Bitcoin ‘Flash Rally’ Briefly Pushed BTC Derivatives Above $56K on Bitfinex

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)

Oliver Knight is a CoinDesk reporter based between London and Lisbon. He does not own any crypto.

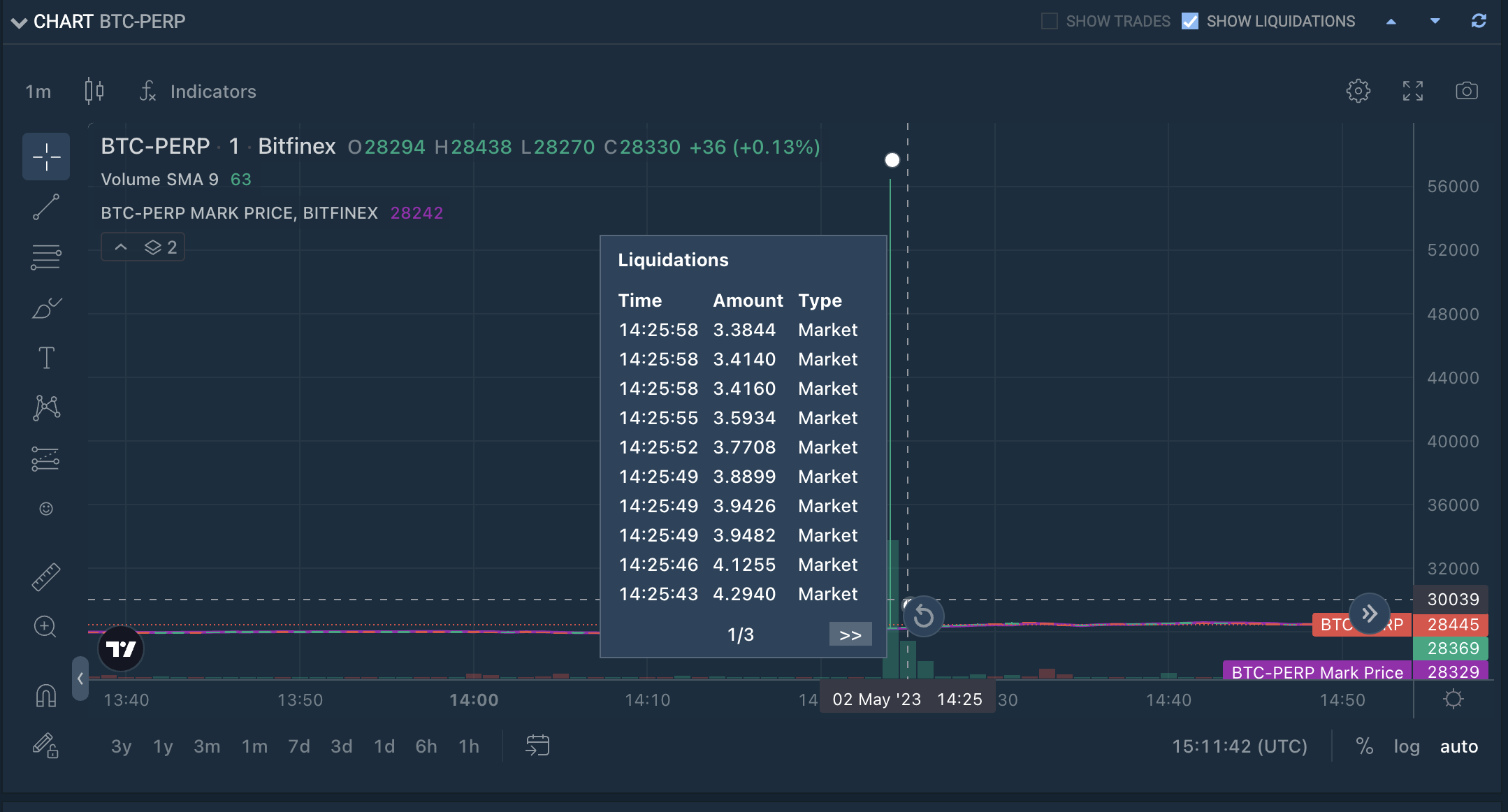

Bitcoin’s (BTC) price on Bitfinex’s perpetual swap market momentarily topped $56,000 on Tuesday – well above prevailing levels elsewhere and prices on Bitfinex’s exchange right before or after – amid a flurry of volume amid an absence of liquidity.

Trading volume on Bitfinex’s BTC-PERP market spiked to 322 BTC ($9.1 million) between 14:24 and 14:26 UTC, equating to around a quarter of daily volume on the trading pair.

Some traders’ positions were liquidated amid the flash rally, according to data on Bitfinex’s trading platform.

Bitfinex spike (Bitfinex)

The move occurred at the same time as bitcoin surged 2.5% on spot markets elsewhere as investors reacted to the stock prices of two banks, Pacwest (PACW) and Western Alliance (WAL), plunging by more than 30% as concerns about the U.S. banking system resumed.

At press time, the BTC-PERP pair has 10% market depth of 110 BTC, meaning that an order to buy 110 BTC would move the price on that specific market by 10% – evidence liquidity remains low on Bitfinex.

A Bitfinex spokesperson did not immediately respond to CoinDesk’s request for comment. Paolo Ardoino, Bitfinex’s chief technology officer, tweeted: “Low liquidity at that moment in time. But system worked as expected. Matching engine handled all orders correctly.”

UPDATE (May 2, 2023, 14:40 UTC): Adds a tweet from Bitfinex’s CTO.

Edited by Nick Baker.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)

Oliver Knight is a CoinDesk reporter based between London and Lisbon. He does not own any crypto.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)

Oliver Knight is a CoinDesk reporter based between London and Lisbon. He does not own any crypto.