Bitcoin Hash Rate Follows Bitcoin and Gains Over 40% Within the Past Two Weeks

TL;DR

- After two months of decline, analysts have noticed stability in Bitcoin hash-rates, even a slight increase, indicating that miners might be returning to the industry.

- The significant cost of electricity and mining equipment were previously too much for Bitcoin miners due to the low BTC value, which is why many of them decided to leave the industry, and hash rates dropped as a result.

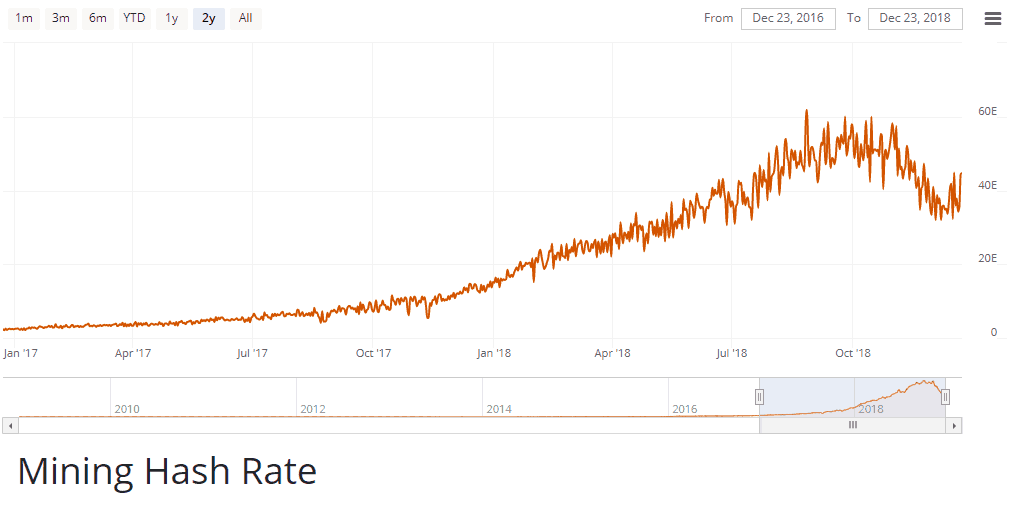

Along with the Bitcoin price, Bitcoin’s Hash-Rate is showing high volatility. After reaching a peak of 62 Exahash (10^18) per second on Sep. 25, we observed two months of drastic decline down to 32 Exahash on Dec. 7. This decline has halted in the last two weeks and has stabilized around 35 Exahash, and in the last few days, we are even starting to see the hash-rate go up to 40-45 (40.6% increase). We could probably correlate this to the recent rally of the entire crypto market we have observed in the last week.

The importance of hash rate

Simply put, crypto mining is a process of performing complex mathematical calculations. By doing this, miners are searching for a specific number that will “solve” a block and provide them with a reward in the form of Bitcoin itself. At the moment, the BTC blockchain rewards miners with 12.5 BTC Block Reward per each block solved.

Every calculation attempt to solve these equations is known as a hash. Meanwhile, the hash-rate is the number of hashes that are done per second. When we are talking about the Hash Rate of the Bitcoin network we are talking about how many hash attempts are being conducted per second in the entire network. All of this is done through ASICs, which is short for Application Specific Integrated Circuits. In short, this is the equipment used for Bitcoin mining, which has become extremely popular due to its ability to solve the complicated equations required for mining BTC.

However, the process of mining Bitcoin is also quite expensive. Even though mining rigs themselves are very valuable, the mining process also consumes a lot of power. This, in turn, means that miners have to deal with exorbitant electrical bills. If Bitcoin’s price is high enough, they can easily make a profit out of rewards they receive and pay their bills at the same time. However, after an entire bearish year marked by two market crashes, the price of Bitcoin is lower than it has been in over a year while solving the blocks requires more and more resources. Low BTC value means lesser earnings from mining, which in turn means that miners cannot generate enough profit to cover their costs.

Some of them even started experiencing losses, which is why many of them decided to abandon the mining industry, and entire mining farms were shut down. Because of that, the growth of hash rates is significant in the crypto industry, as it indicates that miners might be returning.

The price of Bitcoin has grown by 30% in the last week, increasing by $1,000. At the time of writing, Bitcoin price sits at $4,235.69, after a 5.7% increase over the previous 24 hours. The coin has also experienced massive growth in its market cap, and the same is true for the total crypto market cap, which grew by over $40 billion in a single week.

The rest of the market is also experiencing significant increases, with multiple top 10 crypto coins growing even more than BTC. Still, Bitcoin’s dominance is firmly established, and with more than half of the total crypto market cap in its possession, Bitcoin is unlikely to be challenged by any other coin anytime soon.

The hash-rate, as well as many other measurements such as difficulty, volume, tx price, etc., can give us great insight into the Bitcoin and Crypto market sentiment. And when we see this kind of changing trend in one of them, this might indicate a more significant changing direction for the whole industry.

The post Bitcoin Hash Rate Follows Bitcoin and Gains Over 40% Within the Past Two Weeks appeared first on CryptoPotato.