Bitcoin Fees Spike Almost 5X in One Week as BTC Reaches ATH

Happy about the increase in the price of Bitcoin? Share some of your wealth with the miners. Bitcoin’s transaction fees are rising at a frantic pace, following the bull run and the general optimism in the crypto markets.

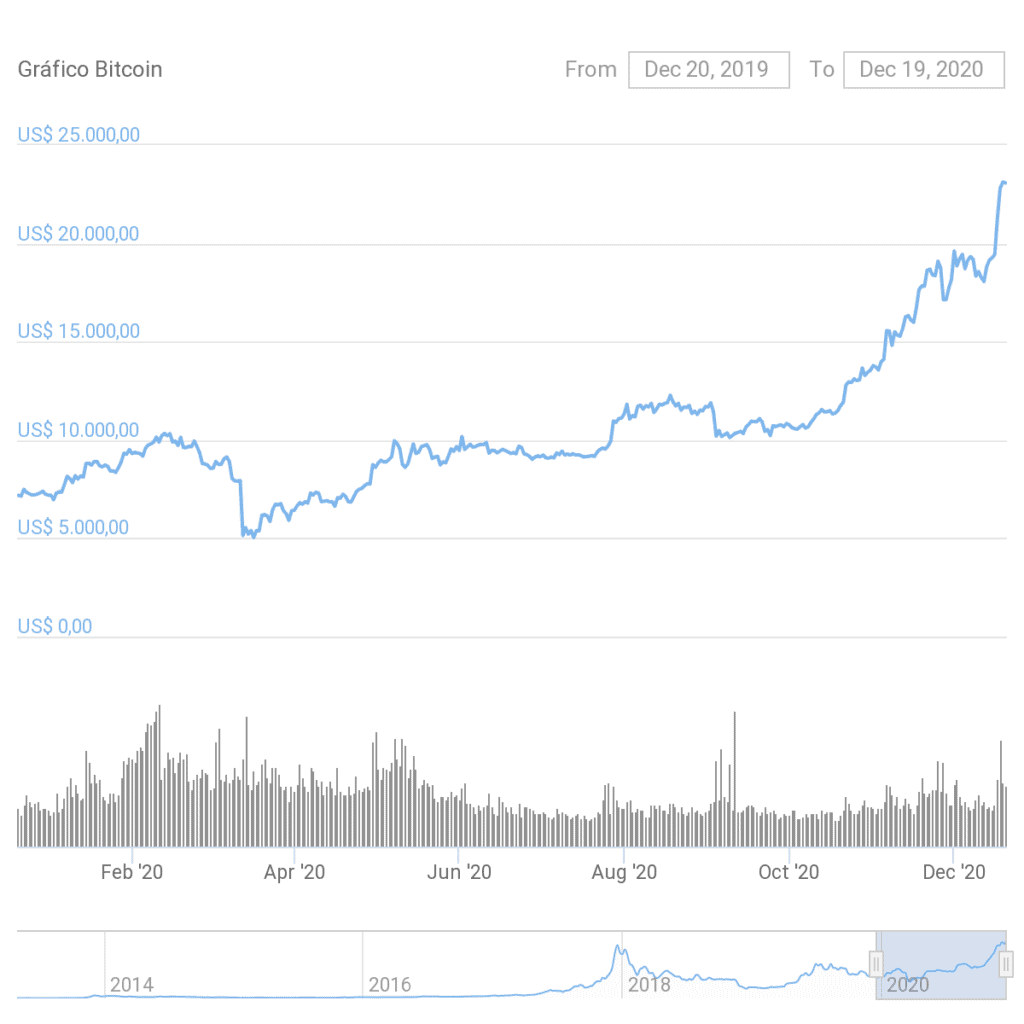

During the last week, Bitcoin’s prices spiked significantly, breaking the previous ATH and hovering above $23100. But transaction fees rose almost in line with Bitcoin’s prices.

Bitcoin Fees Follow The Price

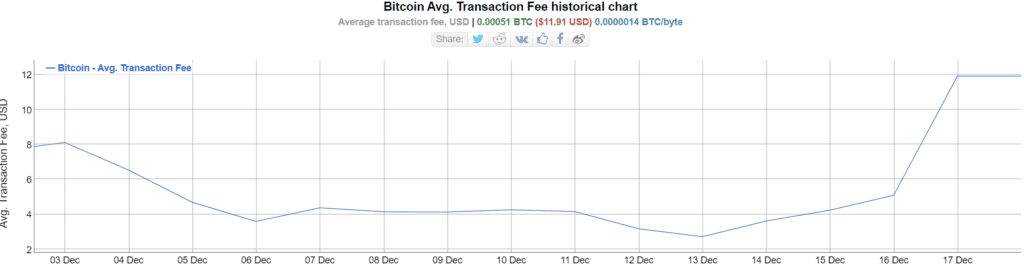

In a matter of about 5 days, the average transaction fee for Bitcoin hodlers went from $2.71 on Dec. 13, 2020, to $11.9 on Dec. 18, representing a 439% increase. In other words, each day of the week, the average Bitcoin transaction was almost 90% more expensive than the day before.

With this rise, the cost of sending Bitcoin is dangerously close to the annual high of $13.15 reached in late October 2020.

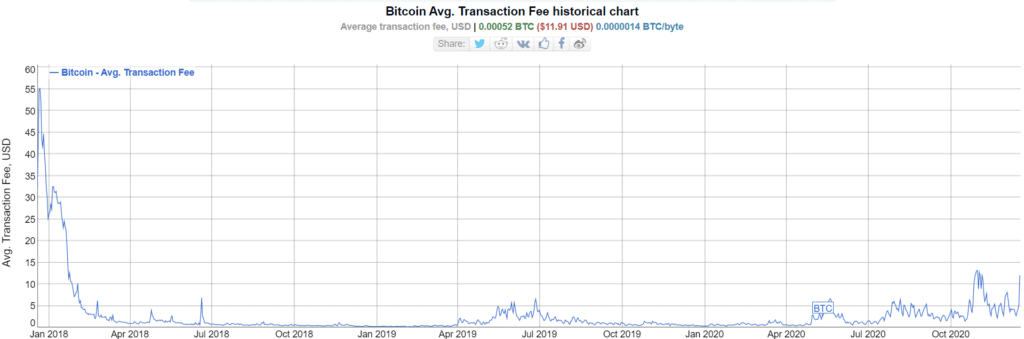

However, the figure pales in comparison to the average transaction fee during the 2017 bull run. At that time, Bitcoin averaged $55 per transaction fee, making it almost unfeasible to use as “digital money” – and becoming the perfect excuse for creating rival forks like Bitcoin Cash, which promised lower fees and greater speed in exchange for bigger block sizes.

The increasing fees are not some random phenomenon. It has two essential explanations:

- Bitcoin’s price has reached record highs, so the dollar cost of a transaction tends to go up as the valuation of each bitcoin token increases.

- Bitcoin is being more used and traded. However, the network has its own limitations by design, and each block can only contain a small amount of information. As more users try to send bitcoins, transactions “fight” for a place in the nearest block. So, the more money someone is willing to pay the miners, the faster their transaction will be confirmed.

Over the past few months, Bitcoin fees have fluctuated, plummeting after significant spikes. If the trend continues, the average fee will likely return to normal levels within a few days.

However, the current spike isn’t a bad sign, especially considering that Bitcoin surpassed its 2017 price high by almost 20%, and its commissions are still at 25% of that year’s record.

Ethereum is Going Through The Same Thing

Ethereum has also felt the effects of Bitcoin’s upswing, and its prices have risen along with its transaction fees.

But it was sort of a fair game, specially considering that after the COVID crash, it was Bitcoin who felt the effects of Ethereum’s influence and started to rise in price thanks to the boom of stablecoins and DeFi projects running on the second most important blockchain in the ecosystem.

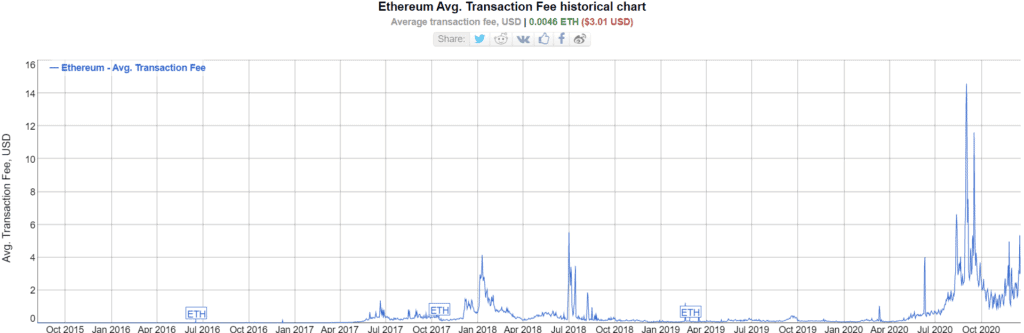

During the peak of the DeFi fever, the average Ethereum fee hit an ATH of 14.5, and although costs started to fall from that moment on, fees increased significantly during the last few days —exactly as it happened with Bitcoin,

On December 13, the average fee was $1.59, and by December 17, those numbers had spiked to $5.3.

But it is worth nothing that Ethereum is working on a scalability solution that will make fees a problem of the past thanks to its move to a PoS algorithm and other layer-two solutions… Bitcoin doesn’t seem to be too worried about that yet.

Perhaps, for some, being “digital gold” is better than being “a peer-to-peer electronic cash system.”