, kill me and it’s just like horrible Cronenberg monster.

So like, what is the attachment to the term ESG specifically for

[00:30:43] Troy Cross: you? If there is? Yeah, I mean, I hate the term. I don’t like the term at all. You know, I, I, I think where it starts is like, we had problems that we identify with corporations and corporate basically business ethics. So we have externalities that are not internalized in price.Those are failures of regulation, basically. We have those externalities can be. Harms to a group of people or they can be benefits. Externalities can be positive. And so they, those can be environmental or they can be in terms of what you’re doing for, for society or they can be in terms of corporate governance.

There’s a lot of attention in the two thousands to basically failures of corporate corporate governance structures, where insiders were enriched at the expense of shareholders. And so you can see people saying like, look, what are the ethical failings of business? They’re environmental, they’re social, they’re in governance.

So what if we come up with a fund that rather than trying to fix those failures through regulation allows us to fix those failures through people, putting their money where their mouth is putting their money, where their values is. So that’s how it happens. But as soon as you get farther than that, you say, okay, what kind of corporate governance structure is ethical?

What do you mean social? Uh, What do you mean environmental. Then it’s completely up for grabs and then, and controversial. And I’ve talked to people who are in wall street about this, and, and they’re saying, you know, like there’s no agreement about what these things are, none at all. And so, and it’s always gonna be different for every person.

Exactly. So there’s, there’s really no shortcut to doing your own due diligence or finding what’s going to happen. What I predict is going to happen is that you’re going to have, because the country has fractured socially and politically religiously. I mean, it’s, we are on the verge of like some kind of social civil war.

And so you’re going to have niche funds that reflect the values of people in the niche. And here’s, what’s happened with ESG. We’ve taken a certain niche of culture and we’ve made that we’ve called that ESG. But really it’s like one flavor of ESG that reflects one cultural viewpoint. This is why, I guess I heard last week, there’s like an anti ESG fund that like basically takes the, the, the stocks at the, that do worse on the ESG metrics.

And you can invest in those two and that’s like, step one. But step two is, you know, your politics are gonna be aligned with your investments and you’ll come up with a fund that just services those investments in a way, what we have is like we had the illusion that wall street and politics were independent.

It’s like Reed college has this like de declaration of political neutrality. So we have a, we have a 800 billion endowment, something like that. And we claim to not be political about how we invest that fund. But if you think about a place like Reed that is hyper political, like how long will that political neutrality really hold up, given the hyper political nature of.

Constituents of the institution. Right. And likewise, if you look at something like Liberty university or something on the right, on the right, how long are they gonna keep investing in like woke companies that, you know, go entirely contrary to their right wing values. So you’re gonna see like a right wing kind of investment fund pop up that serves the Hillsdale colleges and the Liberty universities.

And you’re gonna see left wing once pop up and, and that’s fine. That’s free market, but when you call one of them ESG, and then you intertwine it with policy, that’s just not gonna survive because half the population will disagree. That that’s what Accords with their values. They’ll just say, that’s what Accords with your values.

And then it’ll all melt down. Said.

[00:34:31] Q: So. I want to, I want to keep going down this rabbit hole and Troy, if you don’t want to, you’re totally you’re well, within your rights, cursing is loud and you can tell me to fuck right off. Like ESG to your point. Like, I really started paying attention to it in 2020 when I was starting to invest full-time and on one of the publications I followed, they would send out a weekly report of ESG companies.How much did I don’t wanna say? Like COVID necessarily, but the fact that during COVID people were at home, there was a big influx of traders. You can see it based on the volume of trades that was happening at 2020 versus what’s happening today, or even just in 2021. That in fact, the traders were far more active ESG essentially was being shoved down people’s throats to everyone’s point here.

And this is my least favorite part about ESG is the G is governance. And ultimately any company can, if they ignore environmental, if they ignore social. We’re governing the right way. Like Trump, you asked us to tell you if we’re doing it right or wrong. We’re doing it right. You trust us. Cool. So we’re ESG positive social it’s as simple as, oh, we hired head of diversity.

It’s the only person of color in our entire business whatsoever. And she actually makes more than, or she makes less than every other executive at her level. But Hey, we checked that social box. I’m literally calling out my former employer paradigm who did exactly that laid off every single person of color and then hired a diversity specialist as their S for ESG.

Oh my God. Like why do things like social and governance have to get clumped into while I do believe we need to take care of our planet. We should look for ways to be more efficient. Everything that we’re doing. That’s not to say inefficiencies shouldn’t exist, but we should strive to be better. So why the fuck are we clumping in these other two things that have nothing to do with environmental and how damaging is it to, I think just the idea or narrative of finding efficient energy sources under the landscape of

ESG?

[00:36:37] Troy Cross: Yeah, my, my answer is first of all, that’s a great example of the, the, the metrics being gameable. And I, I have a, my problem goes more broadly of, I think we are completely taken with metrics and metrics are always gameable in my, in my book. They can be useful at times, but I think sort of as a middle, as a management philosophy, we’re just taken with metrics and we’re gonna all suffer for that.But you know, I, I, my thinking on this is the person I was thinking of before, who was at BlackRock is Terre fancy, and it’s shaped by Terre fan’s writings. It, it, the reason why ESGs being pushed on your throat right now is money it’s because it’s the fastest growing segment in finance.

It’s it’s because the, the world of finance was like, okay, we did, like, we invented all these derivatives, what do we do now? We have this market. We’re not serving very well. We, we deliver products for them. And then we, we profit, like we can charge a premium for the SG stuff. So, I think that’s, what’s driving it.

It’s simple. They did the market research. And then of course, they’re also creating the market with advertisement and then it becomes a thing. It becomes a thing, you know, like, are USG investing. It’s basically a social virus that has caught on and they help to create that virus, but they’re also riding it.

Everybody wants in on it. So it’s like when, you know, in 2017, when and I guess it happened again, when people started doing blockchain stuff, you just put blockchain in front of the name of any company and suddenly the multiples just like explode. And it’s the same right now. You just put ESG next to some fund and it just draws capital.

So I, I, I have a crude and simple explanation of what’s going on here. I don’t think it’s a conspiracy, it’s a convenient match between market possibility and a certain ideology. And it’s like, okay, perfect. We can exploit this and whip it up further. And that, that whole thing grosses me. I have to say, and you know, your title is the SG and attack on Bitcoin.

That cultural nexus of top down control dictating values, shaming people into certain kinds of investments is an attack on Bitcoin in the sense that Bitcoin is bottom up individual choice. It’s, it’s, it’s freedom money, right? So I, and, and also they’re gonna design their metrics in a way that Bitcoin’s gonna come out badly.

They’re already doing that. I think that’s what the federal government is doing right now. I think that’s what the white house is doing right now. They’re coming up with metrics for cryptocurrencies and they’re making, they’re going to come up with metrics that measure like, you know, energy per transaction or whatever.

And they’re going to design those metrics in a way that Bitcoin sucks despite it, you know, but despite it maxing out on the social and the governance and in my view, even on the environment, And energy, despite that they will come up with metrics that are stupid because they don’t understand Bitcoin and intentionally designed exactly to, to, to make it suck on their metric.

And we’ll try to explain otherwise, but it won’t matter because we’re gonna be in front of ESG boards at pension funds at sovereign wealth funds. And they’re gonna say, yeah, and I say, this they’re going to, I mean, this is already what it is. Bitcoin is not ESG friendly. We can’t invest in that. How many times have I heard people talk to me and say, I can’t invest in Bitcoin because it’s not ESG.

Our firm can’t touch Bitcoin. We can’t even write emails about Bitcoin internally because it’s not ESG friendly. I heard this from like solar, a solar developer, like who wanted to start like a, a, a black op site or a program within the company where they would discuss cryptocurrencies in Bitcoin.

Somebody wrote back saying our company cannot be involved in Bitcoin in any way because of ES ESG concerns. Like even this email, I’m going to delete it. Please don’t email me again. and like, that’s the kind of weird, that’s the kind of weird blowback we’re gonna get. That’s gonna be institutionalized, shitty metrics.

so we ha we have to fight it. It’s so infuriating

don’t you love when people who know absolutely nothing about technology or just the topic at hand are the ones who get to decide what rules and ways to analyze the data of the topic that they know nothing about. But I think, oh yeah, I mean that’s bad, but I think worse is when people know enough to understand what Bitcoin is.

Cause as we’re talking about Bitcoin, and as Troy said, they are intentionally crafting these metrics, such a, in such a way that they will be. They will anchor into the existing kind of like social and moral bullshit that people have been forced fed. And then they sort of have to say no, because otherwise you’re a terrible person and your, your personal

identity doesn’t support.

It it’s even, there’s the identity part. Yes. But it’s, it’s, it’s it’s worse because the federal government has now said, you know, you can’t work on any cryptocurrency you own. So they’ve made that a policy. Oh my God. I know. So, so you know, the people coming up with the, the ESG metrics for Bitcoin are guaranteed not to own any.

And I don’t, I don’t know about you guys, but when I owned Bitcoin is when I really started studying hard because skin in the game and suddenly like your motivation is off the charts. Like, am I an idiot? Am I in a cult? Is this stupid? Does it have a chance you start like the whole game changes when you own it.

And so for me, the, to have the entire federal government writing meant writing policy for. But guaranteed. None of the people in the government who own it are doing that writing. I’m like oh, I just, I’m just bracing for the worst, you know, and I have to pair this cuz you know, this is all gloom and doom and I have to pair this with, I should say, I’m talking to people in, in companies every day in industry and in, in, in the industry spans, you know, the power industry, utilities, power generators, grid operators people building on Bitcoin and software people building on Bitcoin and you know, mining and landfills doing flare gas mining.

And, and when I talk to people across this industry, I mean, I am so amazingly bullish on Bitcoin’s integration with the energy future and its acceleration of a future that I want my kids and grandkids to have. Bitcoin makes me really optimistic about a subject that I was very pessimistic about, which is the future of the environment.

And so on the one hand, I’m really pessimistic about the bullshit that is going to rain down on us from the top, both from the top of wall street and the top of Washington and the top of Brussels at the ECB and I, and, and at the same time, I’m super bullish on Bitcoin itself, Bitcoin and energy.

It’s just a question of like where and when and how these innovations happen, but the incentive structure for integrating Bitcoin with an. With a, a sustainable and plentiful and abundant energy future that the incentive structure is just too good. It cannot be held back for very long by central authorities.

I wanna

[00:43:42] Q: maybe try to unpack a little bit of this, our producer, Chris, throughout a pretty legitimate question. Although I think we’re assuming Senator loves holds Bitcoin. But like how much of an inhibitor is this policy that you can’t hold a cryptocurrency that you’re working on, on something like lava’s billLama is bill.

[00:44:02] Troy Cross: Like what? Lumus does hold Bitcoin and she’s declared exactly how much she holds and how she got it from her son. And she’s told the whole story. I think she had five Bitcoin, but she’s recently purchased more if I remember. Right. So Lamas is a, a Bitcoin who hold, who huddles and. You know, I think I, it doesn’t affect her.This rule is for the Biden administration. It’s an executive branch restriction, right? So it’s, it’s, the Biden has taken a whole of government approach and I’m pessimistic, but I shouldn’t be too pessimistic. Look, there are a lot of smart people in government. We at the Bitcoin policy Institute where I work, you know, we wrote our response responses to their call for for inform, for information, their request for information as a part of the executive order.

And you know, other Bitcoiners did too. We might get through to some of them. We have the truth on our side. We have good arguments on our side and, and there’s some dedicated and bright people working in government. And so I, I, I shouldn’t be super pessimistic , but it’s just It’s also about where the money is, where, where is money flowing in into the system and who gets an audience who gets an audience with the Biden administration?

Where, what meetings I have seen. It’s like, you know, you’ll have eight representatives from the crypto industry. None of them are Bitcoin companies. Every one of them is a, is a shit going company. And why, why is that? Because they are all companies because their, their tokens and chains are not protocols and commodities.

They are disguised securities, but that also means that they have organized centralized representation with like any other like any other industry. Right. Whereas Bitcoin, we’re like a decentralized mob. And although there are companies that build on Bitcoin, there is no CEO of Bitcoin. Although, you know, lawmakers have asked to speak with that person, the CEO of Bitcoin, right.

We don’t have one. I mean, I, I, I, I have to temper my pessimism. There are bright people there. It’s just that the system is not set up to think clearly about a decentralized protocol and an asset that lives on that protocol. It is set up to hear industries and when it comes to that, it’s amazing that, you know, what, what, what is whatever 40, some percent of all value on crypto assets doesn’t really have a seat at the table in my view, in, in these, in these things.

And nobody owns it within the administration and we’re guaranteed to that. So we’re relying on these bureaucrats to. Read carefully what we write at DPI and, and other places and, and, and to be, be smart and appreciate the arguments, but I’m, you know, it’s hard to be optimistic on that front. The legislature is a completely different deal.

You know, Bitcoiners have done a good job of reaching out to legislators and starting to educate them and starting to build relationships. We have a long way to go on that front. But we are, we are catching up and clearly, yeah, we, when you hear Ted Cruz talk about Bitcoin, it’s like, wow, this guy and Bitcoin and energy, I’m not a Ted Cruz fan in general, but when I heard him talking about Bitcoin and energy, I was like, oh my God, he’s amazing.

He gets it. He gets it as well as anyone. This is phenomenal. So I, I have much more hope about the legislative branch than I do the executive branch.

I like that. I wanna unpack this though, because I have this debate. I was genuinely having this debate before you even came on about the validity of some of these politicians who make claims and statements about Bitcoin.

I think the perfect example of this is Eric Adams comes out and says, while he’s running for mayor of New York, I’ll take my first paycheck in Bitcoin, not even a week later, actually I’m gonna split it between Bitcoin and Ethereum. And then fast forward to the legislation that we saw in New York state pass and someone who’s claimed to be pro Bitcoin, who claimed to be pro crypto was awfully quiet.

I’m not shy about saying this. I think Ted Cruz is the scum of the earth. I think he is very quickly just latched onto the next thing. That’ll keep him in an office for one more term. And he’ll just as quickly take the other side of the argument if it serves his benefit. So my question is why do we even care about politicians getting involved in Bitcoin?

In theory like China, Bann Bitcoin mining, trying to ban transacting of Bitcoin. There’s still transactions of Bitcoin happening in China of all places. Do we genuinely believe that Bitcoin would just stop to exist in America? Let alone the world if no, shut up Troy’s opinion. I mean, no one’s saying that Troy’s mute him.

Someone mute him. Jesus, Troy. I’m kidding. Go ahead, Pete. No, go ahead. I was gonna say like, like, no, one’s even suggesting that cue it’s it’s I think it’s, this is the wrong term, but like almost like a false dichotomy, right? It’s not about like, yes, Bitcoin, as Troy said earlier, the, and I, I said so many times in the show that.

The thing that’s so compelling about Bitcoin is the incentive structures that are in place, right? It, the things that are the best for the network, or sorry for the individual are also extremely supportive of the larger network most of the time. And so you can’t suppress something that has incentives that are that effective.

There will, to your point, there will always be kind of people on the margins who are becoming larger and larger you know, and then eventually become the majority. And I just, but, but having said that the, you know, we are United States citizens, and if the United States comes down against Bitcoin in, in a significant way, that will make our lives far more difficult.

Right. You don’t have to like ban Bitcoin if you just create crazy, is it a random example, like tax structures around it, right. Or, or laws around it. And so it’s important because it really is this game changing technology and. We wanna, we wanna be driving forward towards this hyper Bitcoin ice world as rapidly as possible.

Not, you know, mire in the, in the mud.

That’d be my thought try. Yeah. That’s that’s really well said. And I, of course TikTok next block and you know, China, what’s interesting about it is Cambridge is now showing 20% of all rate is in China. I mean, 20% of all hash rate and it’s illegal to mine there that’s phenomenal how much money is, is held in China in Bitcoin and is being used to circumvent capital controls.

I would guess a lot. I, I, it’s just amazing and yes, Bitcoin will, will survive, but I actually think that why we are so far behind the ball, a lot of it has to do with the attitude that government doesn’t matter. And we’ll just do our thing. That’s why we haven’t put the energy into communicating, educating and building relationships with lawmakers.

You know, it’s because we’re like, ah, screw them. You know, we’ll just like, it’s cipher. Punk’s right code. And we’ll, that’s what we’ll do. We’ll build an independent system. But when everybody’s thinking like that, nobody talks to the lawmakers, but guess who is talking to the lawmakers shit, pointers, shit, pointers are all up in, up in their offices and they get to spin the narrative.

If you don’t control your own narrative, they do. Okay. Why do we care? Just as you said you know, I don’t just want Bitcoin to succeed. I want it to succeed here and now I, I don’t, I don’t want it to like, yeah, there’s a part of me. That’s like, you know, I went to the Oslo freedom forum this year and I was kind of like, yeah, let, let Bitcoin grow from Nigeria, from the Central African Republic, from El Salvador, from Guatemala, from Panama, you know, let it happen there.

And. And then let there be a collapse of this Fiat system in a massive debt bubble. And the weirdly these nonaligned states emerge as global finance leaders in El Salvador, you know, or whatever, like El Salvador is the new Singapore or whatever, you know, there’s a part of me. That’s like, yeah, that would be cool.

But I live here and I want it to happen here and I want it to happen fast. And I, I mean to think about it, Bitcoin is our bid for freedom money. It is our chance to empower the many, rather than the few, our current system empowers a few central bankers, the 1% of the wealthy people in, in positions to make, make decisions about money, get the reward it’s skin tell in effect.

Okay. I’m not telling you anything. You don’t know Bitcoin fixes this. But, but think about these alternative histories, the one where we actually in the next. Six years, educate people about Bitcoin, both making policy and in the world of finance and people at large, the citizenry who will elect those politicians and we get them fired up and we get them to see what free and, and neutral and fair money could do for them.

That’s one, that’s the one history, right, right here in America. And the other history is where the shit corners have their say and they win the political battle and they win the financial battle. And we con we get the rhetoric of freedom, but we get the reality of continued financial servitude, where instead of the central bankers, it’s fatal and friends, you know, instead of the central bankers, it’s the VCs in Silicon valley behind Solana.

And you know, it’s PO it is polygon and whatever it, you know what I mean? I, and then we suffer through that while eventually people come to see, oh, this is also centralized and unfair. Oh, this is a Ponzi and maybe it collapses or maybe it gets captured by the state. And then we’re like, oh, we’re right back where we began.

Of course, Bitcoin is ticking along this whole time. But as a marginal player at most taking the market cap of gold, rather than serving as a global monetary asset, a global reserve asset accessible to everyone in which functions as a savings device for everyone. Instead people get fooled into this alternate reality and we have decades to sort it out.

I want path one rather than path two. And so that means I have to act right now to, to do my best, to bring that reality about, I mean, I think, you know, the slogan of Bitcoin is inevitable to me. I don’t like the slogan. it’s like, I agree. It’s, it’s, it’s an excuse for laziness to me. It’s. Who who is, what does it mean for Bitcoin to succeed?

It means each individual makes individual decisions to adopt it. Okay. It’s one by one person by person by person Bitcoin doesn’t adopt itself. It doesn’t adopt itself. We adopt it. Right? So every one of these conversations we have, like, yeah. Ultimately Bitcoin’s about supply and demand. It’s value is it’s the point where supply and demand meet those curves cross that’s where price is.

Okay. So Bitcoin’s protocol covers the demand, the supply side, it’s, you know, 900 new Bitcoin a day for the next two years and then drops to four 50 and so on. But the demand side is human psych. It’s human psychology. Now, of course, that psychology is informed by Bitcoin’s principles. And Bitcoin has great principles that are attractive to human psychology, like 21 million hard cap.

That’s attractive to us. So it’s not just psychology. It’s not, we’re not an N we’re not an NFT land here. Exactly where the value is just arbitrary. It’s not arbitrary. It’s grounded in the properties of Bitcoin, but that grounding in the properties of Bitcoin is mediated by the, the, the psychological, social, political, human individual lens through which we perceive those properties, the properties do not just automatically lead to investment.

And it’s up to each one of us to communi. Those, those properties to the, to the people we love, you know, our friends and even our enemies, Bitcoin is awesome. It’s in the structure. Like this is like, I’m happy if my enemies adopt Bitcoin. Right? Cause it’s like leads to adoption. So I, I, yeah, I think Bitcoin will keep going to, it’s not, and, and where it succeeds is all we can control rather than whether it succeeds, but, you know, yeah.

The pace at which it succeeds and the alternative realities that are before us are wildly different. And I think we seize our own agency. Bitcoin to me is really empowering as an individual, the, the monetary system that I grew up in and I’ve lived my entire life in, does not give a shit about me. I am not one of its inputs.

I have no say in how it goes, whether it will be, I mean, I have no say in it whatsoever. I am stuck with it. I pay my taxes in it. I get paid in it. I do not make monetary policy decisions. You know, the, the Jerome Paul makes ’em, so Bitcoin is new. I get to run my own node. I get to mine the way I wanna mine.

And I can convince other people to opt into this system in some way, or other allocate, a little bit, run a node, you know, do some mining and I can shape the future of money. I can shape the future of finance. Like that is, that is incredibly empowering. Human beings have never been able to do this before on mass in scale, most human beings have not had a part of this decision to spend the priests, the high priests of money and whoever that was, whether it was bankers or before that were literal priests or Kings.

Those are the people who made that decision. Now, everybody has that chance that I, I feel like that is, what’s so great about Bitcoin and I’m just gonna take it and run with it. You know what I mean? I’m gonna devote my life to furthering, furthering this end that I want, because I can actually.

Potentially help it to happen faster and here rather than not as much. Right. So I, okay. That was a very, very long answer, but I keep running into this and I feel like Bitcoiners are onto a really deep truth when they say Bitcoin is inevitable. But I also feel like, especially in a bull market, it’s easy to kick back when that’s happening.

And you’re just like, oh, all I have to do is huddle. Bitcoin will just take care of itself. It’s inevitable. It’s like, no, get off your ass and talk to people. You know, think it through you, you you’re, you’re now a citizen in the Republic of money in the Republic of Bitcoin. And you know, like you have the rights and responsibilities of a citizen which means you get a vote with your node.

You know, you decide which software to run. I, Andrew Bailey and I wrote a paper in, in we wrote a piece in, in CoinDesk called mind your values. And it’s just basically this whole message of like, Bitcoin gives you a way to exercise your power and. No, that’s, what’s awesome about it, but also like step up and do it.

[00:58:27] Q: So if you could just name one person and I’ll let you cheat and possibly name more than one, but who is the ultimate villain against Bitcoin? After all this conversation, we talked the ESG side of it. We talked the political side, we’ve talked the idiot shit corners, who in your opinion is truly the Thanos to Bitcoin’s Avengers. [00:58:50] Troy Cross: I’m gonna be going to this conference in a few days with him, but I gotta say it’s Alex Dre. I do because it’s like the origin story of the FUD traces back to him. So he’s not, when I look at what he’s done, it is so impressive. He’s somebody who, you know, he had a hobby website called doge economist.He started thinking about the carbon footprint of Bitcoin. He came up with these kind of bullshit metrics. Publishing it, he wrote a couple papers. He had a master’s degree in economics. He went to work for a central bank. The next thing I know, okay. His article influences Camilla Mora to write this piece that gets published in nature.

Climate change. They cite Alex Dre, everybody cites Alex Dre. He’s he’s the, the earth source in every in every paper on Bitcoin’s emissions. He stepped into that space and he’s just repeatedly dishonest, fundamentally dishonest about how he presents data. And it took me a long time to figure that out.

I’m an academic. I presume that people are honest. I presume that when I show them inconsistencies, they’ll be like, oh, I’m sorry about that. I’ll fix it. But that was not his response. It was just like double down at every, at every stage. So he’s responsible for the famous infamous Energy per transaction, stat emissions per transaction stat.

He keeps talking about the cost of a transaction in Bitcoin and dividing the total energy use of Bitcoin by the number of transactions. And that stat has appeared everywhere. It makes a sense. Yeah, it makes zero sense at all. For a thousand reasons I can take it. But it lodged in the popular imagination.

Two months of household energy use for one transaction in Bitcoin. That’s horrible. Who wants to do that? I mean, who’s like your tire electric bill or, or three months or whatever Elizabeth Warren is saying. Now it’s always varying, you know, and it’s ridiculous because of course you pay like a dollar at most for a, for a transaction right now.

And how can you buy two months worth of power with a dollar? How is this even happening? And that’s because, you know, that’s not transaction fees, that’s the block reward. And we have layer twos that are taking our volume. And so when it comes to layer twos, for instance, here’s a part of dishonesty of Alex you know, the lightning network, he mentions it, he mentions it in some of his papers like, oh, he actually mentions like, oh, maybe the lightning network will develop someday.

And if it develops, then the, you know, use per transaction, the carbon per transaction, the electrical use per transaction will go down. Here we go, we get the lightning, it comes along. And what does he say? He says, oh, there aren’t really Bitcoin transactions. So I won’t include them in the stat. Also. We don’t really know how many of them are happening.

And then he is like, but what we should include is the additional power that those lightning notes are consuming. Oh, for fuck sake. Right. So, so he, so he, he wants to add that on top so you can see what I mean. It’s like this throughout everything he writes. Yeah. I mean, here’s another example of dishonesty.

So he writes this paper again. He does the dividing by transaction. He writes this paper on e-waste in Bitcoin and he argues that we are filling, filling landfills with e-waste He, he argues that a single Bitcoin transaction is equivalent to binning two iPhones. That’s how it gets two iPhones worth of e-waste for every single transaction in Bitcoin.

Right. And you look into his paper and I mean, Nick Carter did the, the greatest breakdown of this paper. It was awesome and hilarious, but he estimates the life of a minor to be like 1.2, nine years, something like that. 1.3 years. And you know, there are S nine S there’s still 5% of the network, even with the latest stuff coming out.

And at the time he wrote it, they were 20% of the network. Yeah. And S nines were at that point, you know, five and a half years old. So you could just go onto eBay and look up S nine S and see them all listed. You can’t find anything for cheaper than you couldn’t find anything for cheaper for 300 bucks at the time he was writing that paper.

So this thing is supposedly we’ve been through like three life cycles of minors. and you could, you still have to pay really good money to, to get one of these S nine S yeah. You know, just totally inexcusable. And he’s got this very, very fancy model mathematical model for determining the lifespan of minors.

He could have just checked eBay. You know, another thing he could have just checked is the filings S sec filings of minors themselves, because they have to write down their depreciation for minors. And if their minors were going out of of, of profitability in 1.3 years, they would’ve said that, right.

Because that a racism income for them, you know, and then, then the truth is even, I think even when, like with the S nine S even when their profitability goes negative, Which they’re they’re getting there, we’re getting close. They’re gonna slot it to this awesome role that he refuses to acknowledge of absorbing excess energy.

Your sine doesn’t have to be profitable rather than throwing it into a landfill. You just keep it there. And when you put it behind meter at a wind farm, and when prices go negative, you turn it on and you turn it off. When prices go back positive again, right? Or you use it for waste heat, or you just wait for the Bitcoin price to explode again, because it’s basically an option on future Bitcoin.

So there’s the, you know, the idea that you’re ending up in landfills on the basis of this bullshit model. And then it was every major newspaper around the freaking world. It was time magazine. It was Newsweek. It was the magazines. It was the guardian two iPhones bend per transaction. EWAS blah, blah, blah.

And then it appears in the letter from 70 environmental organizations to Congress, then it appears in Senator Elizabeth Warrens. Literature, then it appears in like Jared Hoffman’s letter to the EPA. It’s just like, it, it, it goes, it, it spreads like wildfire because it started in a peer reviewed journal.

yep. Right. So how is this guy? Not the super villain. It’s the ultimate source of misinformation, which then, you know, the idea that, you know, the, the idea that Bitcoin bros are filling landfills with e-waste one, at one point people measured the e-waste in grand pianos. I mean, there was different like creative ways to measure it.

When I, I, you know, when the actual percentage of EWAS due to Bitcoin, it’s like, it’s less than one, 10000th of e-waste less than one 10,000. It’s basically nothing because almost every ASIC that’s ever been designed, you know, it still makes sense to hold . So it’s, it’s basically, it’s hard to even estimate how much.

But because it’s so low, but anyway, that’s, that’s Dre and he’s on a campaign. And now his buddies also have an ESG style way of measuring. They have a firm that measures you know, the, the environmental footprint of various cryptocurrencies per transaction and overall, and he is pushing that business on the European union and on businesses in Europe who want to invest in ESG conscious ways.

So he’s the person inventing these bullshit metrics that will be taken up by governments, banks, and investment firms. He’s the one who’s hand feeding it to them.

[01:05:38] P: All right. I’m changing the title to Alex. Dre is a liar and a hack. [01:05:43] Troy Cross: Sounds good. Now, now I’m gonna have dinner with him in a few days. [01:05:47] Q: I honestly, I wanna send him ti Andrea, please clip this segment and we’re gonna go ahead and DM that to Alex, just so that that dinner can be as spicy as possible.Oh,

[01:05:58] P: God he’s the keynote, right? He’s the keynote speaker at this conference. It it’s a, it’s in Paris. It’s a, it’s on the sustainable blockchain stuff. And you know, my message is gonna be proof of work is valuable and it’s like nothing else. You know, can’t reap, replicate it with proof of stake, proof of stake.Doesn’t do the same thing. Doesn’t offer the same security, but more importantly, it’s just a completely different model that centralizes wealth over time when you offer people return on money for having money, especially if you’re claiming deflationary status, what do you think that money’s gonna be like, oh, I suppose you have just a pot of money and the people who have the most of it right now get interest on it and it’s deflationary.

So that pot isn’t growing. What does that distribution look like over time? That it just hyper concentrates wealth and control in the hands of a few people. It’s a completely different thing. So my message is gonna be, you know, proof of stake does something completely different than Bitcoin proof of work is worthwhile.

But my message is also going to be that Bitcoin mining is potentially powerful for catalyzing an abundant and green energy future. And I’ll try to make the case. I’ll try to explain exactly how that’s the case. If they let me talk.

Oh man. I hope they do that. Sounds fucking awesome. Can you give us like a little bit of a, a teaser without spoiling the big points?

Do you mind maybe. Figure this like an audition. This is the casting

[01:07:25] Troy Cross: room. Sure, sure. P and I, and casting factors. 1, 1, 1 thing Bitcoin does is the number one threat to the climate right now. The number one warming gas is methane, not CO2 C four is methane it traps heat in the atmosphere. 80 times as much as CO2 over a hundred year period.And, you know, whatever, something like 30 times as much over a 20, 25 year period. What am I saying? I got that backwards. okay. It’s many, many multiples of CO2 in its, in its ability to trap heat. And it’s responsible for up to one third of all warming right now. And it’s also methane is also vastly.

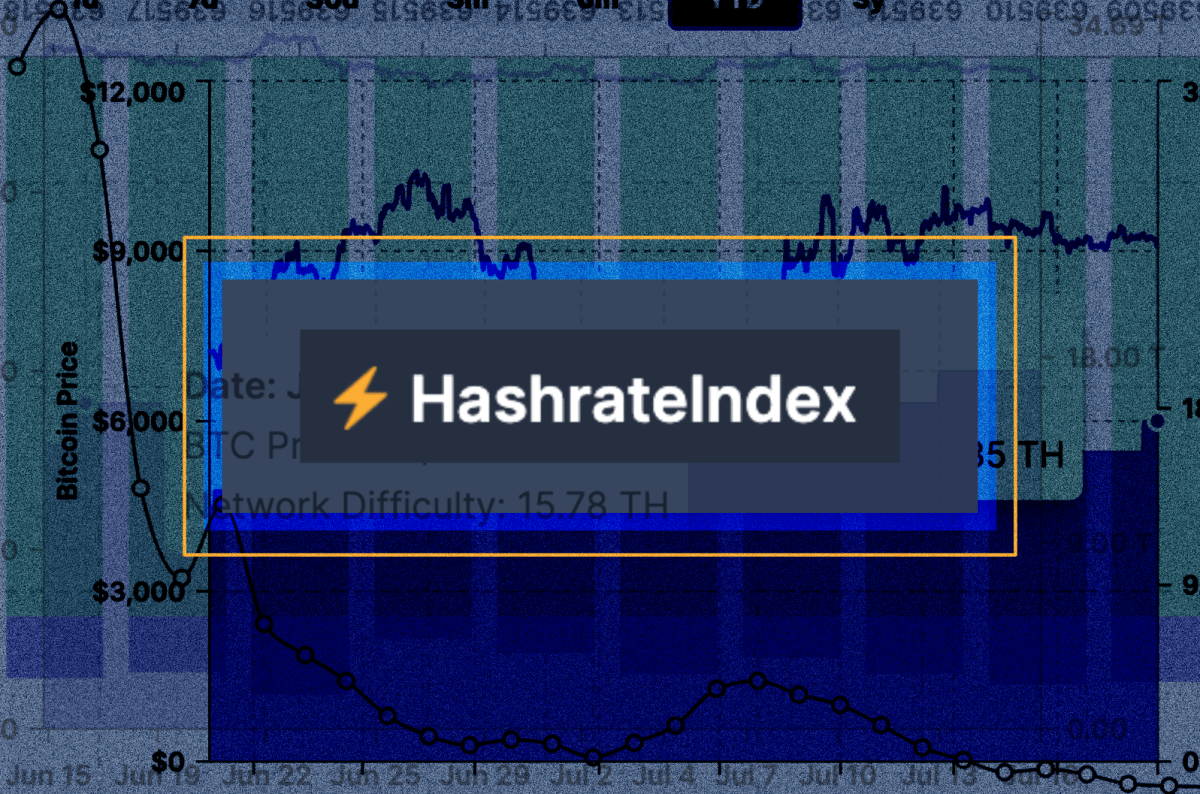

More than we have thought it was. So we keep like measuring methane with satellites and finding out it’s more severe. And basically Bitcoin mining is the only global bottom up monetized incentivized way to clean up methane. Bitcoin mins are parked next to oil Wells that have natural gas as a byproduct and they can burn those off and turn them efficiently into CO2 and that’s happening around the world.

But also landfills emit tremendous amounts of methane. I’m working with company vest, spoon which is mining exclusively on landfill gases. And there’s 2,600 landfills just in America, you know, put when you’re, when your trash decompos, it releases methane. And some met landfills are capturing that methane and generating electricity and putting it to the grid.

Most, the vast majority are not. And so Bitcoin helps to capture that gas and turn it into, to, to CO2 in a really clean and efficient way. But I like this idea, actually, that we look for methane leaks and where the methane is coming from from agriculture wastewater treatment facilities, landfills, gas, oil, and gas, byproducts, oil, and gas leaks.

We can see it from space and like we can produce these heat maps where we see where the methane is coming from roughly. And we can send in Bitcoin miners, like fire jumpers, you know, that’s basically methane is energy. It’s money. We can monetize it. And there’s nothing else that will do this job. So yeah, the number one threat to the climate is methane Bitcoin fixes it.

But also Bitcoin precisely Bitcoin solves the main problems facing renewable development, renewable energy today, and nuclear for that matter. The inflexible sources of load, the great thing about gas and coal is that they’re adjustable. You know, you can, you can adjust a gas turbine plant very easily by consuming more gas and general electricity, or turn it down, consume less gas and less, less electricity.

Solar. You just get whatever the sun is giving you wind, you get whatever the wind is giving you. And nuclear, it likes to pump out at a very, very steady pace. So the actual demand of the grid has to be met precisely with the supply of the system. And those are mismatched and. The upshot of that mismatch is that we end up curtailing a lot of renewable and even nuclear power curtailing means we just waste it.

We don’t send it to the grid and we have end up having a lot of negatively priced energy on the grid at various times of day and times of year. And that slows the build out of new energy because that negatively priced and wasted energy is not creating revenue for the people building power plants.

And so their Bo their balance sheet doesn’t look as good. And by monetizing that waste energy and providing a buyer of it, which Bitcoin mins can be, we find we make it financially viable to build out new energy plants. And the other main thing standing in the way of renewables is interconnection wait times when you wanna build a renewable plant.

It’s not just that it’s unclear what your buyer will be and what time of day on the grid, but it’s also not clear that you will get connected to the grid. The wait times vary. I just saw in Ireland, there was a 10 year wait time to get connected to the grid. So how are they gonna build new power plants there?

It takes 10 years to get interconnection where that’s, where that’s your buyer of power. So who’s gonna finance that and California there’s a several year wait to get connected. So Bitcoin fixes this too, by providing a buyer prior to full grid connection. Bitcoin can take the power off those generators in the meantime.

And then once the interconnection is made, the miners move elsewhere, most of them and the power plant now feeds the grid. So I, yeah, I’m working with different kinds of developers of renewable energy who all appreciate and see this at some level or other because they’re all facing the problem of what’s called solar deflation.

As you get more and more solar on the grid, you have more and more power at certain times of day when the sun is shining brightly and that power is less needed. And so Bitcoin mins can mine with that power and provide financial value for that excess power, which allows you to overbuild a system with renewables, which then can become a robust system like you underbid with renewables.

You know, and then you have a, a lag and sun and wind. You, you might not have any power on the grid if you, if you overbuild and the amount you have to overbuild by is estimated differently in different places and by different people. But if you overbuild renewable capacity, then you’ll have less risk of not meeting power demands.

So basically as the grid gets to be high penetration, renewable. It’s good for the atmosphere. It’s very bad for the grid. It it’s inter intermittent and Bitcoin fixes the problems mostly financially by providing a buyer for power that didn’t have a buyer and making these projects financially viable.

And we just, just like a subsidy, just like a government subsidy, basically, except it’s not a government substance, you know, Joe mansion like killed off the, the energy portion of Biden’s bill. And it’s like, okay, you know, Bitcoin doesn’t need Joe mansion. It can do the same thing just privately and it will do it efficiently.

Right. It won’t do it for power projects that don’t make sense. It’s not gonna be, you know, solar in the Arctic circle. It’s it’s, it’s going to be the free market finding. Think of it this way, Bitcoin puts a floor under energy prices worldwide because it’s location agnostic because it’s time agnostic.

It produces the same amount of Bitcoin from the same amount of energy, anywhere at any time, anywhere in the world with an internet connection, that means Bitcoin will seek out the cheapest energy worldwide and monetize it. Right? So if you can find cheaper energy somewhere, ah, Bitcoin will just flow there.

And that’s going to be, not only is it going to accelerate the build out of renewable, which right now is the cheapest power. Solar’s the cheapest power right now. But it’s going to do it in an efficient way, unlike subsidies, which are gonna be subject to politics. Anyway, how’s that for an answer.

[01:14:19] Q: If I could find the unmute, I would’ve said that was beautifully put, and honestly, I just needed to know where I can watch the full conversation when it happens. Troy. [01:14:25] Troy Cross: Thank you. And I mean, this is all stuff that Bitcoin does automatically. I mean, I have my own idea about how to, if you’re an ESG conscious investor and you and you are concerned about the carbon footprint of Bitcoin, how you can hold Bitcoin in a completely carbon neutral way simply by mining some Bitcoin as well alongside your holdings.That’s the idea that brought me into this space a year ago. And basically the idea is if you own X percent of all Bitcoin do X percent of mining in a, in a very low carbon way. If you own 1% of all Bitcoin do 1% of all mining. And when you mine, Bitcoin, you increase the difficulty for all other mins, because you find blocks sooner than 10 minutes.

And then the difficulty adjustment brings us back to 10 minutes by making it harder. So that’s a disincentive to all other minors. When you buy Bitcoin, you give an incentive to all their miners because you make their Bitcoin worth more. You make their block reward worth more. So if you can bring these two incentives into balance, one is an incentive to mine, and one is an incentive not to mine.

Then you’ll, you won’t be giving any incentives to other Bitcoin miners anywhere in the world, either positive or negative. And so your carbon footprint will be equal to the carbon footprint of your own mining and none, no other mining. And that product is something I’m trying to develop. I’m working with a number of firms.

There’s, it’s hard to bring a real product to market. I’m a philosopher. You know, I, I like deal in the realm of ideas. Real products are different but I hope to have you know, an ETP or an ETF that’s available to plebs and to institutional investors. So I can walk into the ESG board instead of having educate them from the ground up about Bitcoin and how it’s gonna transform our energy future.

Just. Here’s a way to do it, just buy this, this thing, which is like G B TC, except it also has a tiny, tiny percentage of it is devoted to mining either like mining on landfills or mining in micro grid installations across the global south, you know, there’s like a billion people who don’t have access to electricity.

How would you like to buy some hash rate that actually helps monetize the build out of those microgrids for the global south talk about ESG? Like that’s an amazing story. I would, I’d love to be a part of, and I’d love to give Bitcoiners or actually my audience isn’t really Bitcoiners. It’s pre pointers.

I’d love to give pre pointers access to a way to hold Bitcoin. That is provably carbon neutral and which is 99.5% Bitcoin and 5.5% Bitcoin mining.