Bitcoin Floats Above $43K as ‘Buy The Dip’ Sentiment Prevails

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

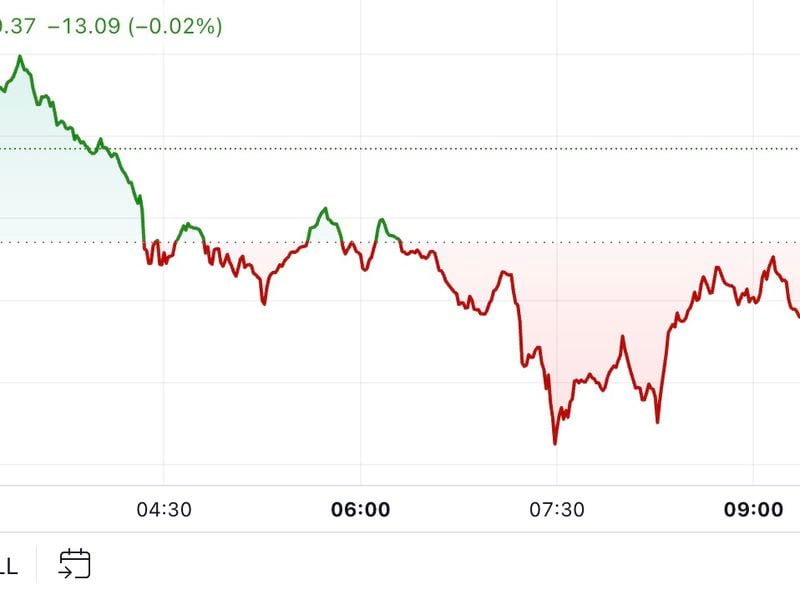

Bitcoin (BTC) prices inched above $43,000 in European afternoon hours on Monday after a relatively flat weekend, showcasing a recent pattern of low volatility ahead of the U.S. trading hours.

Chainlink’s LINK was among the only gainers among majors with a 7% jump in the past 24 hours, extending a run that’s seen the token reach a 22-month high. Bullish sentiment for LINK has strengthened in the past months on the back of rising interest in the tokenization of real-world assets (RWA).

In January, analysts at K33 Research said LINK is the safest way to profit from the ever-strengthening RWA narrative.

Ronin Network’s RON fell 9% as crypto exchange Binance stated it would list the tokens – becoming the latest in a relatively new trend that sees token prices dump as the world’s largest exchange by volume announces their listings.

As such, some traders opined that recent dips were for buying and that bitcoin slides being bought up by traders in the past few weeks indicated a bullish sign.

“Previously, the ‘what doesn’t rise, falls’ formula was often applied to cryptocurrencies,” Alex Kuptsikevich, FxPro senior market analyst, told CoinDesk in an email. “However, recent attempts to sell off after a period of stabilization have been met with increased buying.”

“At the start of trading on Monday, there was an attempt to sell the price lower amid weakness in the Chinese markets. However, BTCUSD was bought back twice on dips to $42,000,” Kuptsikevich said, adding that “buying on dips” remained a defining sentiment among traders.

The trader added that previous catalysts for the crypto market, such as bitcoin ETFs, had already played out – forcing investors to wait for the next signal that could favor volatility.

Elsewhere, analysts at crypto exchange Coinbase said in a Friday note that the selling pressure on bitcoin was easing, and macroeconomic factors favor the growth of bitcoin prices.

“The technical factors that supported bitcoin’s decline are starting to weaken. In addition, there is steady interest in the spot bitcoin ETFs that have been launched,” Coinbase analysts wrote.

Edited by Parikshit Mishra.