Bitcoin Halving History Provides Little Guidance on Outcome: Coinbase

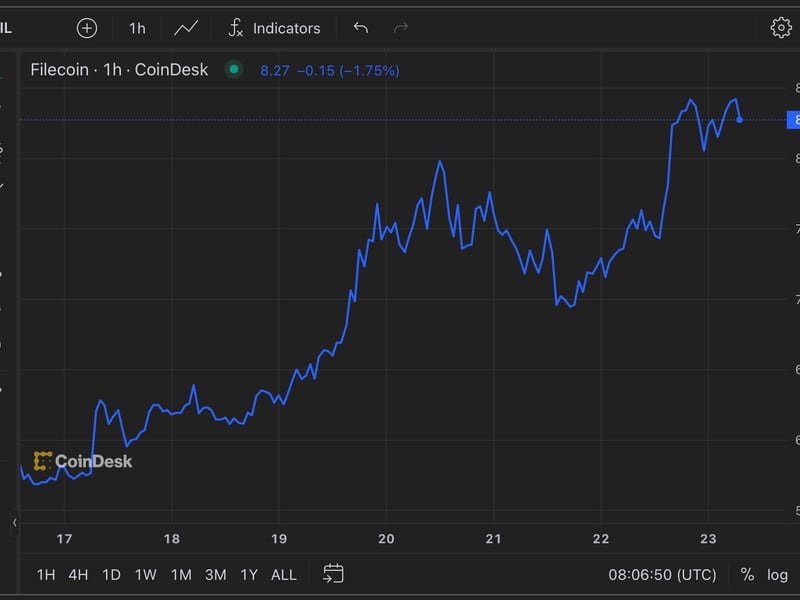

It is possible that the next bitcoin (BTC) halving, expected in second-quarter 2024, will have a positive impact on the cryptocurrency’s performance, but that’s not a foregone conclusion, Coinbase (COIN) said in a report Wednesday.

“Getting a clear picture of how markets reacted to previous bitcoin halving episodes requires disentangling the effect of liquidity, rates and U.S. dollar movements,” analyst David Duong wrote.

The halving of the block reward is often viewed positively because it enhances bitcoin’s “prospective scarcity” and supports its supply/demand dynamics, the note said. When bitcoin halving occurs, rewards are cut by 50%.

Still, with only three recorded halving events in the past, evidence of how markets react is limited, the note added. It is difficult to see a clear pattern, particularly as the events were “contaminated by factors like global liquidity measures,” the report said.

Coinbase says global liquidity appears to have peaked in the near term, noting that there’s still another 9-10 months till the next halving, “which makes it unclear what the net effect on bitcoin’s price behavior might be.”

Retail demand for the largest cryptocurrency is likely to remain strong ahead of the event, according to Wall Street giant JPMorgan (JPM).

Edited by Sheldon Reback.