Bitcoin ‘Grossly Undervalued’ at Current Prices, Traders Say Ahead of CPI, Trump-Harris Debate Week

-

Bitcoin remained stable over the weekend, trading between $54,000 and $55,000, following a significant liquidation of crypto long positions after a U.S. jobs report indicated a weaker labor market.

-

Upcoming events this week include a Presidential debate and the release of U.S. economic indicators like the CPI and PPI, with market analysts from Presto Research suggesting Bitcoin is undervalued due to its record-high network security despite prevailing macroeconomic concerns.

Bitcoin (BTC) was little changed over the weekend ahead of a busy week that includes a much-awaited Presidential debate and the release of key U.S. economic figures that track changes in consumer prices and inflation.

BTC traded in a tight range between $54,000 and $55,000 over the weekend, marked by lower trading volumes on exchanges. On Friday, over $220 million in crypto longs, or bets on higher prices, were liquidated amid a sudden market drop after a jobs report – leading to less activity.

Major tokens were similarly little changed, with ether (ETH), Solana’s (SOL), Cardano’s ADA, Ripple’s XRP (XRP) and Tron’s (TRX) rising just 0.5% in the past 24 hours. Mid-cap tokens showed some gains as memecoin neiro on ETH (NEIRO) and the BitTorrent token (BTT) jumped 25%.

However, bitcoin appears attractive to traders at Presto Research at current prices, who said in a Monday note that they consider the asset “grossly undervalued.”

“Amid macro factors dominating BTC price talk lately, the market is overlooking one of the key fundamentals underpinning Bitcoin’s value – network security,” Presto analysts Peter Chung and Min Jung said. “The hashrate, the computational power that secures the network, has hit an all-time high of 679 EH/s, making it the most secure network by far.”

“If you believe that trend will continue (in fact, the availability of spot ETF means we are in a much better setup than ever before), BTC seems grossly undervalued at the moment,” they added.

Bitcoin (BTC) miners are expanding their capacity again since August, as previously reported, amid all-time highs in hashrate, which has typically marked price bottoms for the asset.

Elsewhere, some traders said the lower-than-expected U.S. payroll figures indicated a weaker labor market, while the lower unemployment figure has lessened the concerns of an imminent recession.

“It seems the lower-than-expected payroll data is dominating the market sentiment at the moment, as broad assets declined since Friday’s data,” Lucy Hu, senior analyst at Metalpha, told CoinDesk in a Telegram message. “We expect the crypto market will remain highly volatile leading to the next Fed meeting.”

However, bitcoin could see movement in the coming week as August’s Consumer Price Index (CPI) figures are scheduled for Tuesday, and Producer Price Index (PPI) figures on Wednesday.

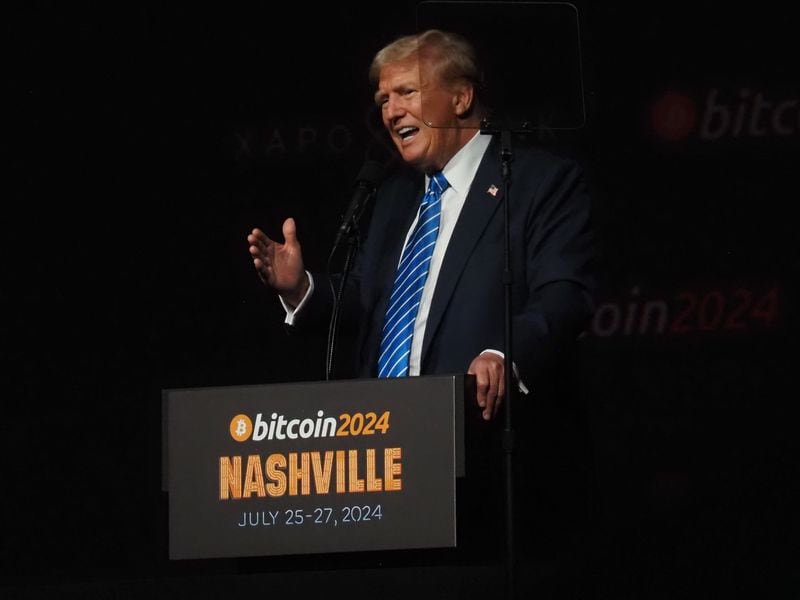

Also on Tuesday, crypto-friendly Republican candidate Donald Trump goes head to head with Democrat Kamala Harris, where voters are on the lookout for policy decisions. Trump has previously said he aims to make the U.S. the “crypto capital” of the world, and Harris aides are also reportedly considering policies to grow the industry.

Edited by Sam Reynolds.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Follow @shauryamalwa on Twitter