Bitcoin Investment In 2021: What Should We Expect?

The bitcoin price has surged about 300 percent over the last 12 months thanks to mainstream adoption and institutional interest. It has rallied massively to surpassing all-time highs of $41,000. At the time of this writing, the price is hovering around $35,000 and it will be interesting to watch traders’ reactions and price behavior for the rest of 2021.

The Bull Run Will Likely Continue

Bitcoin’s bull cycle will likely continue, especially in the second half of 2021. One of the causes of price increase will be widespread adoption. Currently, relatively few people accept and use Bitcoin in everyday life. However, we could see mainstream acceptance in the coming months. For instance, PayPal has allowed its users to buy and sell bitcoin using PayPal accounts. Also, Square invested $50 million in bitcoin. Ongoing mainstream adoption like this could boost bitcoin’s price significantly.

The liquidity in bitcoin has been a telltale sign that more institutional bodies are at play. Similarly, throughout 2021 the institutional interest is expected to drive the prices of bitcoin and other cryptocurrencies.

In another sign of the mainstream growth of cryptocurrencies expected in 2021, major cryptocurrency exchange Coinbase is expected to become a publicly-listed company this year. The exchange’s institutional assets increased from $6 billion to a whopping $20 billion between April and November of 2020.

Caused by the U.S. dollar’s cyclical bear market and global liquidity, bitcoin will benefit significantly from people hedging against inflation. Many retail traders will also jump in due to the fear of missing out (FOMO), pushing the price further. Traders who will not want to invest directly in bitcoin will trade contracts for difference (CFDs) on bitcoin via forex brokers and trading platforms.

Institutional Interest

As mentioned above, in October 2020, PayPal announced that it would support buying and selling cryptocurrency. Also, other Institutions and Wall Street giants have shown interest in cryptocurrency. For instance, JPMorgan Chase & Co. and Citibank are predicting a bullish bitcoin market. According to a leaked report from Citibank, the analysts refer to bitcoin as 21st century gold predicting that it could hit $318,000 by the end of 2021. Likewise, Will Woo, a former partner at Adaptive Capital, has referred to $200,000 as a conservative price.

A note to institutional clients from Tom Fitzpatrick, the global head of CITIFX, leaked on Twitter. The note showed a chart of three bitcoin bulls in the last decade. He suggested that the bitcoin rally could hit a peak of $318,000 in December 2021. However, other analysts such as BTIG and Bloomberg have been more conservative, predicting the price will reach $50,000.

Fiat Fiscal And Monetary Policies

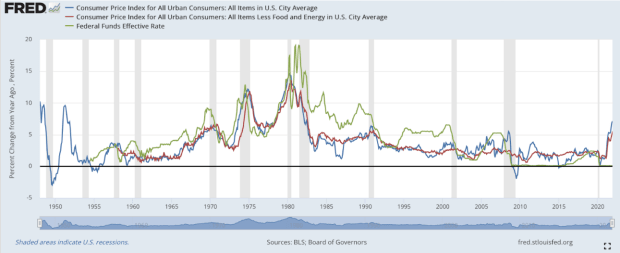

Fiscal policy and monetary policies aiming to devalue currency will work in favor of the bitcoin price. Much of the demand will come from investors who fear that the money printing will devalue conventional money. With fiat money growing out of control, bitcoin is seen as a fixed asset, just like gold.

Besides a weak monetary policy, the dollar could also be affected massively by the COVID-19 vaccine rollout. For these reasons, the demand for bitcoin might increase significantly.

Pullback Could Happen

While cryptocurrency proponents are exuberant, there is a possibility that bitcoin prices won’t rise beyond the all-time high set in 2020. In fact, the price may fall back and remain below this mark for some time, as was the case during the 2017 rally. Some believe that the only time bitcoin is likely to reach another significant high is in 2024, following the next mining subsidy halving.

Bitcoin’s popularity as digital gold is spreading fast. However, unlike gold, bitcoin is experiencing its first global crisis, caused by COVID-19, as it was born in 2009 following the 2008 financial recession. The 2020 bear run in the market saw investors sell equities for cash. Even gold, which is considered by many to be a safer investment than bitcoin, dipped in March. Bitcoin crashed hard in mid-March too, but the bitcoin case was different. The cryptocurrency bounced from the bottom a month later in a bull run that continued until the end of the year.

Regulators

Regulators have been scrutinizing digital currencies for years. Some people, albeit only a few, are using cryptocurrencies to engage in illegal trades and with the surging value of cryptocurrencies, governments around the world will be looking closely at the market. For instance, a lawsuit by the U.S. Securities and Exchange Commission (SEC) against altcoin project Ripple saw XRP prices fall by almost half.

Regulatory agencies could suddenly erect a hurdle to tame unscrupulous activities surrounding bitcoin, but this regulation couldn’t affect bitcoin’s bullish run significantly.

Competition From Central Banks And Big Tech

Transactions involving different fiat currencies can take days and involve heavy fees and a global digital currency could significantly streamline this process in 2021. While bitcoin adoption is growing, the cryptocurrency could face competition to solve this problem from big tech. A good example is Facebook’s digital currency and, while Facebook diem is quite different from Bitcoin, it may draw some attention away from bitcoin in 2021.

Likewise, central banks are also competing against bitcoin. As reported by Banks for International Settlements, 80 percent of central banks are on the verge of developing some form of digital currency. For instance, China is working toward the adoption of a digital yuan. In many critical ways, these central bank digital currencies will be vastly different than bitcoin.

Conclusion

In general, the adaptation of bitcoin in commerce is a perfect cause for price increases in 2021. While bitcoin’s price and adoption is expected to proliferate, we can’t rule out the opposite and volatility is certainly possible.

This is a guest post by Michael. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post Bitcoin Investment In 2021: What Should We Expect? appeared first on Bitcoin Magazine.