Bitcoin Historical Data Shows We Might Be in the Early Stages of a Large Bull Market

It’s debatable whether we should take history as an indicator of future events. However, it’s definitely worth considering. A prominent analyst specializing in Bitcoin’s on-chain metrics recently argued that we might actually be in the early stages of a large bull market.

Large Bull Market Ahead?

Willy Woo is a well-known Bitcoin on-chain analyst with a massive following on Twitter. He is popular for his in-depth analytics and also for conceptualizing the Bitcoin NVT Ratio.

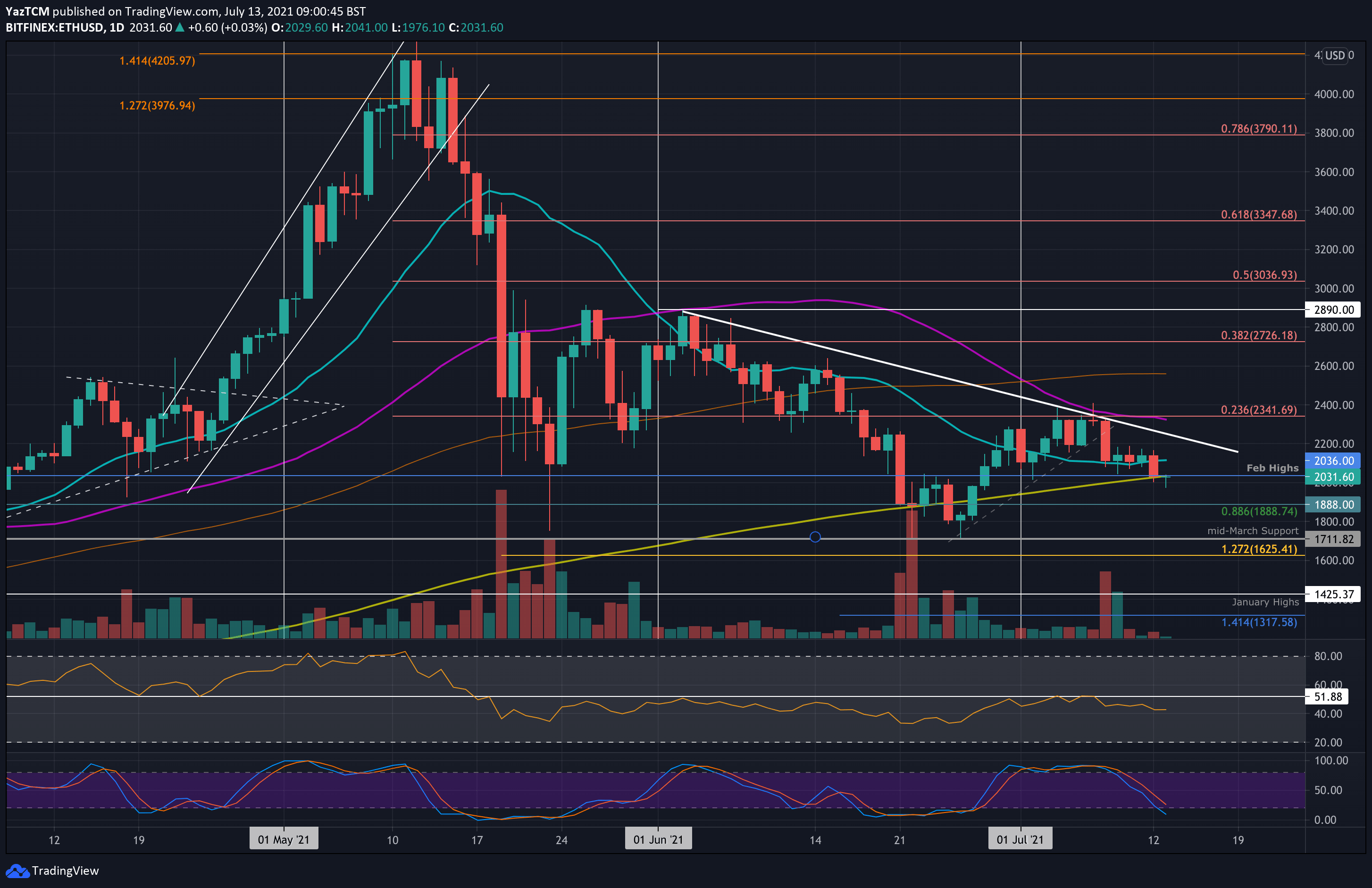

Now, he has prepared another interesting data set involving Bitcoin’s Volume Weighted Average Price (VWAP) Ratio.

Cheat sheet map of where we are in this bull market according to on-chain metrics. We’re closing up the opening act of the bull market, and awaiting the middle bull market to commence. pic.twitter.com/xkmY5i605G

— Willy Woo (@woonomic) September 21, 2019

According to his analysis, the world’s largest cryptocurrency by market capitalization might very well be in the fairly early stages of a large bull market which could see the price soar well above its previous all-time high (ATH).

Woo noted that “we’re closing up the opening act of the bull market, and awaiting the middle bull market to commence.” If history repeats itself, this means that we should see steady growth before entering the phase in which the previous ATH is broken.

Another interesting thing to consider is Bitcoin’s halving. As CryptoPotato reported previously, both previous halving events caused Bitcoin to skyrocket in value. This is perhaps due to basic supply and demand economic principles which dictate that if the supply of a certain asset is reduced while its demand remains the same or increases, its price should go up.

Chaos in the Meantime

As Woo’s data does not indicate precisely where we are in the current bull market, prices are kind of all over the place.

Just today, Bitcoin dropped more than $500 to as low as $9,500 on BitMEX.

More interesting than the dump itself was the fact that it happened 2 days before the launch of Bakkt’s Bitcoin futures platform. And as we all remember, the most prolonged Bitcoin bear market in history took place after CME launched its futures contracts back in 2018.

The post Bitcoin Historical Data Shows We Might Be in the Early Stages of a Large Bull Market appeared first on CryptoPotato.