Bitcoin Gets Away From $20K: The Crypto Weekly Market Update

While Bitcoin has increased by a total of around 400% since the March lows, the picture doesn’t appear as bright in the short-term as it draws away from $20,000.

Over the past seven days, the cryptocurrency lost over $1,000 of its dollar value, charting a decrease of about 5%.

During the week, BTC managed to increase to above $19,300, but, unfortunately, it was all downhill from there. The cryptocurrency touched a low of $17,650 yesterday before recovering slightly to its current level of $18,000. As CryptoPotato reported, it’s testing critical 2-month support on the 4-hour 200 EMA that was last touched back on October 8th. It’s important to see whether the level will hold or if further lows await.

The entire cryptocurrency market is down over the course of the week, losing about $25 billion as most altcoins are also deep in the red.

Interestingly enough, this comes on the back of some seemingly positive news. A US Insurance company with a general investment account of about $225 billion jumped on the Bitcoin bandwagon. The Massachusetts Mutual Life Insurance Company bought $100 million worth of bitcoin for its general investment account.

Elsewhere, the largest Singaporean bank DBS Group made a u-turn on its stance toward crypto and launched a digital asset trading venue. It also announced that it would take a 10% stake in the platform. The bank’s CIO had previously called bitcoin a “bit of a Ponzi scheme.” Billionaire Ray Dalio also soften his stand on BTC, saying that it’s an alternative to gold.

In fact, the number of companies and institutions that consider bitcoin to be gold 2.0 has increased substantially in the past year.

All in all, it was an exciting week on the crypto market, though things took a turn for the worst. It’s interesting to see whether the correction would continue or if bitcoin will make another attempt at its ATH.

Market Data

Market Cap: $531B | 24H Vol: 118B | BTC Dominance: 63%

BTC: $18,006 (-5.12%) | ETH: $546.09 (-7.28%) | XRP: $0.55 (-4.66%)

Billionaire Ray Dalio Softens On Bitcoin, Says It’s A Gold Alternative. The well-known hedge fund manager and founder of Bridgewater Associates, Ray Dalio, appears to be softening his position on Bitcoin. After dismissing it as a currency and a store of value previously, he has now said that it could be an alternative to gold.

Research Indicates Investments Flowing Out of Gold and Into Crypto. Recent reports show that investors have been pulling their funds out of gold markets and putting them into cryptocurrency. There has also been a growing trend among institutional investors to buy into Bitcoin as a hedge against the inflating US dollar.

Spark (FLR) Airdrop For XRP Holders: Which Exchanges Will Support It And What You Should Know. The long-anticipated SPARK (FLR) airdrop for XRP holders is to take place on Saturday, December 12th. Many exchanges announced support for it, and it’s important to be aware of everything there is to know about it.

The Bank That Called Bitcoin a Ponzi Has Now Launched A Crypto Exchange For Institutional Investors. DBS Group, Singapore’s largest bank, went from calling Bitcoin a Ponzi scheme to launching a digital asset trading platform. The bank will even take a 10% stake in the future platform, signaling a complete change of heart and future intentions toward the industry.

$100 Million Worth of Bitcoin Bought By US Giant MassMutual Insurance Company. A US-based insurance company with a general investment account of more than $225 billion has also jumped on the Bitcoin bandwagon. The company said that it had purchased $100 million worth of BTC for its general investment account.

Facebook’s Newly Renamed Diem Cryptocurrency Threatened With A Lawsuit Over Branding. The Libra cryptocurrency project, which recently got rebranded to Diem is could potentially face yet again another lawsuit over its name. The company had supposedly used the same name as a small London-based fintech startup.

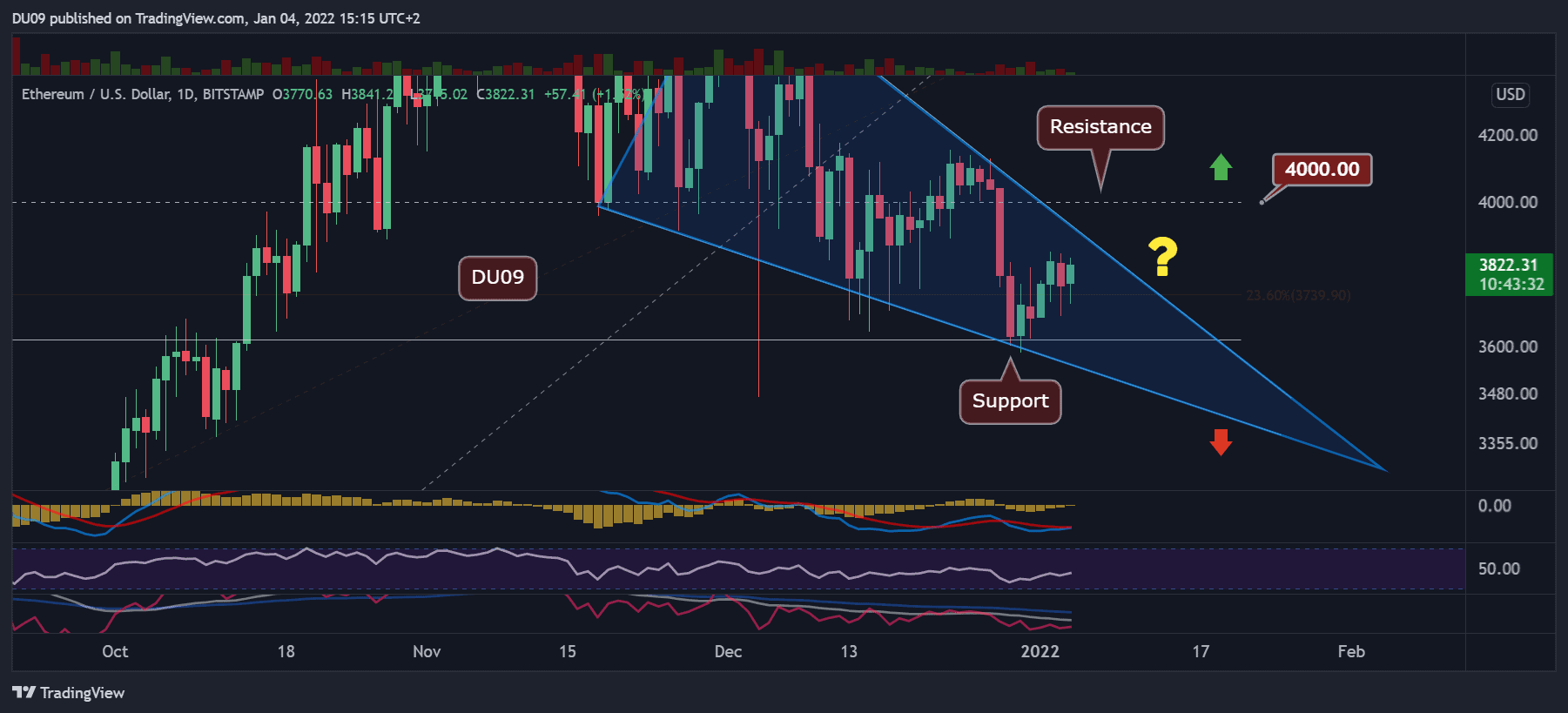

Charts

This week we have a chart analysis of Bitcoin, Ethereum, Ripple, Cardano, and Chainlink – click here for the full price analysis.