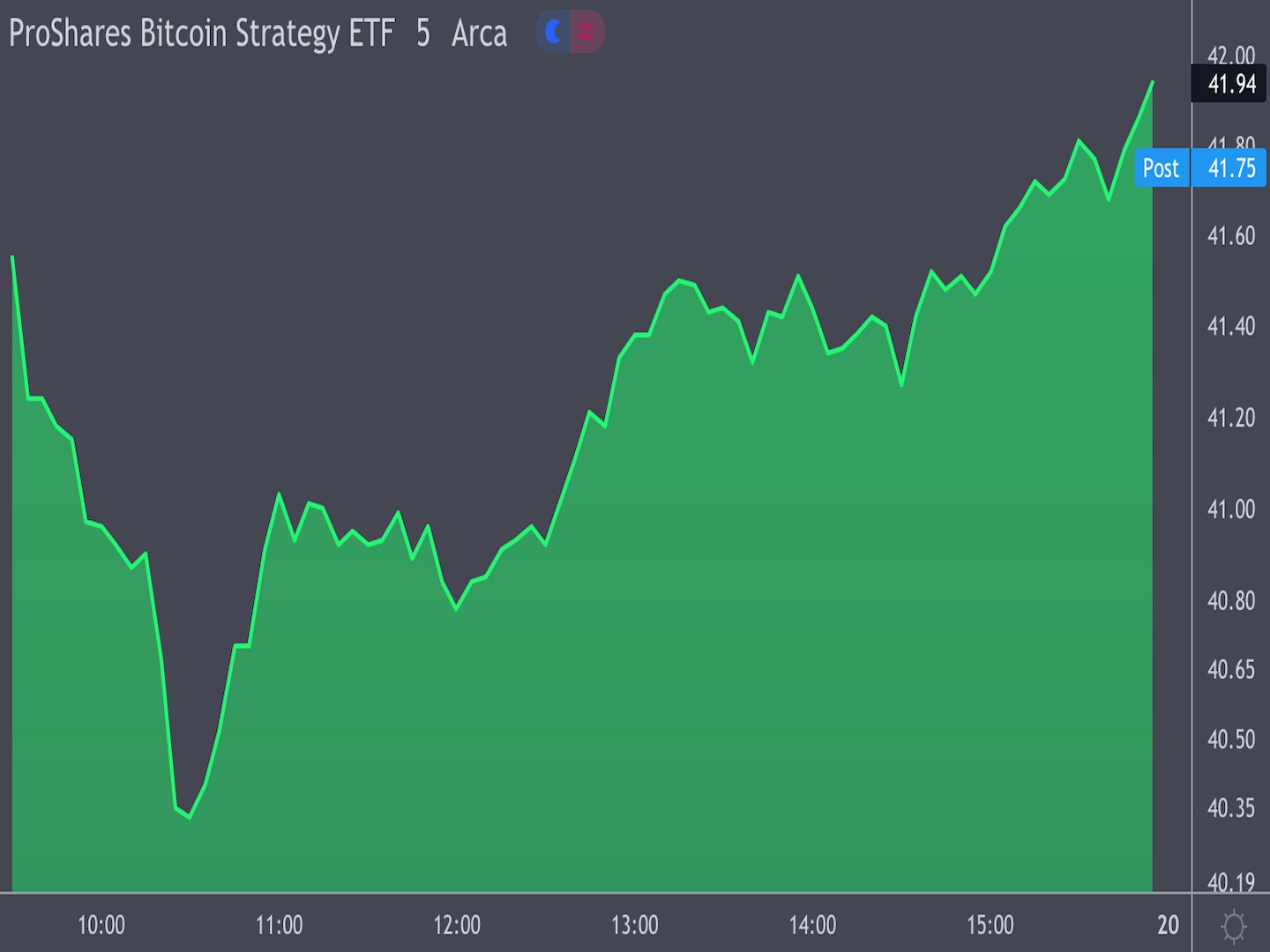

Bitcoin Futures Open Interest Tops $21B, Highest Since November 2021

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

The dollar-valued locked-in open futures and perpetual futures contracts have topped the $21 billion mark for the first time since November 2021.

-

Still, the overall leverage in the market remains low, indicating low odds of sudden liquidations-induced price volatility.

The notional open interest, or the dollar value locked in the number of open or active bitcoin (BTC) futures contracts, has risen to a 26-month high, according to CoinGlass.

As of writing, open interest in perpetuals and standard futures stood at over $21 billion, with bitcoin trading at $49,570 in the spot market. The open interest tally has increased 22% this year, nearing the record $24 billion seen in mid-November 2021 when bitcoin traded above $65,000.

The renewed interest in leveraged products like futures alongside a price rise represents an influx of new money on the bullish side and confirms the uptrend. Bitcoin has rallied 28% in just over three weeks, mainly due to strong inflows into the recently launched spot ETFs in the U.S.

Leverage, however, magnifies both profits and losses. Hence, a notable rise in futures open interest is often viewed as a harbinger of price volatility.

That said, the overall leverage in the market remains low, suggesting a low probability of sudden long (buy positions) liquidations leading to a price crash. Liquidation refers to the forced closure of bullish long or bearish short positions by exchanges on account of a margin shortage. Mass liquidations are known to inject bullish/bearish volatility into the market.

Bitcoin’s estimated leverage ratio has recently ticked slightly higher from 0.18 to 0.20, but it is nowhere near the levels seen in August last year, data from CryptoQuant show.

Besides, at 430,500, futures open interest in BTC terms remains well below the peak of 660,000 reached in October 2022, per CoinGlass.

“The leverage build-up is still relatively low, judging by the BTC futures open interest in BTC terms (to remove the price effect) – it’s climbing fast, but it’s not at frothy levels yet,” Noelle Acheson, author of the popular Crypto is Macro Now newsletter said in Tuesday’s edition.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/QU2RQDIKFFDJNLCJEZVJIYYDUM.png)

Edited by Parikshit Mishra.