Bitcoin Hits $51K, Regains $1T Market Capitalization

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

The bitcoin (BTC) price climbed through $51,000 in European morning hours on Wednesday, touching $1 trillion market capitalization for the first time since December 2021, data shows.

The rise came as bullish sentiment around continued growth of the largest cryptocurrency continued, with options traders betting on prices to touch as much as $75,000 in the coming months.

Some traders are targeting the $64,000 level in the coming weeks as demand from spot bitcoin exchange-traded fund (ETF) products grows. On Tuesday, BlackRock’s IBIT saw nearly $500 million in net inflows, indicative of buying demand.

Edited by Sheldon Reback.

Related Posts

Police Freeze Accounts, Seize Luxury Cars in Probe of ICO Promoter Vanbex

news Canadian police have frozen assets owned by the founders of blockchain services company Vanbex, as part of a fraud investigation into a 2017 initial coin offering (ICO) that raised $22 million. According to court documents dated March 13, the company, led by Kevin Hobbs and Lisa Cheng, raised $30 million CAD (about $22 million) worth…

Colorado Could Be Next in the Race to Bank Crypto (and Cannabis)

news The Takeaway: Colorado’s Office of Economic Development & International Trade has begun the process of creating special-purpose banking legislation to cater to crypto companies. The aim is to get a bill in front of Colorado lawmakers by December. Additionally, Colorado is exploring the option of extending crypto-specific banking laws (similar to those passed in…

Bitcoin’s Carnivore Cult Is Both Stupid and Correct

Bitcoin’s Carnivore Cult Is Both Stupid and CorrectThis entire article is Saifedean’s fault. Saifedean Ammous, author of “The Bitcoin Standard,” kept heaping steak tartare onto my plate at a Bitcoin meetup back in August 2018, in between jokes about liberal plebs. As the youngest woman in the room, per usual, I wanted acceptance from the Bitcoin clan.…

Only 1 Crypto Fund Has Passed Hong Kong’s SFC Regulatory Hurdles in First Year

news A year after the Hong Kong Securities and Futures Commission (SFC) published initial regulations for funds investing in crypto, only one firm has successfully passed that gauntlet. Hong Kong-based Diginex remains the sole crypto fund to pass the regulatory hurdles issued in Nov. 2018 and formalized this October, according to research from Reuters. As…

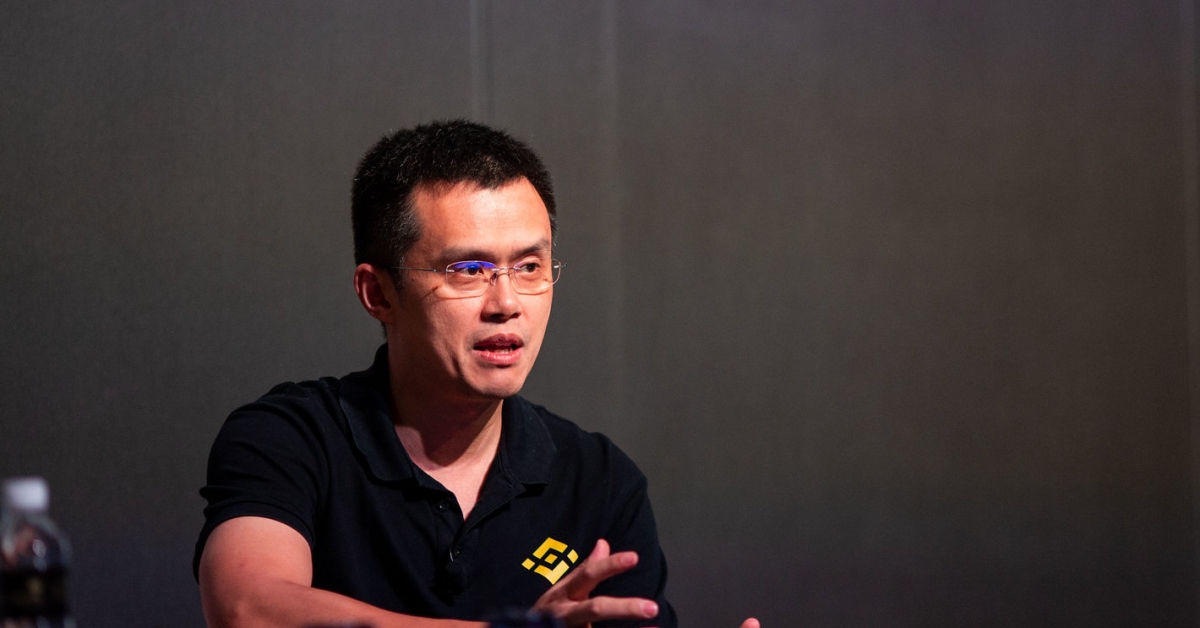

Binance Expects to Earn From $800M to $1B This Year, CEO Says: Report

Dec 4, 2020 at 5:46 p.m. UTCUpdated Dec 4, 2020 at 6:05 p.m. UTCBinance CEO Changpeng Zhao (CoinDesk archives)Binance Expects to Earn From $800M to $1B This Year, CEO Says: ReportCryptocurrency exchange Binance will likely earn between $800 million and $1 billion this year, as market uncertainty drives interest – and trading – in cryptos,…

Crypto for Advisors: Bitcoin’s 4th Halving Is Approaching

Roughly every four years, the creation of bitcoin reduces by 50% during what's known as the halving. Bitcoin's fourth halving is on the horizon, set to occur in late April. What implications could reduced production have on the market value of the asset? Haan Palcu-Chang from Purpose Investments provides his perspective on this event and

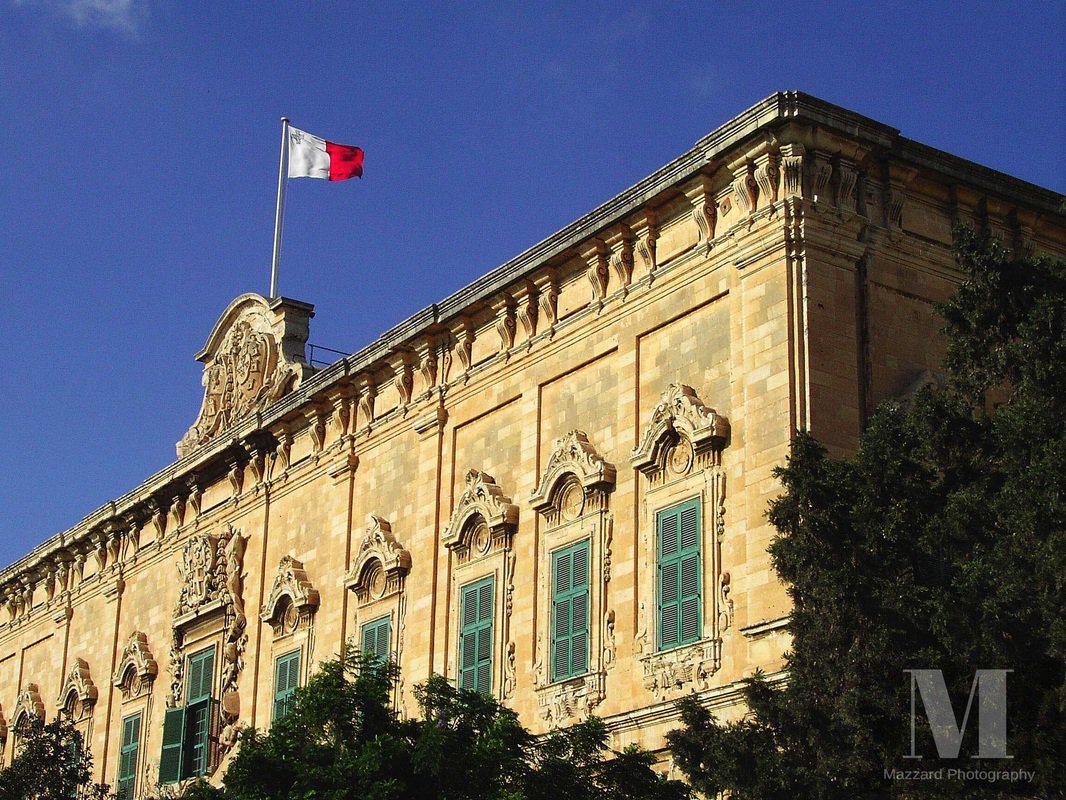

Binance Partners With Malta to Launch Security Token Trading Platform

Binance, the world's largest crypto exchange by volume, is teaming up with the Malta Stock Exchange (MSX) to enable security token trading on the "blockchain island," a local news site reported Tuesday. The exchange's chief financial officer, Wei Zhou, signed a memorandum of understanding with MSX chairman Joe Portelli to launch a security token trading…

Warning for Altcoin Bulls: The Ether-Bitcoin Ratio Is About to Flash Death Cross

The ETH/BTC ratio is on the verge of slipping into a death cross on the weekly chart.Ether underperformance could be a signal of risk aversion and reduced demand for alternative cryptocurrencies.Technical analysis is flashing several warning signals to alternative cryptocurrency (altcoin) bulls, with the ether-bitcoin (ETH/BTC) ratio dropping below a support level and on the