Bitcoin Heading Towards Full Detox of Speculative Interest: Glassnode

Bitcoin’s push above the coveted psychological $20,000-level came after nearly 10% gains over the past 24 hours.

This was followed by a mass profit-taking session as traders anticipating the threshold began selling their bags, as Santiment’s data.

Many traders were apparently awaiting the $20k threshold to begin selling their bags. As #Bitcoin crossed back above this psychological level, mass profit taking ensued. Now we find out whether those anxious to sell will regret their decisions. https://t.co/k5o3UpZGfY pic.twitter.com/kXXbCSz05Y

— Santiment (@santimentfeed) September 27, 2022

- Despite a certain section offloading their Bitcoins, HODlers appear to have remained steadfast while several metrics now point towards a full cycle detox.

- Glassnode’s latest edition of the weekly report stated that a cohort of investors with older coins have held on to their tokens, “refusing to spend and exit their position at any meaningful scale.” It further noted,

“Whilst this is constructive in that it displays HODLer conviction, with such a lackluster demand profile as a backdrop, such an observation may be best interpreted as HODLers bunkering down for the storms ahead.”

- The HODling trend has remained unfazed even in the wake of uncertainty in the global markets, as wealth held by mature coins stood at an all-time high.

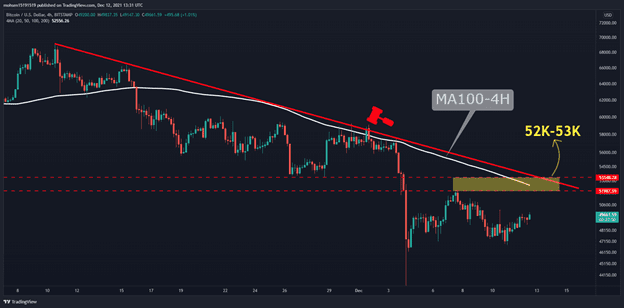

- The Bitcoin market is stepping into a phase of relative stability that signifies nearing a full detox of speculative interest and could potentially approach an equilibrium baseline of users as depicted by the Median Transaction Volume metric that appears to be in the process of steadily flattening out.

- Following the last year’s Great Miner Migration, there has been a significant reset in terms of network adoption, which recently collapsed.

- This essentially highlighted that an “appreciable recovery” may not be underway, and the decline in the influx of new users to the network is palpable.

- Another factor impeding recovery is the retail expulsion that has been observed since the migration and is still in effect, a purge similar to that during the 2018 bear market.

- On further inspection of network activity via Miner Revenue from fees, Glassnode found that the Bitcoin network remains in an extended muted fee regime, thereby confirming a recovery in demand is not yet underway.

- For now, the report suggests that Bitcoin’s network activity remains a barren wasteland, as New Entity Adoption dropped below cycle lows simultaneously with a complete exodus of retail participation.

The post Bitcoin Heading Towards Full Detox of Speculative Interest: Glassnode appeared first on CryptoPotato.