‘Bitcoin Has Failed,’ The 2022 Edition

Why the nearly-14-year-old cryptocurrency has lost its luster … according to the “experts.” There are better options in 2022.

This is an opinion editorial by Aleks Svetski, author of “The UnCommunist Manifesto,” founder of The Bitcoin Times and Host of the “Wake Up Podcast with Svetski.”

It’s October 2022. Bitcoin is once again below $20,000.

R.I.P. bitcoin. You have finally died. You’ve lost your luster. The Ponzi has ended. The show is over. It’s time to go home.

Next stop, $10,000, then $1,000 and then $0.

In this essay, I will be channeling my inner Nassim Taleb, Frances Coppola, Jim Cramer, Peter Schiff and Paul Krugman to prove that this time, bitcoin has well and truly failed!

Bitcoin Has No Hard Cap, You Can Divide It!

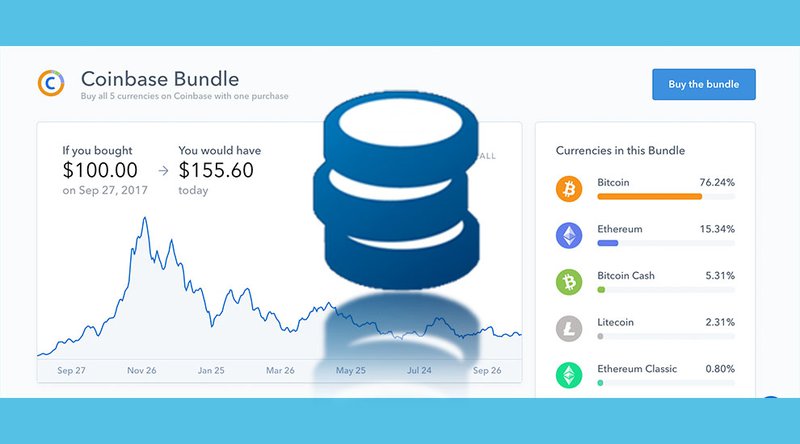

Let’s begin by exploring the big-brained idea of “inflation via divisibility,” proposed by the incredible Coppola. Her theory may be how we solve world hunger and actually feed everybody with a single pizza because “subdivision eliminates scarcity.”

It’s truly extraordinary stuff.

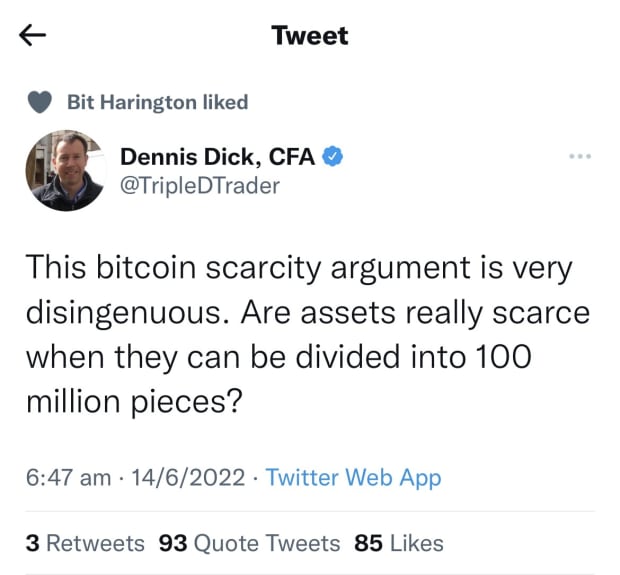

Fan clubs of hers have begun to spring up in chartered financial analyst (CFA) circles all around the world. See Dick below:

According to the experts, if you can divide things down, you can actually create more of them!

Lord Keynes himself could never have imagined such wonders.

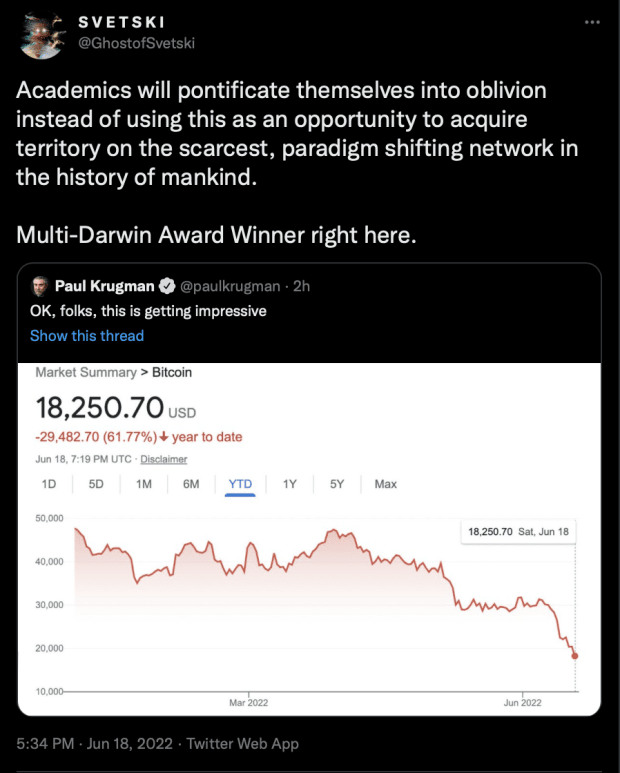

Then there’s Paul Krugman. One of the greatest of the greats, faxed the world his opinion, after having been on the wrong side of history (again). I think this time he’s right. Bitcoin has failed.

Fiat geniuses and Nobel Prize winners such as Krugman are known for their incredible predictions, whether it comes to the impact of the internet, or more recently, Bitcoin.

Krugman has been warning us all for years now of the peril of being involved in Bitcoin. Have you been listening?

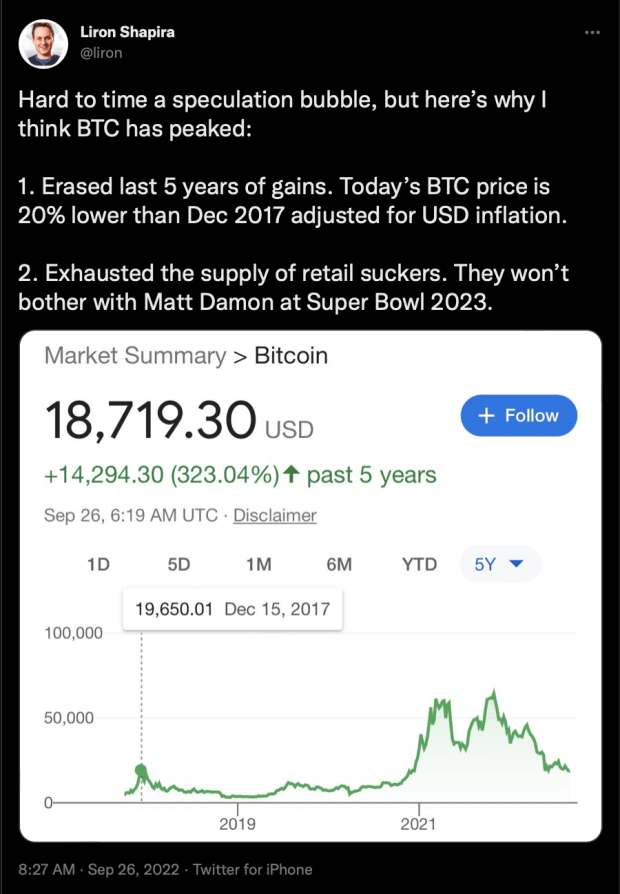

Young Liron Shapira below sure has been:

Oh, Shapira. How could we have not noticed that bitcoin fell 80% (again) and that despite the same thing having happened many times in the last decade, that this time will be different, in the face of orders of magnitude more hash rate, wallets, users and technical development?

Jeez. Bitcoiners are such ignorant morons. They have no idea!

It’s over for retail. There are no more people on the planet who need sound money and savings that won’t melt like ice…

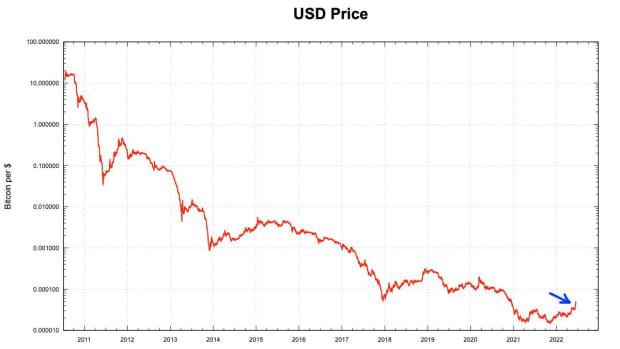

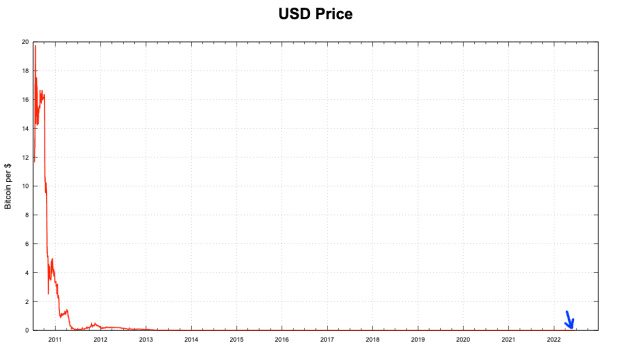

Back to the U.S. dollar we go:

Oops … that’s the logarithmic chart. The real difference is better represented in absolute terms. This recent “bitcoin is dead” phase can be seen in the bottom right hand corner, where the arrow is pointing. This proves the point unequivocally. Bitcoin is dead.

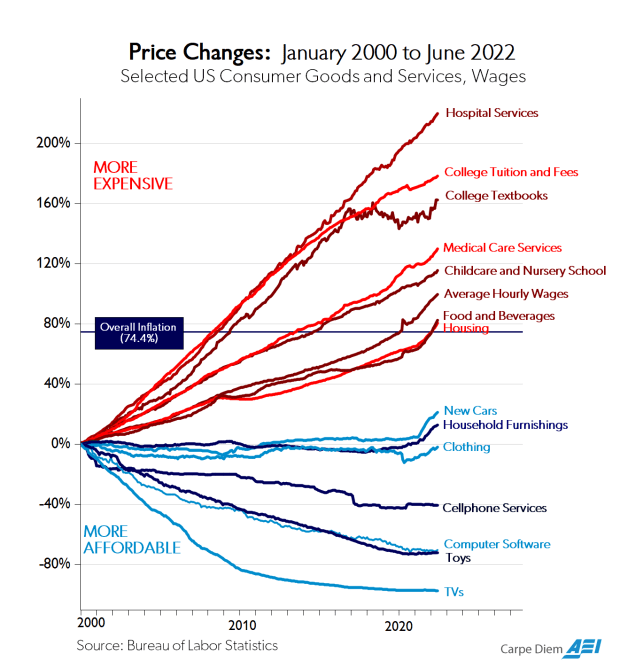

Look! The USD may be suffering a little bit, but at least with it we get cheap TVs!

Reader: please ignore the top half of the following chart. Things like food, healthcare and housing are not important. What matters is that we have a regulated medium of exchange issued by fossils over at the central bank. Only in this way can we have a clearly functional society where irrelevant conveniences like medical service go up in price while TVs go down!

The Facebook To Your Myspace!

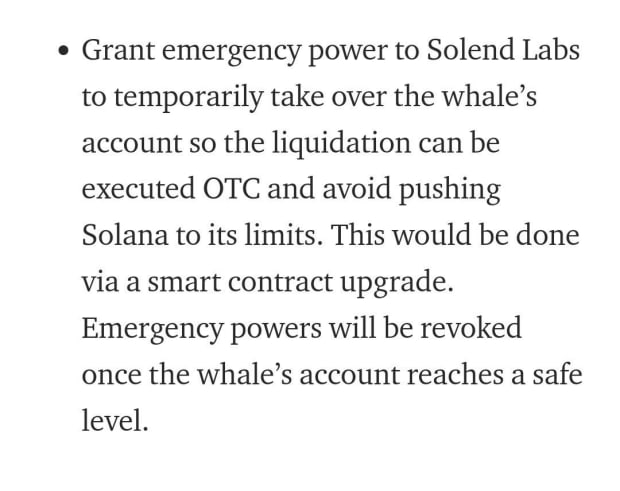

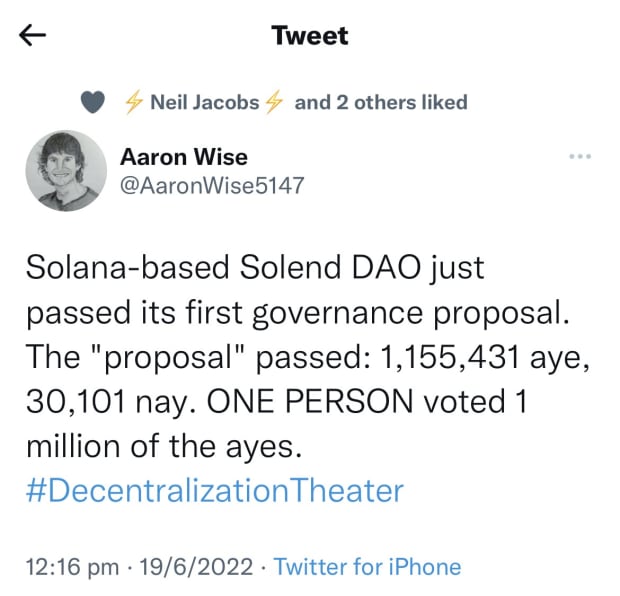

Bitcoin has failed to innovate. In 2022, we’ve created faster, newer, more “dEcEnTrALiZeD” blockchains, like Solana. Nevermind that Solana backwards is actually “Anal OS.” That’s just a coincidence made up by that toxic nym Gigi.

We’ve moved on from old school technologies like proof of work. We’re now using energy efficient consensus mechanisms like proof of stake:

Also — just incase you haven’t noticed, the Federal Reserve isn’t printing any more money, so now venture capital firms have decided to take it upon themselves to print in its stead. The methodology is brilliant and quite simple:

Take a little bit of seed money, mix it with some technical buzzwords, wrap it in a very healthy dose of modern marketing with friends over at Facebook and Google, then have it served by everyone’s favorite Instagram celebrity.

It’s a beautiful thing.

Why would anyone need something so boring as sound money in a world where money doesn’t even need to grow on trees, but can be conjured up with a few lines of code?

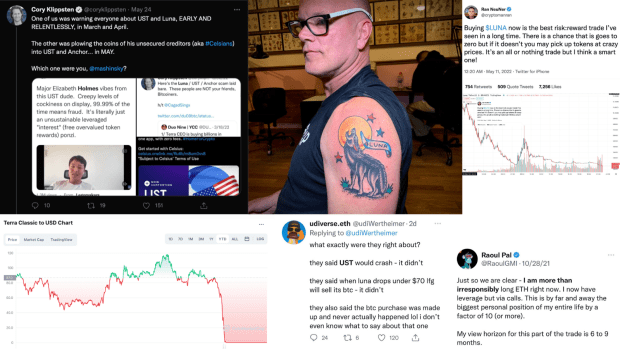

Why would anyone need energy money, inconveniently rooted in the laws of thermodynamics which thus cannot be printed, changed or manipulated, when you can just get tatted-up hedge fund managers and washed up bears from investment banks to pump digital Ponzi schemes?

I mean, just look at the caliber of people backing “crypto”:

Seriously man.

You Bitcoiners have philosophers, engineers, writers, artists and memers.

What are they good for?

We have “influencers” and JPMorgan executives, because “cRyPtO is dA fEwTcHa.”

Bitcoin Is For Losers

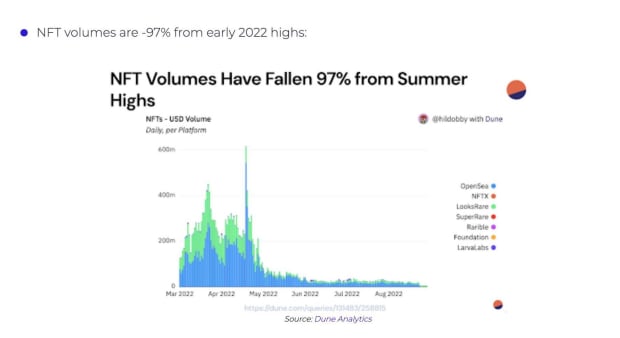

It has clearly failed because, in 2022, you can be an artist and get paid directly. You can monetize your incredible, Fiverr-created or AI-generated JPEG on OpenSea and the lemmings … I mean “fans” … will buy it because they love your art!

Didn’t you know this?

Why in the world would you still need Bitcoin when you can do this?

NFTs have and will continue to take the world by storm.

And once again, Bitcoiners have failed to evolve and change with the times. Just like they missed out on ICOs, they’re missing out on NFTs. And they’ll miss out on more.

Why? Because there is much more…

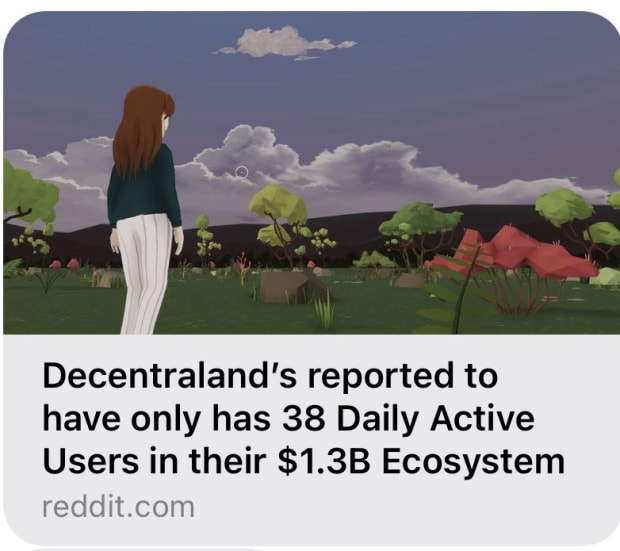

Have you heard about the Metaverse, or the decentralized land on the blockchain? Why would you own real land in the real world, or something as useless as a “sToRe oF vALuE” when you can ackchyually own land on a $1.3 billion network like Decentraland?

Metaverse projects are backed by the smartest people in the world, like Andreessen Horowitz, and it’s truly the future. Come join us and the other 38 people on the network.

It’s a new world, and Bitcoiners are old news.

This is what happens when you don’t adapt and conform to the world around you. You miss out on everything. Even on free money.

Yield!

You Bitcoiners are so stupid that you don’t even get any yield. You sit there with your silly store-of-value tokens, locked up in wallets doing absolutely nothing! Seriously?

It’s 2022. Didn’t you know you have to make your money work for you? That’s what cryptocurrencies and DeFi are all about! Another reason why bitcoin is so dumb.

Using the power of root vegetables, we’ve figured out how to conjure yield from digital money that in turn is conjured up from code, which in turn is conjured up from the imagination of the smartest 20 year olds in the world!

It’s magic all the way down, and we’re making all sorts of money.

DeFi, CeFi, yield, yams. We’ve got it all.

What do you have? Store of value. Hah!

At least some of you are smart enough to wrap your BTC in ETH and stake it, or at the very least, put your bitcoin to work for 3%.

Sure there may be some risks, but you can’t make an omelet without breaking a few eggs. And that’s what Bitcoiners don’t understand. To make progress, you have to move fast and break things.

The Facts

Bitcoiners just don’t get it. They’re a brainwashed cult full of fascist conspiracy theorists and extremists who are too busy being toxic assholes instead of coming to terms with reality.

This is why they’re all wrong. The rest of us, living in the real world, know the facts. And they’re pretty simple:

- Bitcoin is old technology. It’s like the Myspace of cryptocurrency.

- Central banks are raising rates, which means they’ll never again print money. Jerome Powell is the new Paul Volcker and he’s going to set things straight, while Christine Lagarde, together with friends in the European Central Bank, are going to save Europe.

- The great leaders at the World Economic Forum have all our best interests at heart. They want to make the world green, and will help the central banks create a global central bank digital currency (CBDC) that is so much better than bitcoin.

- Unlike CBDCs which will be given to everyone, bitcoin is so unevenly distributed that 10 people own, like, all of it. They can change the rules if they really want to. Richard Heart said so, and he’s always right.

- Of course, then there’s the risk of Satoshi Nakamoto moving his bitcoin. That will prove it’s not unchangeable. People are starting to realize this.

- Bitcoin doesn’t have a security budget, or a development budget. When the block reward runs out, all the miners will go broke because, 120 years from now, the price of bitcoin will be $1,000 so there’s not enough to be made from fees!

- And without a development budget, who is going to upgrade Bitcoin to proof of stake? Did you ever think about that? I bet you didn’t!

And look. Most importantly of all, bitcoin is not even real. I mean — have you even touched one? Didn’t think so. How can something like that be worth anything? There is no intrinsic value.

At the very least, these are all reasons why you should have a diverse portfolio, because you never know what will be the next bitcoin.

It’s been around for 13 years and it’s about time for it to stop going up. And with all that’s happening around the world, I think it’s pretty obvious at this point. If you can’t see it, even with all of the evidence from the experts, I don’t know what else to tell you.

Except of course:

Have fun staying poor!

This is a guest post by Aleks Svetski, author of “The UnCommunist Manifesto,”, founder of The Bitcoin Times and Host of The Wake Up Podcast. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.