Bitcoin Futures Markets Explained And The Defense Against Bitcoin Price Manipulation

The futures market has been a hot topic of late, but it can only have so much impact on the price of bitcoin.

The Problem

Enemies with unlimited cash (The Federal Reserve Board or the International Monetary Fund, for example), can suppress the price of bitcoin; here, I demonstrate why their suppression can have only temporary effects. Exactly what price suppression can achieve, long term, is debatable and not the topic of this article. I will just explain how price suppression can be achieved in the short term, and why the strategy won’t work in the long term.

Futures Markets

Price manipulation can be accomplished through the cash-settled futures market. Here’s how: Imagine you have 1 bitcoin and wish to bet on its future price. Suppose the spot price is currently $50,000. You write a contract that in one year (you can choose other time periods, but let’s go with one year for simplicity), you will sell 1 bitcoin at $50,000 (you can actually set any price).

How much is this contract worth? Well, first consider what are the advantages to the person who buys the contract:

- They can refrain from parting with $50,000 now, and instead wait one year before they pay for the 1 bitcoin – so they get to hold $50,000 in cash for one year, and holding that extra cash has some value because it can earn yield.

- They still get exposure to the price movements of bitcoin without paying for it in full, because no matter what happens to the price of bitcoin in one year, they effectively have to buy it for $50,000 at that time. If the price goes up to say $70,000, they have to buy the bitcoin for $50,000, and can sell it immediately for 70,000 and make $20,000 profit, or they can just hold on to the bitcoin that they got cheaply. But if the price falls, they still need to pay $50,000, even if it’s above the market price of bitcoin.

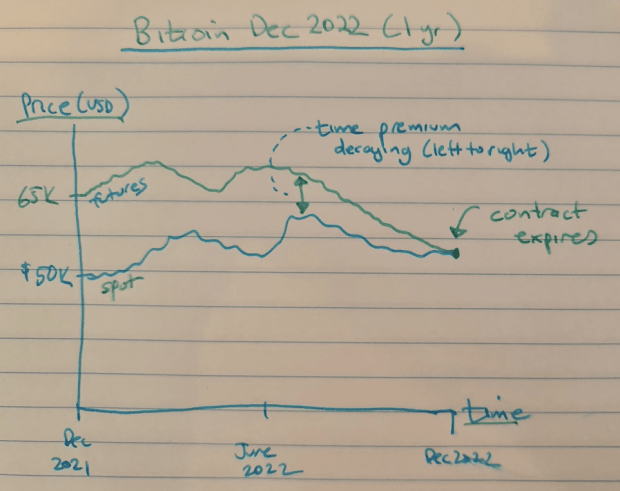

What the value of the contract is, I can’t say – it’s up to the market to determine, but let’s say it has a $15,000 premium over the spot price. This is the price to pay for the benefits listed above. If the premium is $15,000, the contract would have a price of $65,000 on the market. (50,000 for the bitcoin price, and $15,000 for the one-year time premium). The $15,000 represents a 30% annual premium.

EXAMPLE: One year bitcoin futures contract – cash-settled, initial price $65,000:

Now, in reality, you don’t write the details of futures contracts, the exchange sets the terms of the contract. This allows contracts to be fungible, and therefore tradable on an open market.

You simply go to a futures exchange, look up the one-year contract page, you’ll examine the chart, and see if you want to buy or sell.

Let’s say you “sell.” Your order appears in the order book. (What are you selling? You are selling a deal with the specified terms.)

Someone might buy it and when they do, then and only then, a new live contract is created, and the open interest (the total count of contracts open) increases by the size of the number of units traded. You don’t have to wait for the contract to expire to exit. You can buy back the contract at any time at a profit or loss to end the deal (i.e., exit the position, which reduces the open interest).

Why does the price of the contract change? There are three reasons:

1. Time Premium Decay

Time has value, and as time runs out, price reduces. Even if bitcoin’s price stays dead-steady for one year, the $15,000 premium will decay to zero as the contract expiry approaches, and by the end of the contract period, it will be worth $50,000 in total – the same as the spot price of bitcoin. If you are still holding the contract at the end, then your profit will be $15,000 (because you sold it at $65,000, and now it is about to expire at $50,000). In fact, whatever happens to the price of spot bitcoin, the futures contract will lose its time premium until the final moment when the contract will be worth the same as the spot price, whatever that happens to be.

2. Volatility Component To Time Premium

While the time premium decays due to time decay, the volatility of the spot price can cause wild fluctuations of the price of the time premium that is remaining. The time premium is like an insurance policy. If the volatility is high, that means wild swings in price are more likely, and the “insurance” premium becomes more expensive.

3. Spot Bitcoin Price Changes

Apart from the time premium, superimposed on that will be the fluctuations of the spot bitcoin price. Generally speaking, if the price of bitcoin rises the price of the contract does too. So if the spot price doubles, the component of the contract price that excludes the time premium should double too (or close enough).

How Manipulation May Occur:

The evil anti-humanity Marxists wishing to damage Bitcoin may try to drive the price down by selling futures contracts heavily and at a loss (at lower prices than the pro-humanity individualists participating in the free market).

The Marxists don’t need bitcoin as collateral to do this. They only need cash collateral. Why do they need collateral? The collateral is there in case the trade goes against them. If the trade goes badly enough and all the collateral is consumed, the exchange would liquidate the contract and collect what is owed by confiscating the collateral. If there were no collateral, the exchange would be owed money and might never receive it from the Marxist scumbags.

Normally the price of the futures doesn’t deviate from the spot price due to arbitrage. I’ll explain.

Manipulation By Inviting Arbitrage

Imagine, after heavy selling, the futures contract price is $49,000, suddenly dropping from $65,000, but the spot price hasn’t moved from $50,000. (The spot price would move, but imagine it hasn’t yet, I’ll show why it does move, “automatically.”)

A savvy trader would see that the futures price is too cheap. What can he do to take advantage? One way is just to buy the $49,000 contract knowing it is $1,000 cheaper than the spot price. What he can do is buy one bitcoin contract at $49,000, and sell one of his own bitcoin on the spot market at $50,000.

He pays $49,000 for the futures contract, and sells 1 bitcoin for $50,000, so he nets $1,000, FOR FREE. But the selling pressure also drives the spot price of Bitcoin down towards $49,000. Why $49,000 and not lower? Because this arbitrage is only profitable up to a certain point.

(I’m actually ignoring the $15,000 time premium for simplicity, but if that is taken into account, it could be rational to sell bitcoin all the way down to $34,000. The apparent loss in doing this is made up for the extremely cheap one-year futures contract purchase. The time premium would essentially have been snatched up for free.)

Back to the $49,000 versus $50,000 arbitrage – the number of bitcoin our savvy trader holds in total now has reduced by 1.0, but the number of bitcoin he is exposed to, in terms of price, is unchanged. If bitcoin’s price doubles, he still profits, but in fiat terms. He can always exit the futures contract, take the profit in fiat, and buy the bitcoin back at market price and be $1,000 better off (FOR FREE).

Where did the $1,000 profit come from? Whose money is that? Whoever was “silly” enough to sell the futures contract for too cheap. But were they silly? Not if they were someone who could print fiat money in unlimited quantities and wanted to drive down the price of bitcoin.

Does This Work?

It depends on what you mean by “work.” This does suppress the bitcoin price, but only temporarily, and I’ll explain why later.

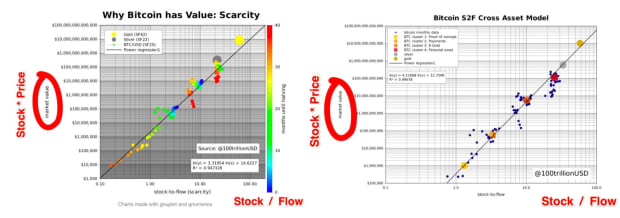

It’s also worth noting the success of this strategy to suppress the gold price. The number of futures claims on gold far outweighs the amount of gold available. How is this sustained?

Because the delivery of the contract is in the fiat value, not in actual gold, and there is no limit to how much fiat can exist. There is also no obligation to deliver the gold.

People tend to not want the gold either, as there is a cost involved in accepting physical gold.

So the scam perpetuates, and the “supply” of gold is effectively increased, and therefore the price is suppressed. Everyone is trading the “paper” gold which is not scarce at all, and there seems to be no limit to how much paper gold can be created.

This is not the case for Bitcoin though:

The Solution

Why The Manipulation In Bitcoin Can’t Be Sustained: Reason #1.

While this manipulation is effective against gold, it won’t work for long against Bitcoin. This is because bitcoin is easy to take into custody and to spend directly, peer to peer, to anyone in the world, instantly. Gold isn’t. Of course, I’m not saying you can’t take custody of gold – you can, but it’s not commonly done. And international trade, without a central party holding custody of the gold, is not common – and so, the market manipulation of the gold price can persist.

You can store bitcoin yourself with your own wallet holding your own private key. Most people teach themselves how to do this, and I do teach people who want help. Eventually, nearly all bitcoin is destined for self-custody.

As people accumulate more bitcoin, whether by converting their fiat money to bitcoin, or whether it is through buying bitcoin on exchanges, demanding it for services rendered, or buying more from arbitrage profits from Marxists trying to manipulate the price down, actual bitcoin is what will be demanded and accumulated long term – not paper promises for it, as is the case with gold.

This activity also contributes to fiat inflation, which strengthens the demand and awareness of bitcoin. In short, while this can be temporarily effective, it will lead to an equal and opposite reaction of creating an increased demand for bitcoin.

In addition, driving the price of bitcoin lower allows those who accumulate bitcoin to extract more bitcoin out of the overall supply for a given quantity of fiat they have available.

The reason demanding real bitcoin breaks the price manipulation is as follows:

Suppose the millions of HODLers accumulating bitcoin continue to do so, and suppose their numbers continue to increase. When they take their fiat to the spot market, they bid at the suppressed price, and at some point, there will be no more bitcoin available. So they bid higher. And higher still – even if the futures price is much lower than spot. As they bid higher, other bitcoin HODLers become tempted to sell perhaps to buy a Lambo, or a châteaux in France with fiat. And thus, bitcoin is transferred from weaker hands to stronger hands. This spot price is driven up by people who want real bitcoin, not paper futures contracts to gamble on.

For the spot price to be driven back down towards the futures price, someone who may initiate an arbitrage strategy would need to have bitcoin in reserve to execute his plan, but HE HAS NO BITCOIN LEFT. He is only holding futures contracts or fiat. And so the price continues to get bid higher.

This is how the manipulation ends.

It is important to know that simply buying bitcoin on the spot market is insufficient to break the manipulation – withdrawal is necessary. Any bitcoin left in the exchange’s custody is not necessarily real bitcoin.

You may be told that you own, say, 1 bitcoin, but you can never be sure if there is more than one claim on that bitcoin. Fractional reserve practices that occur in the banking sector are very possible to replicate on bitcoin exchanges.

An exchange holding 1 million bitcoin, for example, may have customers who are promised 10 million bitcoin in total. Those customers just have account pages with a readout of their bitcoin balance. There is no way for them to check if that bitcoin exists until they withdraw it. If 1 million bitcoin are suddenly withdrawn, the other customers who think they have 9 million will never receive their bitcoin.

I like to use a gold analogy: imagine you have a gold broker, and you log in to their exchange page, navigate to your gold “wallet,” and they show you a photograph of a gold bar. You don’t really know if that bar exists in their safe, and you don’t know how many other people think they own it. It’s not yours until it is sent to you and you put it in your safe. The same is true for Bitcoin. I run through “Six Reasons To Withdraw Your Bitcoin” here.

So to summarise that last argument – you are not really demanding spot bitcoin (and helping break price manipulation) if you leave the coins on the exchange.

Why The Manipulation In Bitcoin Can’t Be Sustained: Reason #2

The other reason the manipulation is not sustainable is that those who are enticed by arbitrage profits (i.e., they sold some bitcoin in exchange for underpriced futures contracts), may at a later date wish to replenish their bitcoin stack. They would then close the futures contract, or let it expire, collect the fiat and any profit/loss, and use the fiat to buy back their bitcoin on the spot market, which then pushes the price back up. That component of the dip caused by the manipulator becomes noise over the time period the futures contract was held.

Summary

In summary, I explained how price suppression MAY be occurring (and likely is), and how it works using the futures market. I also explained why it can’t persist long term. Presuming that bitcoin’s experience will be the same as gold’s is fundamentally flawed because bitcoin does not have the same relevant, exploitable weaknesses as gold.

Bitcoin can easily be demanded, stored, and transacted instantly, all over the world, and it is the demand for real bitcoin that will decouple the price of bitcoin from the futures price.

Remember, you can’t buy a coffee or a Lambo with a futures contract as payment.

This is a guest post by Arman the Parman. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.