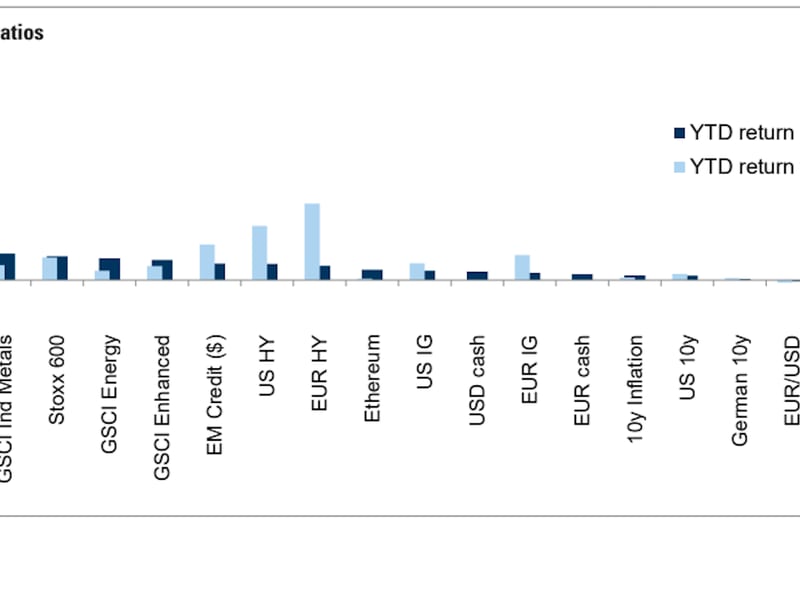

Bitcoin Futures Volume Surges 186% as Price Hits $11K

Bitcoin’s derivative market sprang back to life on Monday with futures trading volume witnessing a triple-digit growth on the back of increased participation from U.S. based institutions.

- Aggregate daily futures volume on major exchanges surged 186% to $43 billion – the highest single-day volume since March 13, according to data source Skew.

- Daily trading volume on institutional exchange CME rose 570% to a yearly high of $1.32 billion; Bakkt registered a record volume of $132 million.

- Total open interest rose to $5 billion – the highest since February.

- Volumes declined sharply amid dull bitcoin price action, but picked up again as bitcoin crossed $10,400 – a bullish breakout.

- The price rise was a combination of increasing retail demand and institutional volumes, said Chris Thomas, head of digital assets at Swissquote Bank.

- Joel Kruger, a currency strategist at LMAX Digital, told CoinDesk bitcoin now looks overextended, especially with the global outlook increasingly uncertain.

- The bitcoin supply – which fell to a 12-month low in Q2 – might now increase again as miners look to sell their coins on the open market – adding additional downside pressure.

- The cryptocurrency has pulled back from Monday’s 11-month high of $11,394 to $10,700.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.