Bitcoin Flat Near $61K as Whales Continue to Accumulate; XRP Down 10% as SEC Appeals Case

-

Bitcoin remains relatively stable above $61,100, while ether experiences a 4% drop to $2,390 amid geopolitical tensions following Iranian airstrikes on Israel, influencing a broader market sell-off.

-

Despite the downturn, there’s significant whale accumulation of Bitcoin, suggesting anticipation of a future bull run. Meanwhile, bitcoin ETFs see outflows, whereas ether ETFs attract inflows.

-

XRP drops over 10% after the SEC’s decision to appeal a ruling on its regulatory powers over crypto markets.

Bitcoin (BTC) and ether (ETH) continued in the red at the start of Asian trading hours Thursday as the market withstood another sell-off.

BTC is flat, trading above $61,100, while ETH is down 4% and trading at $2,390. Crypto markets took a hit from Tuesday night after Irani airstrikes on Israel, which the latter has vowed to retaliate, in a move that has dented a rally in risk assets, including bitcoin.

However, whales continue to accumulate bitcoin at unprecedented rates despite the macro environment and market dullness, CryptoQuant founder Ki Young-Ju said in an X post.

Whales colloquially refer to influential entities that hold largest amounts of any asset – and on-chain data shows new bitcoin whales are making sizeable purchases in anticipation of a bull run ahead.

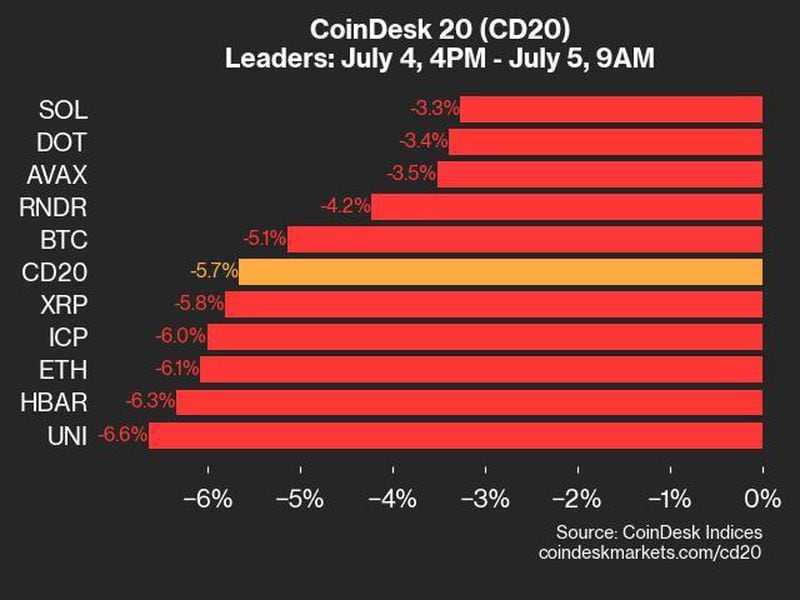

The CoinDesk 20 (CD20), a measure of the performance of the largest digital assets, was down over 3% as investors continue to sell most major cryptocurrencies.

Outflows from the BTC exchange-traded funds (ETFs) continued with $91.76 million in outflow during the Wednesday U.S. trading day. Ether ETFs experienced the opposite, with inflows of $14.45 million, breaking a two-day streak of outflow.

XRP plunged more than 10% in the past 24 hours after the U.S. SEC said on Wednesday that it is appealing a court ruling restricting its ability to regulate cryptocurrency markets. The SEC will ask the 2nd U.S. Circuit Court of Appeals to review a July 2023 decision that the XRP token sold by Ripple Labs on public exchanges did not meet the legal definition of a security.

Memecoin mog (MOG), the second-largest cat-themed token behind popcat (POPCAT), saw little price movement despite being mentioned on Republican candidate Donald Trump’s X account.

A Polymarket market tracking Trump’s mention of the word “mog” – or related adjectives – before December 31 was unchanged at 13% of “yes” votes, leading to some drama among voters.

Elsewhere in the market, LDO, the native token of non-custodial staking solution Lido, is down nearly 9%, following Ether’s decline.

Artificial Intelligence tokens are also not moving, despite an announcement from OpenAI that it had raised $6.6 billion at a valuation of $157 billion.

CoinGecko data shows that the category, which includes (NEAR), {{TAO}}, and (ICP) is down 1.8%. Worldcoin, which was founded by OpenAI’s Sam Altman, but has no formal ties otherwise to OpenAI, is down 4%.

Edited by Parikshit Mishra.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Follow @shauryamalwa on Twitter

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/ff7c302f-d3ab-4905-92e1-2f7f5106d13c.png)