Bitcoin Holds Above 200-Week Average as Dollar Index Rallies Most Since February

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

The heavily shorted U.S. dollar surged against the basket of fiat currencies last week, putting pressure on risk assets, including bitcoin (BTC). The leading cryptocurrency, however, held on to key support in a positive sign for the market.

The dollar index, which gauges the greenback’s performance against fiat currencies, rose by over 1.3%, registering the biggest single-week percentage gain since February, data from charting platform TradingView show.

Bitcoin fell by 5.8%, living up to its reputation of being negatively correlated to the greenback. However, sellers failed to establish a foothold under the 200-week simple moving average, a widely-tracked technical line that capped the upside in February.

“By defending this key average, the bulls have convinced the market of the sustainability of the long-term bullish trend,” Alex Kuptsikevich, senior market analyst at the FX Pro, said in an email.

Per Kuptsikevich, the cryptocurrency must top $28,500 to bring in cautious buyers waiting on the sidelines for stronger evidence of an end of the price pullback. At press time, bitcoin changed hands near $27,400, up 1.4% on the day, having hit a high above $31,000 last month.

Some observers expect the dollar to continue moving higher, keeping gains in cryptocurrencies under check.

“ I think the dollar is due for a bounce as markets take back some FED easing implied in the futures curve. My fundamental FX framework: currencies are driven by real growth differentials and political considerations over longer cycles, but in the short term, it’s all about playing relative central bank policy (changes in nominal rates). Depending on how violent the dollar upswing gets, it could cause some short-term damage to assets like commodities and crypto,” Ilan Solot, co-head of digital assets, derivatives engine at Marex, said in an email.

Analysts at Swissblock Insights voiced a similar opinion in a note to subscribers on Friday.

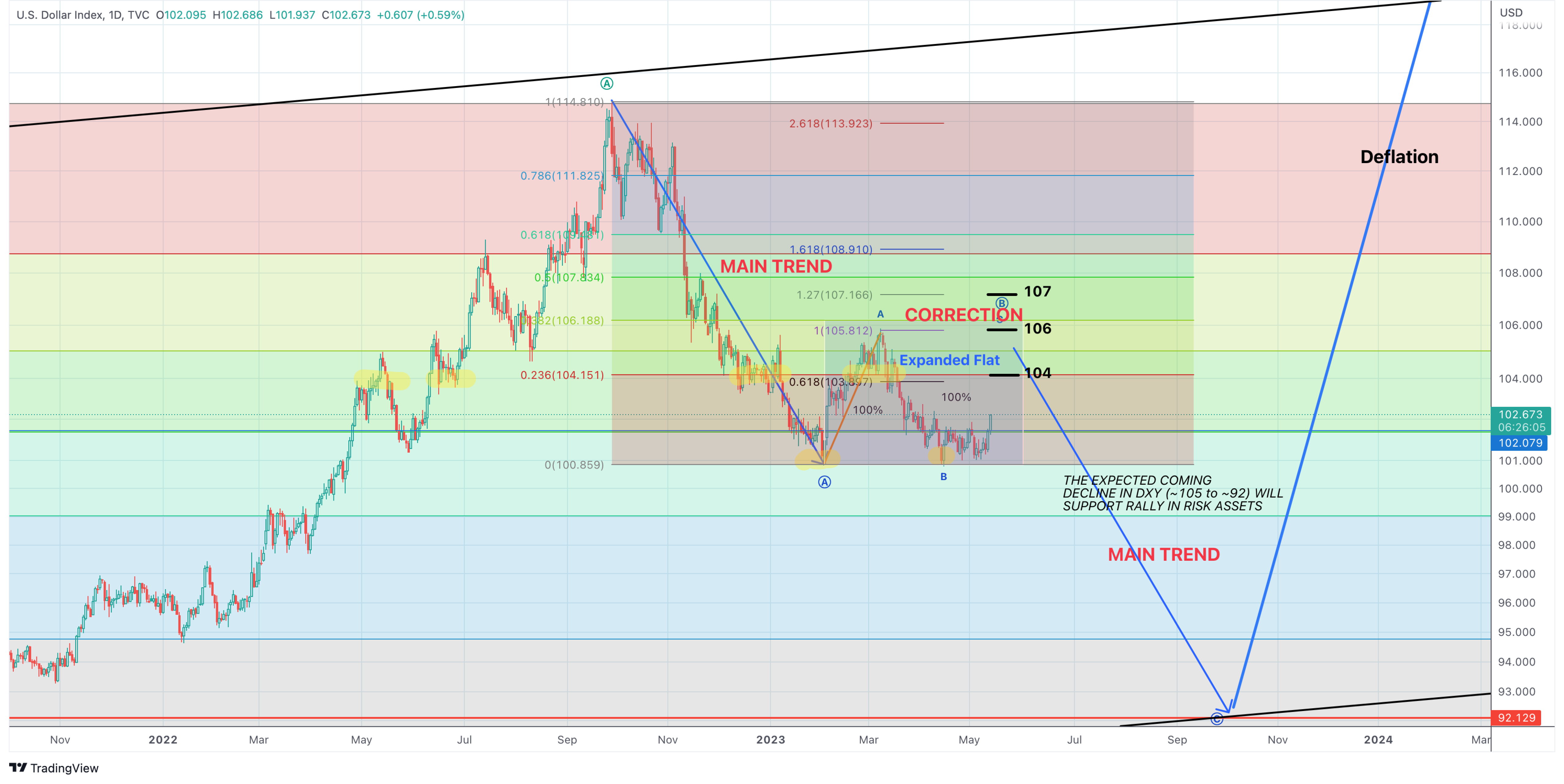

“The DXY could hit anywhere from 104 to 107 considering it crossed over the 102 level since mid-March,” analysts said, adding that renewed dollar strength could continue to pressure BTC as its ties to TradFi are strengthening.

Swissblock Insights expects dollar index to resume downtrend after a brief bounce. (Swissblock Technologies)

Per Swissblock Technologies, the impending dollar bounce will likely pave the way for a deeper decline that would bode well for cryptocurrencies.

“This month-long structure will eventually break, and both assets will experience price discovery – bitcoin to the upside, and DXY to the downside,” Swissblock Insights said.

Solot expects a pullback in bitcoin to be short-lived, offering a “a great entry point to position” for investors.

Wallets known to hold coins for at least six months have accumulated coins during the recent bout of weakness, hinting at confidence in the cryptocurrency’s long-term prospects.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.