Bitcoin Hits 16-Month High Despite Sell-Off in Global Stocks

Bitcoin’s (BTC) price continues to rise even as coronavirus-induced instability rocks the stock markets.

- Bitcoin is trading near $13,420 at time of writing, a 2.77% gain on the day.

- That marks a fresh 16-month high for the cryptocurrency, which is now up 25% for the month and 87% on a year-to-date basis.

- Bitcoin’s on-chain data, too, is showing no signs of investor trepidation.

- The number of daily deposits to cryptocurrency exchanges fell to a nine-month low of 26,889 on Monday.

- Further, the total number of bitcoins held on exchanges slipped to a two-year low of 2,478,799 BTC, according to data source Glassnode.

- So the bullish mood continues for bitcoin, even though the global stock markets suffered losses and Wall Street’s benchmark equity index, the S&P 500, fell nearly by 2% on coronavirus concerns Monday.

- The decline in exchange deposits suggests investors are unperturbed by the risk aversion in traditional markets and see low odds of bitcoin suffering an equity market-induced sell-off.

- Investors typically move coins from their wallets to exchanges to liquidate holdings when expecting a price slide, and take direct custody of their assets when the cryptocurrency is expected to rally.

- In effect, we appear to be seeing a weakening of the positive correlation between bitcoin and the S&P 500 seen since the March crash.

- “The decline in transfers to exchanges despite risk-off in equity markets is a bullish sign,” Matthew Dibb, co-founder, and COO of Stack Funds, told CoinDesk over WhatsApp.

- The cryptocurrency is likely to stay strong in the coming weeks, he added.

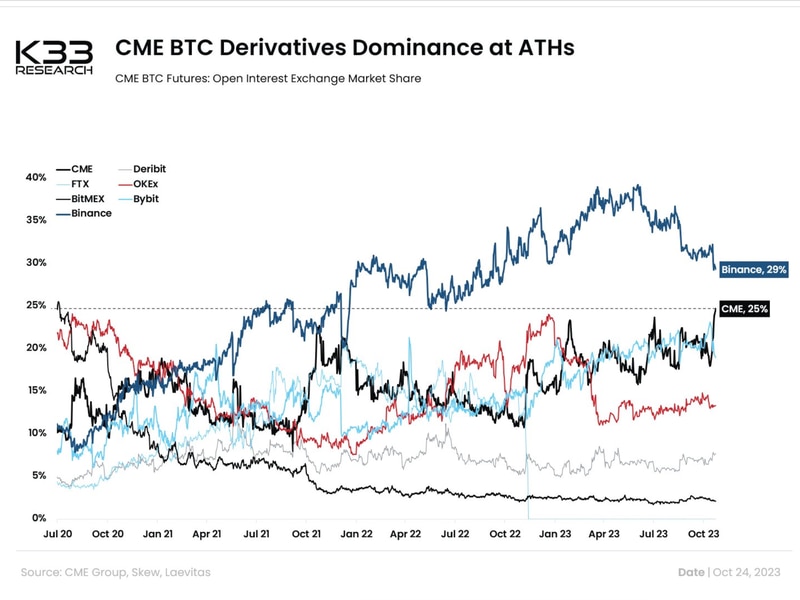

- Bitcoin’s options market is also retaining bullish bias.

- The one-, three- and six-month put-call skews, which measure the cost of puts relative to calls, continue to hover below zero, a sign of calls – bullish bets – drawing higher prices (or demand) than puts – bearish bets.

- The cryptocurrency suffered a minor drop to $12,700 during Monday’s U.S. trading hours only to chart a quick recovery to levels above $13,000.

- “The next resistance to take out is $13,800 (June 2019 high).

- “If bitcoin breaks below $12,700, we will take action and decrease our exposure further,” Patrick Heusser, a senior cryptocurrency trader at Zurich-based Crypto Broker AG told CoinDesk in a Twitter chat.

- Disclosure: The author holds small positions in bitcoin and litecoin.